Cannabis Products & Services News

IIPR Extends Beyond Cannabis – New Cannabis Ventures

Published

6 months agoon

By

admin

Industrial innovative properties announce strategic and diversification of $ 270 million in real estate platform

- Deal is expected to introduce significant earnings report for IIP shareholders

- POSITIONS IIP will benefit from long-term life in life, where IIP leadership has decades of the combined experience

San Diego- (Business Wire) –Innovative Industrial Properties, Inc. (NYSE: IIPR) (“IIP” or “Company” announced today that it has signed agreements to invest, which is $ 270 million with IQHQ, INC.

Investments (“Investment”, “Deal” or “Investment Deal” consists of two discrete investments, which are expected to average annual average interest rates a year.

- The $ 100 million assignment is dedicated to a credit institution (“RCF”) for three years, which can be extended for an additional 12 months, the extension fee after payment. RCF will be fully funded the leader, it is subject to closure to ordinary institutions.

- An obligation to buy up to $ 170 million in IQHQ. Preferred stock investments will be funded in many tranches, between the third quarter of 2025 and the second quarter of 2027, which are subject to expanding the IQHQ version.

- Guarantees at IQHQ are subject to the preferred funding of certain funding for certain funding.

“We are enthusiastic about announcing our first expansion by this high-quality transaction outside the cannabis, which diversifies our business and accelerates the trace of IIP growth,” said IIP Executive Chairman Alan Gold.

If we are committed to the canning industry, this transaction covers the deep historical experience of our team in the scientific industry of life, which we believe through the knowledge of life.

ALAN GOLD, IIP Executive Chairman

ALAN GOLD, IIP Executive Chairman

The transaction is built of key lands that include a wide range of current income in the life of the investment, which are combined with future disorderly opportunities through guarantees and potential to acquire real estate objects.

Strategic and financial advantages of the deal.

- High accumulated transaction

- Investments are expected to accumulate very much for each share, based on the average interest rate (which is expected a year).

- Capital Staple Senior Position Offers a Strong Opportunity of Risk Return

- Investments consist of RCF and preferred stock, both of which are sitting on all the total equity of the captain at IQHQ and a material discount, the cost of replacement of assets.

- Advanced portfolio diversification by industry, tenants and investment types

- Pro Forma, IIP will diversify its reserves to close the transaction and reduce the current section and the concentration of tenants. IIP believes that these funds are further improving its financial worldview.

- Revenues from the regulated cannabis’s calculation facilities will decrease by 88% of the company’s total receipt as of June 30, 2025.

- Improved value of capital potential

- The highlighted scale and diversification from the transaction can support a lower price of equity and debt capital and further accelerate its growth.

- IIP has expertise, long-term secular tail of life

- The IIP management team has decades of scientific experience in life with its leading role in the real estate industry, a leading role in the leading role of public trade.

- The point of view includes Alan Gold’s role as the founder and executive director of Biomed Realty Trust, which held its IPO in 2004 and managed $ 8 billion sales in 2016.

- According to PITCHBOK, the 2025 fundraiser for life scientific industry is intended to achieve the highest level since 2021, which was all time.

- According to the CBRE, the real property of the new life of the science is expected to decrease meaningful during the transaction, which IIP approves in the underlying sector and investment.

The company expects RCF to fund funding and shoot company from the company’s turning credit institution. The company expects to finance the preferred stock investment by manually with cash, the company’s turning credit institution and possible basebooks from future funding. The investment transaction is expected to be closed in the third quarter of 2025, subject to regular closure conditions.

About IQHQ

IQHQ, Inc. is focused on life science, which was founded in 2019.

About industrial innovative properties

Innovative Industrial Properties, Inc. Real Estate Investment Trust (REIT) is focused on the acquisition, property and management of specialized industrial properties, and for the real estate of this contemplated transaction, life science. More information is available on www.innovativindustrialproperties.com.

Published by NCV NewsWire

NCV NewsWire aims to treat high-quality content and information about cannabis companies by New Cannabis Ventures to help our readers make noise and remain the most important cannabical business news. NCV Newswire is hand treated by hand and is not automated. Have secret news tip. Contact:A number

Get our Sunday newsletter

acb. canopy growth

The International Cannabis Opportunity – New Cannabis Ventures

Published

2 days agoon

February 23, 2026By

admin

You are reading this week’s edition of New Cannabis Ventures, a weekly magazine we have published since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve, as well as links to the most important news of the week. We no longer email them like we used to, but post this and all newsletters on our website here.

friends,

While the US is getting a lot of attention from cannabis investors, the industry faces many challenges in America. It’s been more than 12 years since Colorado shops opened their doors to adults beyond medical patients, and since then many states have embraced medical cannabis and adult cannabis. Although legal cannabis has expanded significantly, it remains a state-regulated market, and each state differs greatly in terms of rules and regulations. Cannabis remains illegal federally, and the industry continues to struggle 280E tax.

Cannabis markets outside the US continue to grow. Canada revised its federal medical cannabis program in 2013, with the MMPR replacing the MMAR, and the current Access to Cannabis for Public Purposes Regulations (ACMPR) replaced the MMPR in 2016. Justin Trudeau, who was elected Prime Minister in late 2015, became the first agenda item to legalize cannabis. implement adult use legalization in 2018. The program has its challenges, but the industry has grown as it has matured. StatsCan will release December sales data tomorrow, and it looks like cannabis sales are up about 4% for 2025.

Other countries have developed their own medical cannabis, including Australia, Germany and Israel, with Germany legalizing it for adult use. The Netherlands is holding trials in coffee shops. Uruguay, a small country, began legalizing cannabis sales to adults in 2017, and Germany began a program in 2024 to legalize cannabis for adults, although sales are through social clubs. While this program has not directly created commercial opportunities, it has boosted the market for medical cannabis. Unlike Canada, where cannabis is sold by the provinces, in Germany cannabis is sold in traditional pharmacies. A significant amount of medical cannabis sold in Germany is imported from Canada. David Brown of StratCann suggested this six months ago Almost 50% of German hemp imports in Q2 came from Canada.

The Global Hemp Stock Index, last recalculated at year-end, has 7 Canadian LPs, and these NASDAQ-listed companies tend to be active in international markets. Most MSOs in the US operate exclusively there, but one, Curaleaf, has international operations. Curaleaf trades on the TSX in Canada, but it trades in the US. The company reported total revenue of $320 million in its third quarter, with international operations (Canada, Germany, Portugal, Spain and the UK) accounting for just 14.4%. Year-to-date, it has registered just 12.9% as it has grown while domestic revenues have declined.

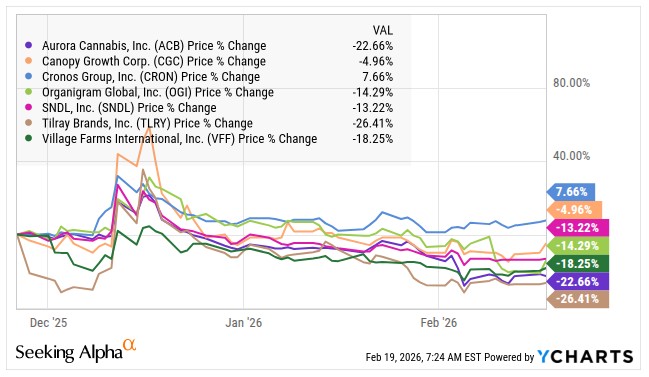

Canadian LPs in the index are Aurora Cannabis, Canopy Growth, Cronos Group, Organigram, SNDL, Tilray Brands and Village Farms. SNDL, which is more of an alcohol than cannabis retailer, has no international cannabis sales. The remaining six are active and active. This week, Organigram announced the acquisition of the rest of the German cannabis company, and it was already active in other markets. Cronos Group has announced the acquisition of CanAdelaar, a deal that is expected to close soon and will give it access to the Netherlands. Canopy Growth is acquiring MTL Cannabis, and increased exports of medical cannabis was a benefit he pointed to.

In: warned about Canadian LPs here at the end of November and I am now more optimistic about this part of the cannabis market. At the time I had 5 of the 7 GCSI members on my Focus List at 420 Investor, but I added Aurora Cannabis when they reported their financial Q3 and fell. Here’s how all 7 have performed since the end of November.

My 420 Investor model portfolio includes a small position in Tilray Brands, a large position in Aurora Cannabis, and a very large position in Organigram. These three positions represent 31.9% of the portfolio, while the GCSI has 27.4% exposure.

The Canadian LP market has certainly been cheaper than it is now, but it seems cheap enough. Balance sheets have improved dramatically, and some of these large companies are trading below tangible book value. NASDAQ listings are superior to the OTC listings that MSOs have. The Canadian market may improve, although I don’t expect it to, and international expansion may continue to help federally legal Canadian LPs export more or expand to other countries. These international operations also involve risks. I see a big international opportunity for Canadian LPs, and investors don’t seem very excited at the moment.

Sincerely,

Alan:

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we have published in the last 2 weeks.

Exclusives

Major cannabis companies are set to report Q4 financials

M&A:

Organigram Global to buy Sanity Group

Follow Alan for real-time updates X.com:. Share and discover industry news with like-minded people on the largest group of cannabis investors and entrepreneurs LinkedIn:.

View: Public Hemp Company Revenue and Earnings Trackingwhich ranks the highest-earning hemp stocks.

Stay on top of the most important communications from public companies by watching what’s coming cannabis investor calendar.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

acb. canopy growth, Aurora Cannabis, CGC:, RELIGION:, Cronos Group:, BREAD, Organization chart, SNDL:, Tilray brands, TLRY:, VFF:, Farms, MOGET:

Related news:

Canadian cannabis sales hit a new record high in December

Organigram Global to buy Sanity Group

Major cannabis companies are set to report Q4 financials

Hemp stocks are off to a bad start in 2026

American Cannabis News

Big Cannabis Companies Are Set to Report Q4 Financials – New Cannabis Ventures

Published

1 week agoon

February 17, 2026By

adminIt Public Hemp Company Revenue and Earnings Trackingrun by New Cannabis Ventures, ranks the leading cannabis companies. This update is our first since mid-August when we previewed Q3 reports.

Tracking rules

This data-driven, fact-based search engine will be continually updated based on new financial filings so readers can stay up-to-date. Companies must file with the SEC or SEDAR and be current to be considered for inclusion. When we launched this resource in May 2019, companies with more than $2.5 million in quarterly revenue qualified. As the industry has grown and as more companies have gone public, we have raised the minimum several times, including $5 million in October 2019, $7.5 million in June 2020, up to $10 million in November 2020, $12.5 million in August 2021, $12.5 million in August 2021, and $202 in September 2021. million dollars. hemp industry, we raised the minimum again in May 2024. The senior list has a minimum of US$50 million (C$68.3 million) and the junior list now has a minimum of US$25 million (C$34.2 million).

Note on adjusted operating income

In May 2019, we added an additional measure, Adjusted Operating Income, which we detailed in our newsletter. The calculation takes reported operating income and adjusts it for any changes in the fair value of biological assets required under IFRS accounting. We believe this adjustment improves comparability between companies under IFRS and GAAP accounting. We note that operating income can often include one-time items such as stock compensation, inventory write-offs or public listing costs, and we encourage readers to understand how these non-cash items may impact quarterly financials. Many companies have moved from IFRS to US GAAP accounting, which has reduced our need to make adjustments. Please note that our rating only includes actual reported income and non pro forma income. We also note that companies with non-hemp operations must provide segment-level financial statements detailing not only revenue but also operating profit in order for their operating profit to be included in the tracking. Currently, Aurora Cannabis (NASDAQ: ACB ) (TSX: ACB ), Jazz Pharma (NASDAQ: JAZZ ) and Tilray (TSX: TLRY ) (NASDAQ: TLRY ) do not provide this information.

Tracker inclusion updates

At the time of our last update on October 21st, 19 companies were eligible for inclusion on the senior lists, including 14 in USD and 5 in Canadian currency, while there were 12 companies on the junior lists. Now, 15 companies denominated in US dollars and 4 denominated in Canadian dollars qualify for the senior lists, for a total of 19 now. The junior list includes 9 companies denominated in US dollars and 2 in Canadian dollars. Tracking public cannabis company revenue and earnings on a combined basis now includes 30 companies. American Junior List lost Scotts Miracle-Gro exits, including Hawthorne Gardening, when it reported its fiscal quarter due to its expected divestment. In Canada, Organigram (NASDAQ: OGI ) (TSX: OGI ) moved from the Senior List to the Junior List.

Companies that have reported since mid-November are included

Many of these companies are in December year-end and year-end reporting for them will begin very soon. There are several companies that have reported since the third quarter reports were released in November.

Senior and Junior – US Dollar Report

Neither company has yet reported Q3, but a flurry of updates begins next week. Tilray brands (NASDAQ: TLRY ) (TSX: TLRY ) reported its fiscal third quarter in early January. The diversified company grew its cannabis business 3% year over year as it grew 5% sequentially.

![]()

Several of the Big 5 MSOs have scheduled calls for their Q4 financial reports, although GTI has changed its policy and will not host any for now. Here is the current outlook of all of them.

- Curaleaf (OTC: CURLF ) (TSX: CURA ) – revenue is expected to decline 1% year-over-year to $328.3 million, with adjusted EBITDA of $66.9 million, a 12% decline.

- Green Thumb Industries (OTC: GTBIF ) (CSE: GTII ) – revenue is expected to increase 1% year over year to $296.1 million and adjusted EBITDA is expected to decline 20% to $78.6 million.

- Trulieve (OTC: TCNNF ) (CSE: TRUL ) – Revenue is expected to decline 1% year-over-year to $296.5 million and adjusted EBITDA is expected to decline 8% to $95.9 million.

- Verano Holdings (OTC: VRNO ) (NEO: VRNO ) – revenue is expected to decline 6% to $205.9 million and adjusted EBITDA is expected to decline 10% to $56.7 million.

- Cresco Labs (OTC: CRLBF ) (CSE: CL ) – Revenue is expected to decline 9% to $160.9 million and adjusted EBITDA is expected to decline 12% to $36.3 million.

Senior and Junior – Canadian Dollar Report

Since the November 3rd quarter reports, High Tide (NASDAQ: HITI ) (TSXV: HITI ), Aurora Cannabis (NASDAQ: ACB ) (TSX: ACB ), Canopy Growth (NASDAQ: CGC ) (TSX: WEED ) and Organigram Global (NASDAQ: OGITS ) have filed to list (NASDAQ: OGITS ). Revenue grew sequentially for each of them except Organigram.

![]()

One of Canada’s senior listed members, SNDL, has yet to schedule its quarterly call.

The Public Cannabis Company Earnings Tracker by New Cannabis Ventures is not a recommendation of any company, and you should not use it as investment advice. A tilde next to a date means an approximate date. All calculations are derived from SEC or SEDAR filings. Any questions or licensing inquiries please contact us.

Did you miss something? Catch them all! Cannabis Revenue Tracking Updates.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

Canopy growth, CGC:, cl:, Cresco Labs, CRLBF:, treatment, Curaleaf:, curly, Green Thumb Industries, gtbif:, gti:, high tide, heat, BREAD, Organization chart, tcnnf:, Tilray brands, TLRY:, WRONG:, to truly believe, summer, WITH:, MOGET:

Related news:

Illinois provides another cannabis update

Hemp stocks are off to a bad start in 2026

Trulieve owes another $60 million

Canadian cannabis sales were abolished in November

American Cannabis News

A Very Large MSO Is Now Extending Its Business – New Cannabis Ventures

Published

4 weeks agoon

January 31, 2026By

admin

You are reading this week’s edition of New Cannabis Ventures, a weekly magazine we have published since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve, as well as links to the most important news of the week. We no longer email them like we used to, but post this and all newsletters on our website here.

friends,

This week, Scotts Miracle-Gro, the largest stock in the Global Hemp Stock Index by market capitalization, announced that it has found a buyer for its Hawthorne Gardening Company business in Vireo Growth. This news first appeared in an online article published by the Wall Street Journaland then Vireo issued a press release like Scotts Miracle-Gro, which also reported in its fiscal 1st quarter.

The deal is not a done deal. Vireo called it a “non-binding memorandum of understanding” but did not discuss the terms of the deal or when it might close. Scotts Miracle-Gro, which had already told investors it was working on this type of deal, did not disclose Hawthorne’s financial results for the 1st quarter. Analysts didn’t really ask any questions about it during the conference. The WSJ article said Vireo is giving Scotts Miracle-Gro 13% of its stock in return, but neither company has disclosed that in their press releases or SEC filings.

I include SMG in my 420 Investor Focus List, but Vireo is not a member of that group. Vireo also failed to qualify for the Global Cannabis Stock Index due to its low trading volumes. As I detailed five weeks ago, The Vireo has grown very large in terms of revenue and its geographic focus. The stock was then at $0.625 and is now lower, closing at $0.55. On Christmas Eve, the decline was 12.0%, while the MSOS fell 10.1%.

Maybe investors are interested in this deal and I’m not. First, it’s not a done deal. Second, to purchase Hawthorne, the investor must assume 280E taxation risk. Third, the price seems high, as 13% of the company is worth about $75 million. Fourth, it’s not clear to me that marrying a hemp operator with a subsidiary makes sense as I recall TILT Holdings.

I have followed Hawthorne Gardening for a long time and am glad that CEO Hagedorn and his team have gone ahead and purchased it and expanded it. The hemp industry has been struggling for about five years, and the big drop in Hawthorne Gardening’s revenue is not SMG’s fault in my opinion. It’s not clear to me how Vireo Growth will make it a better action, but I hope it has a good plan.

I continue to believe that investors should pay close attention to what is happening with shares in Vireo. This potential acquisition was not something that was discussed by analysts or investors, but today’s volume of 277 thousand shares was very low. Once again, Vireo, thanks to its aggressive M&A activity, has become the 7th largest MSO in the NCV Revenue Tracker. It remains very troubling to me that stocks are not earning a lot of interest.

Sincerely,

Alan:

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we published last week.

Exclusives

Canadian cannabis sales were abolished in November

Follow Alan for real-time updates X.com:. Share and discover industry news with like-minded people on the largest group of cannabis investors and entrepreneurs LinkedIn:.

View: Public Hemp Company Revenue and Earnings Trackingwhich ranks the highest-earning hemp stocks.

Stay on top of the most important communications from public companies by watching what’s coming cannabis investor calendar.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

Grow Up Cannabis Cup Samples

CC2CNews special report on 13th MJBiz Con with Alaina Pinto and Jimmy Young &1v1 with Matt Melander

Struggling With pH? Here’s Why

TBI CHANGED ME BUT CANNABIS SAVED ME | NIKKI LAWLEY

Marijuana Retail Report

Liquor shops may start selling low-THC drinks

Indiana Bill To Ban Hemp THC Products Dies As Key Deadline Passes

Headwater Supercharged Saturday!

CC2CNews with Alaina Pinto, Special Report on MJBiz Con Alex Boone & Max Vansluys 1v1 w/ Jimmy Young

The Surprising Reason Fans Are Turning On Cheech & Chong

“Our system can manage equipment across 10,000+ m² using just a few wires”

Florida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

Mazar-i-Sharif Hash Wednesday

Re-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

Your Cannabis Business: Consistent Filings Are Critical

DEA’s Cole Reverses His “priorities” ; Prohibitionists Dig In; Dead & Co Celebrates 60 years in SF

Texas DA Partakes on Tik Tok to prove a point; Boston Sheriff arrested for Extortion of $ w/ Ascend

Weak Michigan Cannabis Sales Again in July – New Cannabis Ventures

From Finance to Wellness: Brad Zerman’s Impactful Pivot

New Hampshire Governor Says Federal Marijuana Rescheduling Won’t Change Her Opposition To Legalization

Trending

-

Cannabis News6 months ago

Cannabis News6 months ago“Our system can manage equipment across 10,000+ m² using just a few wires”

-

Florida6 months ago

Florida6 months agoFlorida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

-

Video5 months ago

Video5 months agoMazar-i-Sharif Hash Wednesday

-

Video6 months ago

Video6 months agoRe-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

-

Best Practices6 months ago

Best Practices6 months agoYour Cannabis Business: Consistent Filings Are Critical

-

Video6 months ago

Video6 months agoDEA’s Cole Reverses His “priorities” ; Prohibitionists Dig In; Dead & Co Celebrates 60 years in SF

-

Video6 months ago

Video6 months agoTexas DA Partakes on Tik Tok to prove a point; Boston Sheriff arrested for Extortion of $ w/ Ascend

-

aawh6 months ago

aawh6 months agoWeak Michigan Cannabis Sales Again in July – New Cannabis Ventures