Cannabis News

Strategies for Distressed Cannabis Businesses

Published

1 year agoon

By

admin

It’s pretty easy to write about everything that’s going wrong in today’s cannabis industry. Today, I want to change gears and talk about some of the strategies we’ve seen work for distressed cannabis businesses in the past. Yes, some of these strategies may seem obvious at first. But pulling them off correctly – especially in a highly regulated market – may be a challenge.

What I’m about to talk about might not work for every cannabis business and certainly not for every problem they face. And this is certainly not legal advice. The point I’m trying to make is that despite being in an over-taxed, over-regulated, industry on the edge of (if not in) a recession, there may be ways out. So without further ado, here goes:

1. Negotiating with tax authorities

Hands down, the worst problem facing cannabis businesses today is taxation. If you’re not as familiar with that issue, I suggest you delve into my recent post, “Cannabis Taxation is Theft” to see how dire the situation is. At the end of last year, cannabis businesses owed the California Department of Tax and Fee Administration (CDTFA) hundreds of millions of dollars in unpaid taxes. This number is going to keep growing until the state figures out a way to deal with it.

As the CDTFA’s unpaid tax balance balloons, we have seen the agency become increasingly aggressive. It can assess 60% penalties plus interest and other fees for late payments! It can levy assets, report cannabis businesses to the Department of Cannabis Control (DCC) to suspend licenses, and can even go after individual officers or managers of cannabis businesses in some cases. And this is just the state – the IRS has much more power and local tax agencies can be as aggressive as their state and federal counterparts.

As the CDTFA and other agencies have become more aggressive, we’ve developed a practice of negotiating payment plans for a number of clients. CDTFA typically won’t budge on waiving penalties until underlying tax principal has been paid. But that’s the state. Local jurisdictions may operate on completely different wavelengths, and may even agree to a waiver up front. It really just depends on the circumstances of the taxpayer, the tax agency, and the ways they negotiate.

2. Resolving costly disputes in court and before court

I don’t think I’ve ever seen a distressed cannabis business that wasn’t mired in at least one, usually nasty, dispute. In a lot of cases, a company hasn’t paid vendor X, and hasn’t been paid by vendor Y, so the company has to fight on both ends. Sometimes employees sue. Sometimes competitors sue. Sometimes the government files an administrative action. Sometimes they have to sue someone. You get the idea.

It almost seems too obvious to say, but it is key for distressed cannabis businesses to resolve disputes as quickly as possible and as cost-effectively as possible, while avoiding a bad settlement. Going to court, or even taking precursor actions to going to court, are not easy things for people to do. It’s costly, stressful, and has no guaranty of success. A lot of businesses are understandably hesitant to reach out to counsel “until things get too late,” and for a lot of them, things got too late weeks before they did that.

Sometimes, it may seem like an issue will never be resolved, but a simple demand letter gets the other side to pay. Or a cease and desist letter gets the other side to cut its shenanigans out. When things need to be escalated, pre-filing mediation or even early mediation can be an effective tool to avoid costly litigation. Our dispute resolution team has seen plenty of cases resolved out of court or at least early on that could easily have turned into 2-3 years in court. But sometimes that doesn’t work. Sometimes, filing and moving forward with litigation is the only way out. And sometimes a hard-fought dispute leads a business to a massive judgment and recovery of attorneys’ fees.

Again, all of this may seem obvious, because it is – conceptually at least. But navigating difficult disputes to achieve a cost-effective, reasonable outcome is incredibly complicated.

3. Other third-party remedies (both in and out of court)

Sometimes cannabis businesses have specific options that they can use in connection with a dispute or potential dispute in addition to just sending demands or litigating. Those might include:

Taking secured property. Lenders often insist on collateralizing assets as part of a loan. This is called a “security interest” and is governed by Article 9 of the Uniform Commercial Code. Sometimes, even landlords do this. If the debtor defaults and fails to cure its default, the creditor will have the right to take the secured property. Think about repossessing a car. Depending on the state and type of asset, this may require filing an action, but that’s not always the case. And depending on the terms of the security agreement, the creditor may be able to auction the asset or even keep the asset for its own use. So collateral interests can be a huge benefit to cannabis creditors.

Landlord self-help remedies. Some states allow commercial landlords to engage in self-help remedies. This includes changing locks, evicting tenants, etc. If a state (and also a lease!) allows this, it can be a powerful tool for landlords to evict non-paying tenants. But many states expressly bar self-help remedies, and landlords that engage in self-help in these states can find themselves in a worse situation than before.

Appointing a receiver. I wrote about receiverships just the other day, so I won’t belabor the point in this post. A receiver can help get a business back on track, or, if things fail, sell off business assets. This can be an immensely powerful tool for creditors.

Writs of attachment. Let’s say a cannabis business fails to pay money to a creditor. The creditor can take them to court (see point 2 above) but by the time a case is resolved, the cannabis business may be insolvent. If the creditor has good reason to believe that the debtor has assets and will get rid of them, it can file a writ of attachment and have the court “freeze” the assets of the debtor pending resolution of the action. Procedures for getting a writ of attachment vary from state to state, sometimes significantly. But once a bank account is frozen, that money’s not going anywhere and the creditor can rest easy for the duration of the suit. Moreover, once a debtor’s assets are attached, there’s a huge incentive for that debtor to start settlement talks in good faith.

These are just a few of what I think of as the “extra” remedies beyond just filing a lawsuit and waiting for the suit to make its way through the court system. Again, some of these things can be done out of court depending on the contract at issue and depending on state law. Attorneys versed in cannabis dispute resolution can guide creditors and debtors alike through prosecuting and defending against these remedies.

4. Business restructuring

When a state opens up cannabis licensing, there’s usually a mad dash to acquire as many licenses and locations as possible. Over the following years, cannabis business owners begin to realize that some aspects of their supply chain aren’t profitable or don’t make sense for other reasons. Combine this with all of the other costs of being in the industry and the dwindling cannabis economy, those businesses often have to figure out ways to restructure.

One of the most common things we’ve seen over the years is a shedding of assets. Here are some common examples:

Selling an operating subsidiary (a business sale) an operating subsidiary’s assets (an asset sale). This will allow a parent company to sell off one or more “branches” or locations and net some capital that it can use to fund other branches. The problem is this only really works for productive assets. If a company’s subsidiary has no business or very poor sales history, it’s going to be hard to find an interested buyer.

Sale-leaseback deals. In my experience, probably 90+% of all cannabis real estate deals are leases, as opposed to acquisitions, because it’s a lot easier and takes up a lot less up-front capital to lease a parcel of land. Businesses that nevertheless bought real estate and become cash-strapped often try to sell the real estate off and lease it back. Like with a business sale, it means that the seller will have a capital infusion that it can reinvest in its business.

Shedding licenses. If a location is not producing revenue, and there’s nothing else special about it, no buyer will want it. For those assets, cannabis businesses may just opt to get rid of them. I’ve seen this quite a bit over the years with distribution licenses in California. Many cannabis businesses thought a distro license would be a nice addition and help them stay vertically integrated. But for those businesses that never intended to offer distribution as a service to third parties, having a license doesn’t usually mean a whole lot. The ability to do self-transport may end up costing more in licensing, vehicle, employee, and insurance per year than simply paying someone else. So in many cases, businesses may just drop these licenses altogether.

Refinancing past-due debt. As the market for cannabis matures, we’re seeing more established lenders jump into the game. This can mean interest rates and other debt service costs that are lower than a few years ago. We’ve helped plenty of cannabis businesses refinance and secure better loan terms, whether that means lower interest, longer payment terms, or completely different loan structures. Refinancing can be an essential tool for cannabis debtors.

These kinds of restructuring opportunities can shed costly assets and gain money, or better manage mountains of debt– sometimes all at once. But cannabis businesses need to be aware that there are tons of pitfalls if this is not done the right way. For example, restructuring often requires explicit permission from regulators, secured creditors, or even landlords of the property where assets are being sold. And in my experience, these third-party approvals tend to be the hardest, longest, and most complicated parts about a business restructuring. This is especially true for cannabis landlords who, from time to time, can be the worst part of any business restructuring. Failure to consider these types of gating issues at the beginning can not only kill a deal, but it can also lead to license revocation or other penalties.

It’s hard to be a cannabis business owner in 2023. But when things get tough, it doesn’t necessarily have to mean insolvency or dissolution – if a business thinks ahead and picks remedies that make sense given its situation. As 2023 continues to unfold and we continue to see the distressed market under pressure, we’ll be sure to keep writing about all of these topics. So stay tuned to the Canna Law Blog.

You may like

-

Latest Trump Weed Rumor – Trump Will Federally Deschedule and Decriminalize Cannabis, but Not Legalize It

-

Webinar Replay: Post-Election Cannabis Wrap – Smoke ’em if You’ve Got ’em

-

I Had Just One Puff

-

Marijuana firms Eaze, Green Dragon find new life after $10 million capital infusion

-

Get some rest on Modified Grapes—November’s Leafly HighLight

-

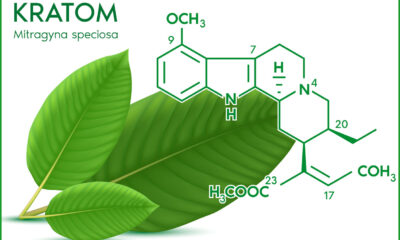

Is Kratom Addictive? Understanding Dependence, Risks, and Safe Usage

Cannabis News

Latest Trump Weed Rumor – Trump Will Federally Deschedule and Decriminalize Cannabis, but Not Legalize It

Published

11 hours agoon

November 14, 2024By

admin

In a recent interview, former New Jersey Governor Chris Christie made headlines by asserting that President-elect Donald Trump will pursue significant reforms in federal policies regarding marijuana and cryptocurrency. As the nation grapples with evolving attitudes toward cannabis and the burgeoning digital currency market, Christie’s predictions have ignited discussions about the potential implications of such changes on both industries. This article delves into Christie’s insights, the current state of marijuana and cryptocurrency regulations, and the broader implications of these anticipated reforms.

The Current Landscape of Marijuana Legislation

Federal vs. State Laws

Marijuana remains classified as a Schedule I substance under the Controlled Substances Act (CSA), which places it in the same category as heroin and LSD. This classification has created a complex legal landscape where states have moved to legalize cannabis for medical and recreational use, while federal law continues to impose strict prohibitions. As of now, over 30 states have legalized marijuana in some form, leading to a burgeoning industry that generates billions in revenue.

Challenges Faced by the Cannabis Industry

Despite its legality in many states, the cannabis industry faces significant hurdles due to federal restrictions. These challenges include:

-

Banking Access: Many banks are hesitant to work with cannabis businesses due to fear of federal repercussions, forcing these businesses to operate largely in cash.

-

Taxation Issues: The IRS enforces Section 280E of the tax code, which prohibits businesses engaged in illegal activities from deducting normal business expenses, leading to disproportionately high tax burdens for cannabis companies.

-

Interstate Commerce: The lack of federal legalization prevents cannabis businesses from operating across state lines, limiting their growth potential.

Chris Christie’s Perspective on Marijuana Reform

Christie, a former presidential candidate known for his tough stance on drugs during his tenure as governor, has evolved his views on marijuana over the years. In his recent statements, he emphasized that Trump is likely to pursue descheduling cannabis, which would remove it from the Schedule I classification. This move would not only provide clarity for businesses operating in legal markets but also open avenues for banking and investment.

Christie highlighted that descheduling would allow for a more regulated market where safety standards could be established, thus protecting consumers. He believes that this approach aligns with a growing consensus among Americans who support legalization and recognize the potential benefits of cannabis use for both medical and recreational purposes.

The Future of Cryptocurrency Regulation = The Rise of Cryptocurrencies

Cryptocurrencies have surged in popularity over the past decade, with Bitcoin leading the charge as the first decentralized digital currency. The market has expanded to include thousands of alternative coins (altcoins), each with unique features and use cases. As cryptocurrencies gain traction among investors and consumers alike, regulatory scrutiny has intensified.

Current Regulatory Challenges

The cryptocurrency market faces several regulatory challenges that hinder its growth and adoption:

-

Lack of Clarity: Regulatory frameworks vary significantly across states and countries, creating confusion for investors and businesses.

-

Fraud and Scams: The rapid growth of cryptocurrencies has led to an increase in fraudulent schemes targeting unsuspecting investors.

-

Consumer Protection: Without clear regulations, consumers are often left vulnerable to risks associated with volatile markets.

Christie’s Vision for Crypto Regulation

Christie believes that under Trump’s leadership, there will be an effort to find a “sweet spot” for cryptocurrency regulation balancing innovation with consumer protection. He argues that overly stringent regulations could stifle growth in this emerging sector while too little oversight could expose consumers to significant risks.

In his view, a balanced regulatory framework would include:

1. Clear Definitions: Establishing clear definitions for different types of cryptocurrencies and tokens to differentiate between securities and utility tokens.

2. Consumer Protections: Implementing measures to protect investors from fraud while promoting transparency within the market.

3. Encouraging Innovation: Creating an environment conducive to innovation by allowing startups to thrive without excessive regulatory burdens.

Christie’s insights reflect a growing recognition among policymakers that cryptocurrencies are here to stay and that appropriate regulations are necessary to foster growth while safeguarding consumers.

Implications of Proposed Reforms

Economic Impact

The potential reforms proposed by Christie could have far-reaching economic implications:

-

Job Creation: Legalizing marijuana at the federal level could lead to significant job creation within the cannabis industry—from cultivation and production to retail sales.

-

Investment Opportunities: Descheduling cannabis would open up investment opportunities for institutional investors who have been hesitant due to federal restrictions.

-

Boosting Local Economies: Legal cannabis markets have proven beneficial for local economies through increased tax revenues and job creation.

Similarly, clear regulations around cryptocurrencies could stimulate investment in blockchain technology and related industries, fostering innovation and economic growth.

Social Justice Considerations

Both marijuana legalization and sensible cryptocurrency regulations have social justice implications:

-

Addressing Past Injustices: Legalizing marijuana could help rectify past injustices related to drug enforcement policies that disproportionately affected marginalized communities.

-

Financial Inclusion: Cryptocurrencies offer opportunities for financial inclusion for those underserved by traditional banking systems, particularly in low-income communities.

Political Landscape

The political landscape surrounding these issues is complex. While there is bipartisan support for marijuana reform among certain lawmakers, challenges remain in overcoming entrenched opposition. Similarly, cryptocurrency regulation has garnered attention from both sides of the aisle but requires collaboration to establish effective frameworks.

Conclusion

Chris Christie’s predictions about President-elect Donald Trump’s approach to federal marijuana descheduling and cryptocurrency regulation suggest a potential shift in U.S. policy that could significantly reshape both industries. As public opinion evolves on these issues, lawmakers have an opportunity to enact meaningful reforms that promote economic growth while ensuring consumer protection. The anticipated changes could foster a more robust cannabis industry that contributes positively to the economy and addresses social justice concerns, while clear regulatory frameworks for cryptocurrencies could encourage innovation and protect consumers in the digital economy. Stakeholders in both sectors are closely watching these developments, eager to see how potential reforms might impact their futures. While the realization of Christie’s predictions remains uncertain, it’s clear that the conversation around marijuana and cryptocurrency regulation is ongoing and far from settled.

TRUMP 2.0 ON CANNABIS REFORM, READ ON…

TRUMP 2.0 ON FEDERAL CANNABIS REFORM – WHAT DO WE KNOW?

Cannabis News

Webinar Replay: Post-Election Cannabis Wrap – Smoke ’em if You’ve Got ’em

Published

1 day agoon

November 13, 2024By

admin

On Thursday, November 7th, Vince Sliwoski, Aaron Pelley and Fred Rocafort held a post election discussion “Post-Election Cannabis Wrap – Smoke ’em if You’ve Got ’em”. Watch the replay!

Key Takeaways from the “Smoke ’em if You’ve Got ’em – 2024 Post Election Cannabis Wrap” Webinar:

- Panelists:

- Vince Sliwoski: Oregon Business lawyer specializing in cannabis and commercial real estate.

- Aaron Pelley: Experienced in cannabis law since Washington’s legalization in 2012.

- Fred Rocafort: Trademark attorney working closely with the cannabis team.

- Election Results Overview:

- Most 2024 cannabis ballot measures did not pass.

- Florida, South Dakota, and North Dakota saw failures.

- Nebraska became the 39th state to legalize cannabis for medical use when it passed two cannabis initiatives, Initiatives 437 and 438.

- Federal and State-Level Developments:

- Medical use is currently legal in 38 states, and 24 states allow recreational use.

- Republican support for marijuana legalization is growing.

- Federal Policy Implications:

- Schedule III Rescheduling: The process to move cannabis to Schedule III is ongoing, which could significantly impact the industry.

- Importance of Federal Appointments: The future of cannabis policy depends heavily on who is appointed to key positions in the administration.

- International and Domestic Trade:

- Schedule III status could ease import/export restrictions on cannabis.

- Unified control of House, Senate, and presidency might expedite legislative progress.

- Economic and Industry Impact:

- Cannabis stocks experienced volatility post-election, reflecting investor uncertainty.

- Federal legalization and banking reforms are crucial for industry stability and growth.

- Future Outlook:

- The potential for federal rescheduling remains strong, with hearings scheduled for early 2025.

- State-level initiatives and regulatory developments will continue to shape the industry.

“How Long Does One Puff of Weed Stay in Your System?”… This topic can be difficult to answer since it is dependent on elements such as the size of the hit and what constitutes a “one hit.” If you take a large bong pull then cough, it might linger in your system for 5-7 days. A moderate dose from a joint can last 3-5 days, whereas a few hits from a vaporizer may last 1-3 days.

The length of time that marijuana stays in the body varies based on a number of factors, including metabolism, THC levels, frequency of use, and hydration.

Delta-9-tetrahydrocannabinol, or THC, is the primary psychoactive component of cannabis. THC and its metabolites, which remain in your body long after the effects have subsided, are detected by drug tests.

Since these metabolites are fat-soluble, they cling to bodily fat molecules. They could thus take a while to fully pass through your system, particularly if your body fat percentage is higher.

THC is absorbed by tissues and organs (including the brain, heart, and fat) and converted by the liver into chemicals such as 11-hydroxy-THC and carboxy-THC. Cannabis is eliminated in feces at a rate of around 65%, while urine accounts for 20%. The leftover amount might be kept within the body.

THC deposited in bodily tissues ultimately re-enters the circulation and is processed by the liver. For frequent users, THC accumulates in fatty tissues quicker than it can be removed, thus it may be detectable in drug tests for days or weeks following consumption.

The detection time varies according to the amount and frequency of cannabis usage. Higher dosages and regular usage result in longer detection times.

The type of drug test also affects detection windows. Blood and saliva tests typically detect cannabis metabolites for shorter periods, while urine and hair samples can reveal use for weeks or even months. In some cases, hair tests have detected cannabis use over 90 days after consumption.

Detection Windows for Various Cannabis Drug Tests

Urine Tests

Among all drug tests, urine testing is the most commonly used method for screening for drug use in an individual.

Detection times vary, but a 2017 review suggests the following windows for cannabis in urine after last use:

– Single-use (e.g., one joint): up to 3 days

– Moderate use (around 4 times a week): 5–7 days

– Chronic use (daily): 10–15 days

– Chronic heavy use (multiple times daily): over 30 days

Blood Tests

Blood tests generally detect recent cannabis use, typically within 2–12 hours after consumption. However, in cases of heavy use, cannabis has been detected up to 30 days later. Chronic heavy use can extend the detection period in the bloodstream.

Saliva Tests

THC can enter saliva through secondhand cannabis smoke, but THC metabolites are only present if you’ve personally smoked or ingested cannabis.

Saliva testing has a short detection window and can sometimes identify cannabis use on the same day. A 2020 review found that THC was detectable in the saliva of frequent users for up to 72 hours after use, and it may remain in saliva longer than in blood following recent use.

In areas where cannabis is illegal, saliva testing is often used for roadside screenings.

Hair Tests

Hair follicle tests can detect cannabis use for up to 90 days. After use, cannabinoids reach the hair follicles through small blood vessels and from sebum and sweat surrounding the hair.

Hair grows at approximately 0.5 inches per month, so a 1.5-inch segment of hair close to the scalp can reveal cannabis use over the past three months.

Factors Affecting THC and Metabolite Retention

The length of time THC and its metabolites stay in your system depends on various factors. Some, like body mass index (BMI) and metabolic rate, relate to individual body processing, not the drug itself.

Other factors are specific to cannabis use, including:

– Dosage: How much you consume

– Frequency: How often you use cannabis

– Method of consumption: Smoking, dabbing, edibles, or sublingual

– THC potency: Higher potency can extend detection time

Higher doses and more frequent use generally extend THC retention. Cannabis consumed orally may remain in the system slightly longer than smoked cannabis, and stronger cannabis strains, higher in THC, may also stay detectable for a longer period.

How Quickly Do the Effects of Cannabis Set In?

When smoking cannabis, effects appear almost immediately, while ingested cannabis may take 1–3 hours to peak.

The psychoactive component THC produces a “high” with common effects such as:

– Altered senses, including perception of time

– Mood changes

– Difficulty with thinking and problem-solving

– Impaired memory

Other short-term effects can include:

– Anxiety and confusion

– Decreased coordination

– Dry mouth and eyes

– Nausea or lightheadedness

– Trouble focusing

– Increased appetite

– Rapid heart rate

– Restlessness and sleepiness

In rare cases, high doses may lead to hallucinations, delusions, or acute psychosis.

Regular cannabis use may have additional mental and physical effects. While research is ongoing, cannabis use may increase the risk of:

– Cognitive issues like memory loss

– Cardiovascular problems including heart disease and stroke

– Respiratory illnesses such as bronchitis or lung infections

– Mood disorders like depression and anxiety

Cannabis use during pregnancy can negatively impact fetal growth and development.

Duration of Effects

Short-term effects generally taper off within 1–3 hours, but for chronic users, some long-term effects may last days, weeks, or even months. Certain effects may even be permanent.

Bottom Line

The amount of time that cannabis remains in your system following a single use varies greatly depending on individual characteristics such as body fat, metabolism, frequency of use, and mode of intake. Frequent users may maintain traces of THC for weeks, whereas infrequent users may test positive for as little as a few days. Hair tests can disclose usage for up to 90 days, while blood and saliva tests identify more recent use. Urine tests are the most popular and have varying detection durations. The duration that THC and its metabolites are detectable will ultimately depend on a number of factors, including dose, strength, and individual body chemistry.

PEE IN A CUP COMING UP, READ ON..

Latest Trump Weed Rumor – Trump Will Federally Deschedule and Decriminalize Cannabis, but Not Legalize It

Webinar Replay: Post-Election Cannabis Wrap – Smoke ’em if You’ve Got ’em

I Had Just One Puff

Marijuana firms Eaze, Green Dragon find new life after $10 million capital infusion

Get some rest on Modified Grapes—November’s Leafly HighLight

Is Kratom Addictive? Understanding Dependence, Risks, and Safe Usage

New Rule, December 5: Oregon Cannabis Retailers, Processors and Labor Peace Agreements

The CBD Dog Treat Guide

Trippin’ Golf Balls – Can Magic Mushrooms Help Your Golf Game?

Australian Broadcasting Corp Alleges Military Veterans Have Been Targeted By Medicinal Cannabis Companies Via Social Media & Offered Free “Product”

Distressed Cannabis Business Takeaways – Canna Law Blog™

United States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

What you Need to Know

Drug Testing for Marijuana – The Joint Blog

NCIA Write About Their Equity Scholarship Program

It has been a wild news week – here’s how CBD and weed can help you relax

Cannabis, alcohol firm SNDL loses CA$372.4 million in 2022

A new April 20 cannabis contest includes a $40,000 purse

Your Go-To Source for Cannabis Logos and Designs

UArizona launches online cannabis compliance online course

Trending

-

Cannabis News2 years ago

Cannabis News2 years agoDistressed Cannabis Business Takeaways – Canna Law Blog™

-

One-Hit Wonders2 years ago

One-Hit Wonders2 years agoUnited States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

-

Cannabis 1012 years ago

Cannabis 1012 years agoWhat you Need to Know

-

drug testing11 months ago

drug testing11 months agoDrug Testing for Marijuana – The Joint Blog

-

Education2 years ago

Education2 years agoNCIA Write About Their Equity Scholarship Program

-

Cannabis2 years ago

Cannabis2 years agoIt has been a wild news week – here’s how CBD and weed can help you relax

-

Marijuana Business Daily2 years ago

Marijuana Business Daily2 years agoCannabis, alcohol firm SNDL loses CA$372.4 million in 2022

-

California2 years ago

California2 years agoA new April 20 cannabis contest includes a $40,000 purse