Canadian Cannabis News

Be Careful With Canadian LPs – New Cannabis Ventures

Published

3 months agoon

By

admin

You are reading this week’s edition of New Cannabis Ventures, a weekly magazine we have published since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve, as well as links to the most important news of the week. We no longer email them like we used to, but post this and all newsletters on our website here.

friends,

Canadian LP stocks have been quite strong this year. I’ll provide an update on the November action on Friday, but the NCV Canadian Cannabis LP Index ended today at 59.32, leaving the 13-stock index up 18.4% in 2025. Some readers may attribute the demonstration to Village Farms, but Village Farms is not on the NDAASQ index for that reason alone. Village Farms is on the NCV Global Cannabis Stock Index, which is down 11.1% year-to-date. It is also in MSOS, which is down 10.0% so far in 2025.

I’ve written very optimistically about some of the Canadian LPs over the past few years, and very negatively about others. Newsletter articles on Canadian LPs over the past eighteen months include:

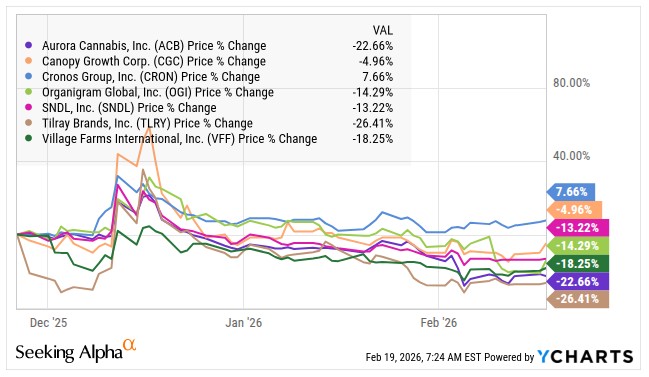

It’s been a little over three months since Canadian LPs have been the focus of this newsletter, and I want to provide an update today as we head into the end of the year, with these stocks outperforming the hemp sector. At 420 Investor, I include 5 Canadian LPs in my 19-stock Focus List, including Canopy Growth, Cronos Group, Organigram, Tilray Brands, and Village Farms. These are all in the Global Cannabis Stock Index, along with Aurora Cannabis and SNDL. Here’s how they’ve performed since 8/8, the day before news of a possible US move broke:

Here are my current thoughts on each.

- Canopy growth. it was unpleasant, but all that dilution fixed their balance sheet. I don’t see the stock, which is down 56.0% in 2025, as attractive, and I remain concerned about their US operations being held as an investment rather than as part of their operations (to maintain a NASDAQ listing).

- Cronos Group. I’m not much of a fan of it, other than the huge cash and such a large majority ownership by Altria. That said, it makes up 6.7% of my model portfolio at 420 Investor, despite being the strongest LP of the five, up 23.0% year-to-date.

- Organigram. I like the balance and the valuation seems about right. What matters is that their actions were strong. This week, the company announced a new CEO, who will take over in mid-January. I don’t know much about him, but he spent two decades at British American Tobacco, which owns a lot of OGI. The stock has pulled back a lot and is down 0.6% in 2025. I include it in my model portfolio at 11.9%.

- Tilray Brands. I am not a fan of this company at all and they have zero involvement in the US state regulated cannabis market. I thought they were bullshitting the MedMen and I’m glad their investment was completely written off. The latest ban on hemp products, which will take effect next year, undermines the efforts they’ve been making with THC drinks. I really liked it when it was under $1 earlier this year, as I expressed here, but now I don’t care. The stock will reverse split after the close on Monday. I don’t have a problem with this at all, but many investors don’t like reverse splits. TLRY closed at $1.03 but announced a reverse split after the close. Compared to last year, it decreased by 21.8%.

- Village farmers. I loved it earlier this year, and I loved it when they made their big move in May to divest themselves of their produce business. The stock is very much up (418.2% year-to-date in my opinion) and not widely followed by Wall Street. The company didn’t provide any guidance, but analysts’ estimates look really high. I think many are excited about their potential win in the Texas medical cannabis market, which is in the process of expanding from 3 licensed producers to 15, with news from VFF on 12/1. This Texas is excited about program changes and producer expansion, but I’m still not excited about the potential financial impact that could eat into cash and not be recognized on the income statement. Note that MSOS has acquired a position (in the summer ahead of news of a possible realignment). The ETF currently has 3.5 million shares, a position of 2.2 percent of the ETF, although it sold 2 percent of its holdings when it hit redemption last week.

I write a lot about Canadian LPs on Seeking Alpha, and you always can look at my articles more details there. This past weekend I upgraded my rating on Organigram from Hold to Buy and downgraded my rating on Village Farms from Sell to Strong Sell. Last week I upgraded Canopy Growth from Strong Sell to Hold after being very negative for quite some time. In late September, I downgraded Tilray Brands to Strong Sell. That one rallied sharply a few days later on their Q1 report, but failed. In mid-September, I initiated coverage of SNDL via selling. At 420 Investor, I include 5 Canadian LPs in my Focus List, including Canopy Growth, Cronos Group, Organigram, Tilray Brands, and Village Farms.

Canadian LPs are doing better than most other sectors. I’ve written positively about hemp REITs, and they seem like a better bet to me. I think investors should be careful with Canadian LPs as they are no longer as cheap as they used to be and have been buoyed by enthusiasm for MSOs since the potential realignment was announced in August, although the realignment will not affect them. I hope there are improvements in Canadian taxation, distribution and regulation, as these changes can help LPs. Until then, I suggest caution.

I wish everyone a Happy Thanksgiving.

Sincerely,

Alan:

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we published last week.

Exclusives

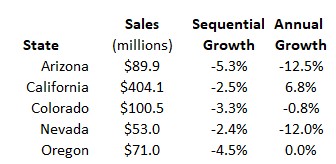

Canadian hemp sales fell from record lows in September

Follow Alan for real-time updates X.com:. Share and discover industry news with like-minded people on the largest group of cannabis investors and entrepreneurs LinkedIn:.

View: Public Hemp Company Revenue and Earnings Trackingwhich ranks the highest-earning hemp stocks.

Stay on top of the most important communications from public companies by watching what’s coming cannabis investor calendar.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

Canopy growth, CGC:, RELIGION:, Cronos Group:, meat, BREAD, Organization chart, SNDL:, Tilray brands, TLRY:, VFF:, Farms, MOGET:

Related news:

Canadian hemp sales fell from record lows in September

Cannabis supplies are being destroyed

Big insider sales at GTI

Cannabis War

You may like

-

CANNABIS YEAR IN REVIEW 2021

-

Republican Control of Congress, so how will federal reform work now? Cannabis Coast to Coast News

-

CANNABIS INDUSTRY INNOVATION | CULLEN RAICHART

-

Cannabis Sales Remained Weak in February – New Cannabis Ventures

-

Cannabis products recalled due to “unreliable” tests

-

CANNABIS LIAISON | LIZ ROGAN

aawh

Share Repurchases Are Not Always a Good Idea for Cannabis Companies – New Cannabis Ventures

Published

5 days agoon

February 28, 2026By

admin

You are reading this week’s edition of New Cannabis Ventures, a weekly magazine we have published since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve, as well as links to the most important news of the week. We no longer email them like we used to, but post this and all newsletters on our website here.

friends,

Earnings season kicked off this week, and so far it’s been a mixed bag. Green Thumb Industries beat expectations, while Trulieve missed. Cronos Group also missed adjusted EBITDA despite falling revenue.

What’s most interesting to me about these quarterly reports are the updates we get in documents or press releases. A large category is share buybacks that are done.

GTI, which has a strong balance sheet, especially compared to other MSOs, has bought back more inventory. Cronos Group, which is cash- and debt-free, also bought some shares in November and December. These shares were acquired at close to tangible book value.

Trulieve did not report the share buyback, but the 10-K disclosed a 2025 bonus announced on 2/24 for CEO Rivers. The company has net cash, but its tangible book value is very negative and has deteriorated. The company does not buy back shares.

Ascend is set to report Q4 financials on 3/12 and it will be interesting to see if this very cheap stock company continues to buy back shares. The company has negative tangible book value, and the GTI 10-K disclosed that Ascend paid a $17 million penalty to GTI on 2/12, so I don’t expect it to be as aggressive with buybacks.

Stock buybacks seem like a good thing, especially when valuations are so low. However, investors should be wary of hemp companies buying back shares when they have balance sheet challenges.

Sincerely,

Alan:

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we have published in the last 2 weeks.

Exclusives

Canadian cannabis sales hit a new record high in December

Michigan hemp sales began in 2026

Financial statements

Green Thumb Industries’ revenue is rising as profitability improves

Capital increase

Curaleaf took out $500M over 3 years at 11.5%

GTI increases borrowings by $50 million

Follow Alan for real-time updates X.com:. Share and discover industry news with like-minded people on the largest group of cannabis investors and entrepreneurs LinkedIn:.

View: Public Hemp Company Revenue and Earnings Trackingwhich ranks the highest-earning hemp stocks.

Stay on top of the most important communications from public companies by watching what’s coming cannabis investor calendar.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

AKAN

Cannabis Stocks Held Steady – New Cannabis Ventures

Published

6 days agoon

February 27, 2026By

admin

Hemp stocks, as measured by the Global Hemp Stock Index, were quite volatile in 2024 and then again in 2025 as well. Although the index rose in December, it fell on the year. In January, the indicator decreased by 10.6%, reaching 5.89. February saw a drop in prices, but the market recovered with the index ending the month at 5.86, down 0.5%.

After collapsing 21.8% in late 2024 to 6.88 in Q4, the index fell heavily in Q1 and then marginally in Q2. The global hemp stock index, which now has 27 members, gained 53.0% in the third quarter but fell 14.2% in the fourth quarter, down 4.2% for the full year. In 2026, it decreased by 11.1%.

Since its peak in February 2021, the global hemp stock index is down 93.7% from a closing high of 92.48.

The 3 strongest names in February, each an MSO, were all up more than 13%;

Jazz Pharma rallied in 2026, but the other two declined.

February’s 3 weakest names are all down more than 13%;

All three have fallen significantly in 2026 so far.

We will summarize the performance of the index again in a month. In April, we historically combined the two articles, and we update here the other indexes that New Cannabis Ventures continues to maintain: the American Cannabis Operator Index, the Ancillary Cannabis Index, and the Canadian Cannabis LP Index.

American Hemp Operator Index

The ACOI sank in January, falling 12.5% to 11.53, and fell further in February, falling 5.8% to 10.87. In 2025, it increased by 57.7% to 13.18 and decreased by 17.5% in 2026. The large AdvisorShares Pure US Cannabis ETF ( MSOS ) fell 3.7% in February.

The strongest performing stock in February was TerrAscend (OTC: TSNDF ), up 7.7%. The weakest, Vireo Growth (OTC: VREOF ), fell 17.9%.

In March, the index will have seven members with the removals of Jushi Holdings (OTC: JUSHF ) and Vireo Growth.

Auxiliary cannabis index

Ancillary commodities lost 5.7% in February as the index fell to 9.84. The index decreased by 19.5% in 2025, reaching 11.09, and this year it decreased by 11.3%.

The strongest stock in February was Turning Point Brands (NASDAQ: TPB ), which rose 13.1%. The weakest iPower fell by 55.8%.

In March, the index will have seven members after the removal of GrowGeneration (NASDAQ: GRWG ), iPower (NASDAQ: IPW ) and Chicago Atlantic BDC (NASDAQ: LIEN ) during February’s low trading volume.

Canadian Hemp LP Index

Canadian LPs fell 0.9% in February as the index fell to 55.65. In 2025, the index increased by 17.8%, reaching 59.01, and in 2026, it decreased by 5.7%.

The strongest Canadian LP in February was Rubicon Organics (TSXV: ROMJ ), which rose 8.9%. Simply Insoluble Concentrates (TSXV: HASH ) was the weakest, down 27.8%.

In March, the index will have the same thirteen members.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

WILL, Akanda, HASH:, high tide, heat, capacity, ipw:, Jazz, jazz farm, Rome, Rubicon Organics, the power, rhythm, Simply for free, Terrascend:, TPB:, TSNDF:, Revolving brands, vireo growth, vreof:

Related news:

Canadian cannabis sales hit a new record high in December

Major cannabis companies are set to report Q4 financials

Hemp stocks are off to a bad start in 2026

A very large MSO is now expanding its business

acb. canopy growth

The International Cannabis Opportunity – New Cannabis Ventures

Published

1 week agoon

February 23, 2026By

admin

You are reading this week’s edition of New Cannabis Ventures, a weekly magazine we have published since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve, as well as links to the most important news of the week. We no longer email them like we used to, but post this and all newsletters on our website here.

friends,

While the US is getting a lot of attention from cannabis investors, the industry faces many challenges in America. It’s been more than 12 years since Colorado shops opened their doors to adults beyond medical patients, and since then many states have embraced medical cannabis and adult cannabis. Although legal cannabis has expanded significantly, it remains a state-regulated market, and each state differs greatly in terms of rules and regulations. Cannabis remains illegal federally, and the industry continues to struggle 280E tax.

Cannabis markets outside the US continue to grow. Canada revised its federal medical cannabis program in 2013, with the MMPR replacing the MMAR, and the current Access to Cannabis for Public Purposes Regulations (ACMPR) replaced the MMPR in 2016. Justin Trudeau, who was elected Prime Minister in late 2015, became the first agenda item to legalize cannabis. implement adult use legalization in 2018. The program has its challenges, but the industry has grown as it has matured. StatsCan will release December sales data tomorrow, and it looks like cannabis sales are up about 4% for 2025.

Other countries have developed their own medical cannabis, including Australia, Germany and Israel, with Germany legalizing it for adult use. The Netherlands is holding trials in coffee shops. Uruguay, a small country, began legalizing cannabis sales to adults in 2017, and Germany began a program in 2024 to legalize cannabis for adults, although sales are through social clubs. While this program has not directly created commercial opportunities, it has boosted the market for medical cannabis. Unlike Canada, where cannabis is sold by the provinces, in Germany cannabis is sold in traditional pharmacies. A significant amount of medical cannabis sold in Germany is imported from Canada. David Brown of StratCann suggested this six months ago Almost 50% of German hemp imports in Q2 came from Canada.

The Global Hemp Stock Index, last recalculated at year-end, has 7 Canadian LPs, and these NASDAQ-listed companies tend to be active in international markets. Most MSOs in the US operate exclusively there, but one, Curaleaf, has international operations. Curaleaf trades on the TSX in Canada, but it trades in the US. The company reported total revenue of $320 million in its third quarter, with international operations (Canada, Germany, Portugal, Spain and the UK) accounting for just 14.4%. Year-to-date, it has registered just 12.9% as it has grown while domestic revenues have declined.

Canadian LPs in the index are Aurora Cannabis, Canopy Growth, Cronos Group, Organigram, SNDL, Tilray Brands and Village Farms. SNDL, which is more of an alcohol than cannabis retailer, has no international cannabis sales. The remaining six are active and active. This week, Organigram announced the acquisition of the rest of the German cannabis company, and it was already active in other markets. Cronos Group has announced the acquisition of CanAdelaar, a deal that is expected to close soon and will give it access to the Netherlands. Canopy Growth is acquiring MTL Cannabis, and increased exports of medical cannabis was a benefit he pointed to.

In: warned about Canadian LPs here at the end of November and I am now more optimistic about this part of the cannabis market. At the time I had 5 of the 7 GCSI members on my Focus List at 420 Investor, but I added Aurora Cannabis when they reported their financial Q3 and fell. Here’s how all 7 have performed since the end of November.

My 420 Investor model portfolio includes a small position in Tilray Brands, a large position in Aurora Cannabis, and a very large position in Organigram. These three positions represent 31.9% of the portfolio, while the GCSI has 27.4% exposure.

The Canadian LP market has certainly been cheaper than it is now, but it seems cheap enough. Balance sheets have improved dramatically, and some of these large companies are trading below tangible book value. NASDAQ listings are superior to the OTC listings that MSOs have. The Canadian market may improve, although I don’t expect it to, and international expansion may continue to help federally legal Canadian LPs export more or expand to other countries. These international operations also involve risks. I see a big international opportunity for Canadian LPs, and investors don’t seem very excited at the moment.

Sincerely,

Alan:

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we have published in the last 2 weeks.

Exclusives

Major cannabis companies are set to report Q4 financials

M&A:

Organigram Global to buy Sanity Group

Follow Alan for real-time updates X.com:. Share and discover industry news with like-minded people on the largest group of cannabis investors and entrepreneurs LinkedIn:.

View: Public Hemp Company Revenue and Earnings Trackingwhich ranks the highest-earning hemp stocks.

Stay on top of the most important communications from public companies by watching what’s coming cannabis investor calendar.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

acb. canopy growth, Aurora Cannabis, CGC:, RELIGION:, Cronos Group:, BREAD, Organization chart, SNDL:, Tilray brands, TLRY:, VFF:, Farms, MOGET:

Related news:

Canadian cannabis sales hit a new record high in December

Organigram Global to buy Sanity Group

Major cannabis companies are set to report Q4 financials

Hemp stocks are off to a bad start in 2026

Strawberry Tart Marijuana Monday

13th Annual MJBiz Con Preview with Emilie Lewis and PCMTV Founder Jimmy Young

Easy Ebb and Flow Hydroponics in a 2×4 Tent

CANNABIS YEAR IN REVIEW 2021

Marijuana Retail Report

A steel roof transforms the silo into a solid building instead of a container with a cover on it

Florida Lawmakers Pass Bill To Provide Discounted Medical Marijuana Cards For Military Veterans

Tremblant Hash Worm Wednesday

Republican Control of Congress, so how will federal reform work now? Cannabis Coast to Coast News

Why Do We Call It That? The Hidden Truth of Slang

“Our system can manage equipment across 10,000+ m² using just a few wires”

Florida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

Mazar-i-Sharif Hash Wednesday

DEA’s Cole Reverses His “priorities” ; Prohibitionists Dig In; Dead & Co Celebrates 60 years in SF

Your Cannabis Business: Consistent Filings Are Critical

Re-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

From Finance to Wellness: Brad Zerman’s Impactful Pivot

Weak Michigan Cannabis Sales Again in July – New Cannabis Ventures

Texas DA Partakes on Tik Tok to prove a point; Boston Sheriff arrested for Extortion of $ w/ Ascend

New Hampshire Governor Says Federal Marijuana Rescheduling Won’t Change Her Opposition To Legalization

Trending

-

Cannabis News6 months ago

Cannabis News6 months ago“Our system can manage equipment across 10,000+ m² using just a few wires”

-

Florida7 months ago

Florida7 months agoFlorida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

-

Video5 months ago

Video5 months agoMazar-i-Sharif Hash Wednesday

-

Best Practices7 months ago

Best Practices7 months agoYour Cannabis Business: Consistent Filings Are Critical

-

Video6 months ago

Video6 months agoDEA’s Cole Reverses His “priorities” ; Prohibitionists Dig In; Dead & Co Celebrates 60 years in SF

-

Video7 months ago

Video7 months agoRe-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

-

Video7 months ago

Video7 months agoFrom Finance to Wellness: Brad Zerman’s Impactful Pivot

-

aawh7 months ago

aawh7 months agoWeak Michigan Cannabis Sales Again in July – New Cannabis Ventures