American Cannabis News

Cannabis Stock Traders Care About MSOs Again – New Cannabis Ventures

Published

5 months agoon

By

admin

You read this week’s publication New Cannabis Ventures Weekly Newsletter we publish from October 2015. We no longer send them. By mail as before but we post this and all newsletters On our website hereA number

Friends,

Every quarter, I refresh the Cannabis Stock Index, which covers active cannabis shares. The index returns at the end of 2012 and developed as the cannabis industry developed. I will share the full update next week, when Q3 is over, but I want to discuss a change in the index on the upcoming re-elexatization, which was based on data on 09/23.

The last quarter, I refreshed that the figure would again have 23 members, which is a typical type of shares. What surprised me about changes was that the MSOS in the index went down 6 to only 3. It is possible that the removal of its low trade in June may have been more shocking. 3 MSOS presented only 13% of the index at 6/30.

This next quarter, the number of shares, which qualifies 28, four new or returning members, are given to MSOS. Returning the indicator will be CRESCO LABS, CURALAF, TERRASCEND and VERANO HOLDINGS. On 7/30, on 7/30, 25% of the 7s index will be presented. Although MSOS’s share has sharply increased, this is not a high percentage. At the end of April 2024, only only only MSOS was 38% of the index when there were 11 MSOS 29.

I have constantly discussed how cannabels and investors can extend their concentration beyond only one part of the cannabis, so “only 25%” do not stand out to me. It’s the same percentage of what Canadian LPS is holding and it is inferior to 39% of assistance. MSOS has a great drawback because they trade on OTC, but they also face 280e taxation, which is combined with the debt of the balance sheet sheet.

The Rebalanced index will include all 5 of the largest MSOS, plus two people. The most interesting thing for me is what will not include. Of course, the heart is no longer in the figure, but there are several msos that are not yet in it, despite their mass income. The one who stands out is Vireo’s growth, which is not described due to its trading volume, which has not increased enough.

The growth of Varo first started trading in early 2019. For some time, it was an increase of kindness, but last summer became a virus. Originally, it was a medical canpian company based in Minnesota and operates in New York before I expanded Maryland. The company had to be united with the review, but the deal was distinguished and remained in court. Bengal Bengal Capital Josh Rosen joined as an interim executive director in early 2023 and became General Director in the summer of 2024 before leaving for October. The current CEO of the company, John Mazarakis, who joined Chicago Atlantic, at the end of 2024 as a company announced a big plan Buy 4 single state operators and collect $ 75 million for one share for $ 0.625. Company actually raised $ 81 millionA number of this was quite impressive.

There have been some people who are discussing Vireo growth, including multiple jacket Aaron Edelheit in many articles, as well as Pablo Zuanic. The company has already closed most of the achievements announced in December and caused $ 48 million, completing the quarter for $ 106 million in cash. Still, it seems that a lot of analyst does not seem coverage. In the past month, the shares on average made a daily trading shares that are lower than $ 400k minimum required.

Perhaps more disappointing than the lack of interest in investors has been the price of prices. At the end of 2024, the shares are currently kept by 10.7% when the company announced that it sold $ 81 million worth $ 0.625. MSOS gathered by 22%, and Cannabis Global Index has purchased 4.9% as of 9/25. Since the company announced transactions, it doubled at prices by 22% with MSOS. While the return of a year in MSOS is a lot, the vodge has been a little advanced.

Of course, Varo’s growth has seen a lot over the past few years. In 2023, it took the low level of all time, but the shares were falling since August. Cannabis investors should consider it. Big capital raising is underwater, and the volume of trade is small compared to the size of its actions.

Commercial volumes have expanded, especially for MSOS, and Varo’s growth has been transformed into itself. Investors, however, seem to be not yet. I continue to control the company’s evolution, but still do not include it in my focus of 19 shares. I want the growth of Viro to the best and hope that the buyers of his shares are approaching the end of the year, now 20%, do not stay in the red.

Frankly,

Alan

New hemp enterprises publish medicine articles, as well as exclusive news. Here is what we published this last week.

Exclusive

To get real-time updates follow Alan X.com:A number can also share and discover industry news along with sympathetic people, a large hemp group and entrepreneurship group ConnectionA number

Watch Revenue and Revenue Search Engine:which occupies the best income producing Cannabis shares.

Stay on top of some important communications of public companies by watching upcoming Cannabis Investor Calendar:A number

Based on the Houston, Alan cries out his experience as the founder of the online community 420 InvestorThe first and still the biggest decent diligent platform focused on the shares sold in the cannabis industry. Alan continues to find new ways to connect industry and facilitate its sustainable growth in the Canepuni community. Approximately New hemp enterprisesHe is responsible for content development and strategic alliances. Until the early 2013 focuses on the cannabis industry, Alan, who began his career in Wall Street, worked as more than two decades of research and portfolio. Article 650 of the Article 650 published in 2007 Looking for alphaWhere he has 70,000 followers, Alan is a frequent speaker for industry conferences and a Frequent source The media, including NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Ration | Facebook | Connection | Email

Get our Sunday newsletter

You may like

-

Cannabis Stocks Held Steady – New Cannabis Ventures

-

New rules raise cannabis stock limits for Malta’s associations

-

WIZ KHALIFA CANNABIS FESTIVAL 2022 | BLUNTZ

-

Missouri Rolls Out Decals To Identify Licensed Cannabis Dispensaries

-

Curaleaf Q4 Revenue Grows 2% – New Cannabis Ventures

-

Data collection as an operational tool in commercial cannabis cultivation

AKAN

Cannabis Stocks Held Steady – New Cannabis Ventures

Published

5 minutes agoon

February 27, 2026By

admin

Hemp stocks, as measured by the Global Hemp Stock Index, were quite volatile in 2024 and then again in 2025 as well. Although the index rose in December, it fell on the year. In January, the indicator decreased by 10.6%, reaching 5.89. February saw a drop in prices, but the market recovered with the index ending the month at 5.86, down 0.5%.

After collapsing 21.8% in late 2024 to 6.88 in Q4, the index fell heavily in Q1 and then marginally in Q2. The global hemp stock index, which now has 27 members, gained 53.0% in the third quarter but fell 14.2% in the fourth quarter, down 4.2% for the full year. In 2026, it decreased by 11.1%.

Since its peak in February 2021, the global hemp stock index is down 93.7% from a closing high of 92.48.

The 3 strongest names in February, each an MSO, were all up more than 13%;

Jazz Pharma rallied in 2026, but the other two declined.

February’s 3 weakest names are all down more than 13%;

All three have fallen significantly in 2026 so far.

We will summarize the performance of the index again in a month. In April, we historically combined the two articles, and we update here the other indexes that New Cannabis Ventures continues to maintain: the American Cannabis Operator Index, the Ancillary Cannabis Index, and the Canadian Cannabis LP Index.

American Hemp Operator Index

The ACOI sank in January, falling 12.5% to 11.53, and fell further in February, falling 5.8% to 10.87. In 2025, it increased by 57.7% to 13.18 and decreased by 17.5% in 2026. The large AdvisorShares Pure US Cannabis ETF ( MSOS ) fell 3.7% in February.

The strongest performing stock in February was TerrAscend (OTC: TSNDF ), up 7.7%. The weakest, Vireo Growth (OTC: VREOF ), fell 17.9%.

In March, the index will have seven members with the removals of Jushi Holdings (OTC: JUSHF ) and Vireo Growth.

Auxiliary cannabis index

Ancillary commodities lost 5.7% in February as the index fell to 9.84. The index decreased by 19.5% in 2025, reaching 11.09, and this year it decreased by 11.3%.

The strongest stock in February was Turning Point Brands (NASDAQ: TPB ), which rose 13.1%. The weakest iPower fell by 55.8%.

In March, the index will have seven members after the removal of GrowGeneration (NASDAQ: GRWG ), iPower (NASDAQ: IPW ) and Chicago Atlantic BDC (NASDAQ: LIEN ) during February’s low trading volume.

Canadian Hemp LP Index

Canadian LPs fell 0.9% in February as the index fell to 55.65. In 2025, the index increased by 17.8%, reaching 59.01, and in 2026, it decreased by 5.7%.

The strongest Canadian LP in February was Rubicon Organics (TSXV: ROMJ ), which rose 8.9%. Simply Insoluble Concentrates (TSXV: HASH ) was the weakest, down 27.8%.

In March, the index will have the same thirteen members.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

WILL, Akanda, HASH:, high tide, heat, capacity, ipw:, Jazz, jazz farm, Rome, Rubicon Organics, the power, rhythm, Simply for free, Terrascend:, TPB:, TSNDF:, Revolving brands, vireo growth, vreof:

Related news:

Canadian cannabis sales hit a new record high in December

Major cannabis companies are set to report Q4 financials

Hemp stocks are off to a bad start in 2026

A very large MSO is now expanding its business

American Cannabis News

Curaleaf Q4 Revenue Grows 2% – New Cannabis Ventures

Published

1 day agoon

February 26, 2026By

admin

- Q4 2025 net income of $333 million

- Q4 2025 international revenue: $51 million;

- Q4 2025 Gross Margin 49%

- Full year operating and free cash flows from continuing operations

- $152 million and $89 million, respectively

STAMFORD, Conn., Feb. 26, 2026 /PRNewswire/ — Curaleaf Holdings, Inc. (TSX: CURA) (OTCQX: CURLF) (“Curaleaf” or the “Company”), a leading international supplier of consumer cannabis products, today reported its financial and operating results for the fourth quarter and full year ended December 31, 2025. All financial information is presented in accordance with US generally accepted accounting principles” or “USGAAP” and “other USGAAP principles” are indicated.

Curaleaf President and CEO Boris Jordan said: “We closed 2025 with clear momentum, delivering fourth-quarter revenue of $333 million. Revenue increased 5% sequentially and 2% year-over-year, driven by a broad-based return to growth in nearly all of our domestic markets, despite our robust international $1 closed environment. Fourth-quarter revenue, representing 10% sequential growth and 65% year-over-year revenue growth, expanded to 49%, up 20 basis points year-over-year, as benefits from increased productivity at our growing facilities outweighed price compression.

For the year, revenue came in at $1.27 billion, with adjusted gross margin of 50% and adjusted EBITDA of $275 million, or 22% of revenue. We generated $152 million in operating cash flow and $89 million in free cash flow from continuing operations, while ending the year with $102 million in cash on the balance sheet. These results were achieved despite double-digit price compression for the third year in a row, highlighting the strength, discipline and flexibility of our operating model and the success of our Back to Our Roots programme.”

Mr. Jordan continued. “With our $500 million debt offering and Back to Our Roots plan now complete, we have re-founded our business and are transitioning from stabilization to acceleration with our Built for Growth strategy. Using the platform, we have enhanced: improved processing economy, more stringent commercial position, innovation discipline, to improve the brand. sustained organic growth augmented by opportunistic acquisitions”.

Financial highlights for the fourth quarter of 2025

Net income was $333.1 million, up 2% year over year from $327.9 million in Q4 2024. Subsequently, net income increased by 5% in 2025. compared to the third quarter: 317.9 million dollars.

Gross profit was $161.8 million and gross profit margin was 49%, up 60 basis points year-over-year.

Adjusted gross profit¹ of $161.9 million and adjusted gross profit margin¹ of 49%, up 20 basis points year over year

Net loss attributable to Curaleaf Holdings, Inc. from continuing operations of $49.3 million, or $0.06 per share from continuing operations.

Adjusted net loss¹ from continuing operations of $39.5 million or adjusted net loss¹ from continuing operations of $0.05 per share

Adjusted EBITDA¹ of $69.0 million and Adjusted EBITDA margin¹ of 20.7%, down 250 basis points year over year.

Cash at the end of the quarter was $101.6 million

Operating and free cash flows were $42 million and $25 million, respectively

Financial highlights for the full year 2025

Net income: $1,268.1 million

International revenue is $172.5 million, up 63 percent from 2024’s $105.6 million.

Gross profit $631.0 million and gross margin 50%

Adjusted gross profit¹ $632.5 million and adjusted gross profit margin¹ 50%

Operating cash flow from continuing operations of $152.0 million and free cash flow from continuing operations of $89.3 million.

Net loss from continuing operations was $201.9 million, or $0.26 per share.

Adjusted net loss¹ from continuing operations of $175.9 million, or adjusted net loss per share of $0.23 from continuing operations

Adjusted EBITDA¹ of $274.7 million and adjusted EBITDA margin of 21.7%

¹Adjusted EBITDA, adjusted net income (loss), adjusted gross profit and free cash flow are non-GAAP financial measures, and adjusted EBITDA margin, adjusted net income (loss) per share and adjusted gross profit margin are non-GAAP financial ratios, which in each case may not be used by US GAAP and other standards. See “Non-GAAP Financial Performance Measures” below for definitions and additional information regarding Curaleaf’s use of non-GAAP financial measures and non-GAAP financial ratios. See “Reconciliation of Non-GAAP Financial Measures” below for a reconciliation of each non-GAAP financial measure used in this press release to the most directly comparable US GAAP financial measure.

Published by NCV Newswire

New Cannabis Ventures’ NCV Newswire aims to gather high-quality content and information about leading cannabis companies to help our readers filter through the noise and stay on top of the most important cannabis business news. The NCV Newswire is edited by an editor and is not automated in any way. Got a secret news tip? Get in touch.

Get our Sunday newsletter

acb. canopy growth

The International Cannabis Opportunity – New Cannabis Ventures

Published

4 days agoon

February 23, 2026By

admin

You are reading this week’s edition of New Cannabis Ventures, a weekly magazine we have published since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve, as well as links to the most important news of the week. We no longer email them like we used to, but post this and all newsletters on our website here.

friends,

While the US is getting a lot of attention from cannabis investors, the industry faces many challenges in America. It’s been more than 12 years since Colorado shops opened their doors to adults beyond medical patients, and since then many states have embraced medical cannabis and adult cannabis. Although legal cannabis has expanded significantly, it remains a state-regulated market, and each state differs greatly in terms of rules and regulations. Cannabis remains illegal federally, and the industry continues to struggle 280E tax.

Cannabis markets outside the US continue to grow. Canada revised its federal medical cannabis program in 2013, with the MMPR replacing the MMAR, and the current Access to Cannabis for Public Purposes Regulations (ACMPR) replaced the MMPR in 2016. Justin Trudeau, who was elected Prime Minister in late 2015, became the first agenda item to legalize cannabis. implement adult use legalization in 2018. The program has its challenges, but the industry has grown as it has matured. StatsCan will release December sales data tomorrow, and it looks like cannabis sales are up about 4% for 2025.

Other countries have developed their own medical cannabis, including Australia, Germany and Israel, with Germany legalizing it for adult use. The Netherlands is holding trials in coffee shops. Uruguay, a small country, began legalizing cannabis sales to adults in 2017, and Germany began a program in 2024 to legalize cannabis for adults, although sales are through social clubs. While this program has not directly created commercial opportunities, it has boosted the market for medical cannabis. Unlike Canada, where cannabis is sold by the provinces, in Germany cannabis is sold in traditional pharmacies. A significant amount of medical cannabis sold in Germany is imported from Canada. David Brown of StratCann suggested this six months ago Almost 50% of German hemp imports in Q2 came from Canada.

The Global Hemp Stock Index, last recalculated at year-end, has 7 Canadian LPs, and these NASDAQ-listed companies tend to be active in international markets. Most MSOs in the US operate exclusively there, but one, Curaleaf, has international operations. Curaleaf trades on the TSX in Canada, but it trades in the US. The company reported total revenue of $320 million in its third quarter, with international operations (Canada, Germany, Portugal, Spain and the UK) accounting for just 14.4%. Year-to-date, it has registered just 12.9% as it has grown while domestic revenues have declined.

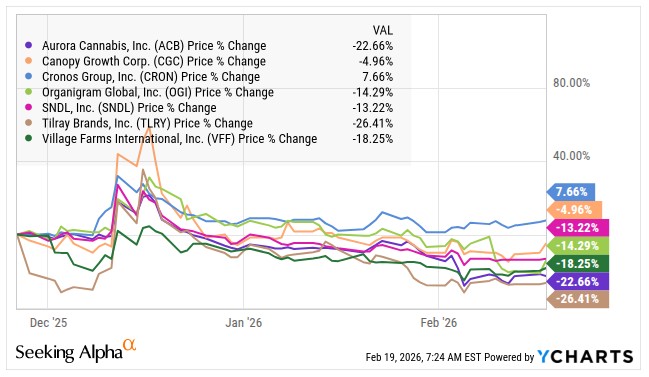

Canadian LPs in the index are Aurora Cannabis, Canopy Growth, Cronos Group, Organigram, SNDL, Tilray Brands and Village Farms. SNDL, which is more of an alcohol than cannabis retailer, has no international cannabis sales. The remaining six are active and active. This week, Organigram announced the acquisition of the rest of the German cannabis company, and it was already active in other markets. Cronos Group has announced the acquisition of CanAdelaar, a deal that is expected to close soon and will give it access to the Netherlands. Canopy Growth is acquiring MTL Cannabis, and increased exports of medical cannabis was a benefit he pointed to.

In: warned about Canadian LPs here at the end of November and I am now more optimistic about this part of the cannabis market. At the time I had 5 of the 7 GCSI members on my Focus List at 420 Investor, but I added Aurora Cannabis when they reported their financial Q3 and fell. Here’s how all 7 have performed since the end of November.

My 420 Investor model portfolio includes a small position in Tilray Brands, a large position in Aurora Cannabis, and a very large position in Organigram. These three positions represent 31.9% of the portfolio, while the GCSI has 27.4% exposure.

The Canadian LP market has certainly been cheaper than it is now, but it seems cheap enough. Balance sheets have improved dramatically, and some of these large companies are trading below tangible book value. NASDAQ listings are superior to the OTC listings that MSOs have. The Canadian market may improve, although I don’t expect it to, and international expansion may continue to help federally legal Canadian LPs export more or expand to other countries. These international operations also involve risks. I see a big international opportunity for Canadian LPs, and investors don’t seem very excited at the moment.

Sincerely,

Alan:

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we have published in the last 2 weeks.

Exclusives

Major cannabis companies are set to report Q4 financials

M&A:

Organigram Global to buy Sanity Group

Follow Alan for real-time updates X.com:. Share and discover industry news with like-minded people on the largest group of cannabis investors and entrepreneurs LinkedIn:.

View: Public Hemp Company Revenue and Earnings Trackingwhich ranks the highest-earning hemp stocks.

Stay on top of the most important communications from public companies by watching what’s coming cannabis investor calendar.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

acb. canopy growth, Aurora Cannabis, CGC:, RELIGION:, Cronos Group:, BREAD, Organization chart, SNDL:, Tilray brands, TLRY:, VFF:, Farms, MOGET:

Related news:

Canadian cannabis sales hit a new record high in December

Organigram Global to buy Sanity Group

Major cannabis companies are set to report Q4 financials

Hemp stocks are off to a bad start in 2026

Marijuana Retail Report

Cannabis Stocks Held Steady – New Cannabis Ventures

New rules raise cannabis stock limits for Malta’s associations

Trump Administration ‘Very Anxious’ To Allow Psychedelic Therapy ‘As Quickly As Possible,’ RFK Tells Joe Rogan

Tiger Bomb Marijuana Monday

MJBizCon 2024 Las Vegas LIVE Recap | Special Interviews | Technology & Product Reviews and MORE!

Tommy Chong Didn’t Deserve This

WIZ KHALIFA CANNABIS FESTIVAL 2022 | BLUNTZ

Missouri Rolls Out Decals To Identify Licensed Cannabis Dispensaries

Curaleaf Q4 Revenue Grows 2% – New Cannabis Ventures

“Our system can manage equipment across 10,000+ m² using just a few wires”

Florida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

Mazar-i-Sharif Hash Wednesday

Your Cannabis Business: Consistent Filings Are Critical

Re-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

Texas DA Partakes on Tik Tok to prove a point; Boston Sheriff arrested for Extortion of $ w/ Ascend

Weak Michigan Cannabis Sales Again in July – New Cannabis Ventures

From Finance to Wellness: Brad Zerman’s Impactful Pivot

DEA’s Cole Reverses His “priorities” ; Prohibitionists Dig In; Dead & Co Celebrates 60 years in SF

New Hampshire Governor Says Federal Marijuana Rescheduling Won’t Change Her Opposition To Legalization

Trending

-

Cannabis News6 months ago

Cannabis News6 months ago“Our system can manage equipment across 10,000+ m² using just a few wires”

-

Florida6 months ago

Florida6 months agoFlorida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

-

Video5 months ago

Video5 months agoMazar-i-Sharif Hash Wednesday

-

Best Practices6 months ago

Best Practices6 months agoYour Cannabis Business: Consistent Filings Are Critical

-

Video6 months ago

Video6 months agoRe-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

-

Video6 months ago

Video6 months agoTexas DA Partakes on Tik Tok to prove a point; Boston Sheriff arrested for Extortion of $ w/ Ascend

-

aawh6 months ago

aawh6 months agoWeak Michigan Cannabis Sales Again in July – New Cannabis Ventures

-

Video6 months ago

Video6 months agoFrom Finance to Wellness: Brad Zerman’s Impactful Pivot