Cannabis News

Cash Is King, Use Your Data, and Go Sell Legal Cocaine in Canada

Published

2 years agoon

By

admin

Out of Money, Out of Time, and Debt Piling Up – The Benzinga Cannabis Conference Miami 2023

I wanted to not be a curmudgeon.

I wanted to talk about the key phrases the speakers kept brining up like “cash is king”, “data is so key to your future”, “AI is here and coming for cannabis”. But alas, none of that will matter if everyone closes due to expenses being greater than revenue.

I wanted to go to Benzinga and find out there is a light at the end of the tunnel, and cannabis industry in North America has a bright and vibrate future.

Well, as Roadrunner taught us, the light at the end of this tunnel is actually another train about to run you over called Federal Legalization and international legalization.

The toils of the cannabis industry are well written about now, high taxation, high regulation costs, no access to capital, a fierce black market emerging in all legal states, 280E tax code issues, etc, etc. But after 72 hours in Miami checking under the hood of the cannabis and psychedelics industry, it is much, much worse than you thought.

The best way to go over how bad it is right now is to pull out a rap battle, Comedy Central Roast, or old Henny Youngman or Rodney Dangerfield type of narrative. Do you remember, the “your wife is so fat, she could put on high heels and hit oil!”, and the next comedy would jump I and say, “Well, your wife is so fat, she can XYZ..”

No respect, as Rodney would say, but let me get to my point about, “the cannabis industry is so bad” comedy routine…

To be clear, the Benzinga group and cannabis conference is 1st class, and the most important cannabis show to hit all year due to it’s access to VIP people, great networking events, fund raising options there, etc. They show is fantastic each year on South Beach and you NEED to attend it if you want to know what is really going on with the movers and shakers in weed. That being said, even that group of fabulous people can only polish a turd so much. This is a review of the cannabis industries problems, not a reflection of the Benzinga show or people, that is top notch, first rate, invest in them if you can.

Let’s get to the main event…

The cannabis industry is so bad…. The show opener on the “deal and finance” stage was a rousing, high-five-ing talk about how “lucky we are this year because we only paid 8% on debt, and everyone else is double digits! Woooohoooo! Give me some love!.” I paraphrase but you get the point, that was the opener of the show! Not “Jumping Jack Flash” or “Start Me Up”, we got the “my debt payments are only half as bad as I thought and way better then the other guy drowning in debt!”

And that talk opened the show, on the “let’s make a deal” stage!

The cannabis industry is so bad…we were told if you paid all your bills and paid all your taxes including your 280 taxes, and had 0 left after that, you are winner this year! If you ended the year and were able to pay your debt and taxes, and had nothing left after that, guess what, you killed it! You are a cannabis 1% er! Congrats on that take-home pay.

The cannabis industry is so bad…. Deal makers talked on stage about how if it weren’t for debt financing, there would be no marijuana industry anymore. All cash has completely dried up, equity deals are dead as no one wants crappy stock and buyers don’t want to dilute their shares and ruin the cap-x tables. No cash deals, no equity deals, only thing left is debt. Debt costs have obviously risen greatly in the last 6 months as interest rates climb in the US. The industry is living off credit card debt basically, turning over debt frantically and trying to find where the next dollar is coming from regardless of payback terms and rates. The future be damned, if we don’t do it, we are done anyway, was a common realization for people in the last 72 hours.

The cannabis industry is so bad…. Sellers can’t even sell. There is no more cash payout and go to your own island and retire. The M&A experts said sellers may be lucky to get 10 to 20% in cash. There are no more sales, only getting acquired. Whoever buys you is going to give you a modicum of cash, and stock in the company or project you are being acquired for. If it is Walmart, you are getting some small cash payment and Walmart stock, if it is Jungle Gym Vapes buying you, are getting $50 and a whole lot of “what could be” with JGVapes stock. Buyers are taking much longer to close deals and doing more due diligence. Cash, and cash flow is king right now, preserve it, protect it, because you have no idea if someone or company will ever hand you cash again.

The cannabis industry is so bad….that certain attorney presentations talked about clients wanting to “use the IRS as their banks, don’t pay the IRS but keep paying your lender, the fees and penalties are worse from your lender than the IRS, so let them finance you.”

I fell on the floor after that one. The OG cannabis legend I got to spend the show with just looked at me like he didn’t believe what he just heard. I would be 32% richer too if I didn’t pay my taxes, too, but that doesn’t mean you can do it. The problem is the IRS will throw you in real jail if you skip out on your taxes long enough, Citibank can’t and won’t. This is one of the worst ideas in the history of bad cannabis ideas. Stiff the IRS and let them finance you? No way. While there is one tax strategy out there used by some MSOs on 280E called deferment, or, as we call it, kicking the can down the road.

That basically means they are deferring this massive tax sums to future quarters hoping that federal legalization will happen and they can take the IRS to court to say these taxes are actually not invalid, as weed is now a federally legal drug and subject to regular IRS regulation and not draconian 280E.

How long can companies keep rolling the amount forward? Does the IRS allow unlimited deferment? I can defer paying my taxes for 10 years? 50? 100? There is a limit to how long you can “kick the can down the road praying for regulations to change”, the IRS is not stupid, and the one thing to remember is that they will never run out of people, time, or money, and you will. This may work for now but the massive bills coming due, whether we see federal legalization or not, are going hurt some bottoms lines of your favorite cannabis investments in the future.

The IRS should never be your bank or finance option. They are a taxation collection agency, they can put you in jail if cheat enough or brazenly enough like this industry is thinking of doing, take the L and pay, the future is much worse if you don’t. The interest and penalties on those taxes numbers are going to be much worse than your 9% credit line.

The cannabis industry is so bad – two lawyers on stage talked about doing deals out of receivership or bankruptcy, if the cannabis companies could even declare it. Yes, some people are moving on distressed debt and buying companies from the owner of the loan, but is $0.55 on the dollar a good deal if you can pay $0.20 in 90 days? It is a small and bold crew calling a bottom in April of 2023.

The cannabis industry is so bad…even the data people I talked to, who are right by the way, think using your data to improve your margins is nice, but can only do so much. So I asked, “The black market is beating you 85 to 0 and by improving your margins and getting tighter on what you offer and knowing what you clients want will make it 85 to 10?” They all nodded and said, “yeah, kind of”. I applaud the use of data, but data can only boost your efficiency so much to improve your bottom line, 6% here, 12% there, it can’t overcome a 93% price difference in legal to illicit edible pricing.

The cannabis industry is so bad…. venders are now setting up “buy now and pay over time” for their industry. Why? Because no one has cash to pay their bills. Remember, Weedmaps now has hundreds of vendors in errs for over 90 days. That means they are nonpaying clients, unable to pay the monthly tab for being on their map and selling weed. The famous vape brands setting up the “buy now and we will finance you” model said they listened to their customers biggest problems and they all need help paying their invoices.

So now brands and suppliers are financing the retail guys, the guys on the front lines, sharing their pain of a very restricted cash flow. If brands and suppliers don’t do it, their customers won’t be able to pay the invoice anyway, so might as well work with them on financing the deal. A little of something is worth more than nothing as they say.

Yes, you knew the cannabis industry was a disaster right now, but, no, you probably don’t know how bad. The biggest problem is that there is no good news coming down the tracks like a train at the end of a tunnel. I few speakers and investors talked about how we are at the bottom, and it may be a great time to buy. Says who? One deal maker said he got a company that raised over $10 million for only a $1 million this week. That’s great, but what if you could have got that company for free next month since they can’t pay their debt? You just overpaid by $1 million dollars. You could then go to their lenders and say I will pay you $0.02 on every $1 of debt, take it or leave it, $0.02 is better than the 0 you are going to get. The lender will likely want to get anything they can for the investment and say yes.

The cannabis industry is a falling knife right now and some people are thinking of trying to catch it. Warren Buffet will tell you that is one of the hardest things to do in life, catch a falling market at the right moment.

If the cannabis industry was worth a $1, but is now worth $0.35 in your mind, that doesn’t mean it is a good time to buy, it may find a bottom at $0.05.

The next two events coming to save the day are also strong negative influences for an already punished market. The light at the end of the tunnel to save the day is an oncoming locomotive called Federal Legalization. If you think we are within 36 months of Federal legalization (I am not of that thought), interstate commerce will decimate the industry margins as legal and illegal markets begin selling and shipping massive amounts of cannabis by taking orders online and shipping through major channels.

Price compression, round 64.

The second catalyst to save the idea is international legalization, changing the UN drug treaties and allowing every low-cost provider country to ship and sell cannabis. That is the end for the US legal market and will also take a good chunk out of illegal market sales. As we covered with Colombia producing at $0.04 a gram and shipping all over the world already, look for Latin and South American countries to win this war long term.

There is no way at the current cost structures that currently run the cannabis industry.

What happens to all that debt when ounces when there are $50 ounces online, free shipping and 48-hour delivery? If that is the new legal price with interstate commerce smoothing out the industry, as we look at here on the black market, if ratios hold, you are looking at $25 to $30 ounces on the illicit markets being shipping all over the country too. Does the price and revenue model of your company work at those numbers?

There will never be enough cash or refinancing to take on all this debt, even with legalization. We will see a major MSO bankrupt, if not more, as funding may dry up even for them. There will be many losers and life savings lost on this cycle. It will have to crumble to be rebuilt with the correct prices for the commodity known as cannabis.

The current industry is bleak, and the future doesn’t look much better, unfortunately.

The cannabis industry is so bad…. the best idea I heard was to sell legal cocaine in British Columbia. BC recently decriminalized aggressive drug use and there are so many people dying of fentanyl, they are supposedly issuing licenses for clinics to sell medically pure cocaine as a gateway drug off fentanyl. Groups were pitching their licenses and the potential of being a legal coke dealer in Canada.

The best idea in cannabis is to be a legal coke dealer in Canada.

That about sums it up.

MORE ON BENZINGA SHOWS, READ ON…

You may like

Cannabis News

The Cannabis Industry is in a Free Fall

Published

2 hours agoon

February 27, 2025By

admin

The cannabis industry in Colorado, once heralded as a model for legal marijuana markets across the United States, finds itself grappling with significant challenges. The latest sales figures reveal that January 2025 marked the weakest sales performance for the state since 2017, raising alarm bells among industry stakeholders and policymakers alike. This article delves into the factors contributing to this downturn, the implications for the cannabis market, and potential pathways forward as Colorado navigates these turbulent times.

A Closer Look at the Sales Figures

According to data released by the Colorado Department of Revenue, total cannabis sales for January 2025 reached approximately $92.79 million. This figure represents a 7.3% decline compared to January 2024 and an 8.2% decrease from December 2024. The downward trend is particularly concerning given that Colorado has been a pioneer in the legal cannabis space since the state legalized recreational marijuana in 2012.

Key Sales Statistics

-

Total Sales for January 2025: $92.79 million

-

Year-over-Year Decline: 7.3%

-

Month-over-Month Decline: 8.2%

-

Comparison with Previous Years: January 2024 sales were significantly higher, indicating a stark contrast in consumer spending.

This decline marks a troubling trend for an industry that has experienced robust growth over the past decade. The current figures highlight a stark contrast to January 2024 when sales were considerably higher, raising questions about consumer behavior and market dynamics.

Understanding the Market Dynamics

The decline in cannabis sales can be attributed to several interrelated factors that have reshaped the landscape of Colorado’s cannabis market.

As the market matures, consumer preferences are evolving. Many consumers are becoming more discerning about their purchases, seeking quality over quantity. This shift has led to increased competition among dispensaries, pushing prices down and forcing retailers to adapt their offerings to meet changing demands.

Price Adjustments

In January 2025, the average price of cannabis items in Colorado rose slightly to $14.54, up from $13.49 in December 2024. Despite this increase, overall sales volume did not meet expectations, suggesting that consumers may be more price-sensitive than before. The rising costs may deter budget-conscious consumers from making purchases at licensed dispensaries.

Increased Competition from Illicit Markets

One of the most pressing challenges facing Colorado’s legal cannabis market is competition from unregulated sellers. The illicit market continues to thrive, offering consumers lower prices and greater accessibility than licensed retailers can provide.

The Impact of Illicit Sales

The presence of unlicensed sellers undermines the efforts of licensed dispensaries to maintain profitability. Many consumers are drawn to these illicit sources due to lower prices and convenience, which can lead to significant revenue losses for legal businesses. As a result, licensed retailers are struggling to compete in an increasingly saturated market.

Regulatory Challenges

The regulatory environment surrounding cannabis in Colorado is complex and often burdensome for businesses. High compliance costs and stringent regulations can create barriers for new entrants while placing additional pressure on existing businesses.

Compliance Costs

Licensed dispensaries face significant costs associated with compliance with state regulations, including fees for licensing, testing requirements, and security measures. These expenses can eat into profit margins and make it difficult for retailers to remain competitive against unlicensed sellers who do not face such stringent requirements.

Broader Implications for the Cannabis Market

The decline in Colorado’s cannabis sales is not an isolated incident; it reflects broader trends observed across several states where legalized marijuana markets are experiencing fluctuations in revenue.

National Trends in Cannabis Sales

According to BDSA’s analysis, cannabis sales decreased by 1.3% sequentially across multiple states in January 2025. This decline indicates that Colorado’s struggles may be part of a larger pattern affecting legal cannabis markets nationwide.

The Rise of New Markets

As more states legalize cannabis, competition increases not only within individual states but also between states vying for cannabis tourism and consumer spending. Neighboring states like New Mexico and Arizona have launched their own legal markets, further eroding Colorado’s position as a leading destination for cannabis consumers.

Economic Pressures on Retailers

Retailers in Colorado are facing increasing economic pressures as they navigate this challenging landscape. Many licensed dispensaries report struggling to maintain profitability amid rising costs and declining sales.

Profitability Challenges

With declining revenues and rising operational costs, many dispensaries are forced to make difficult decisions regarding staffing, inventory management, and marketing strategies. Some businesses may even consider downsizing or closing their doors altogether if conditions do not improve.

Industry Reactions: Voices from Within

The current state of Colorado’s cannabis market has prompted reactions from industry experts and stakeholders who express concern over the future of legal marijuana in the state.

Expert Opinions

Jonatan Cvetko, executive director of the United Cannabis Business Association (UCBA), stated that the current market conditions reflect a “complete failure” of regulatory frameworks designed to support licensed businesses. He emphasizes that without meaningful reforms and support from policymakers, many businesses may struggle to survive.

Calls for Change

Industry advocates are calling for changes that could help stabilize the market and support licensed businesses:

-

Regulatory Reforms: Streamlining regulations to reduce operational burdens on licensed businesses.

-

Consumer Education: Initiatives aimed at educating consumers about the benefits of purchasing from licensed retailers versus illicit sources.

-

Market Diversification: Encouraging innovation within product offerings to attract a broader customer base.

Challenges Faced by Retailers

Retailers are facing increasing pressure from both regulatory burdens and competition from unlicensed sellers who often offer lower prices. Many licensed dispensaries report struggling to maintain profitability as consumer spending shifts away from legal sources.

Potential Pathways Forward

As stakeholders work to address these challenges, several potential pathways forward could help stabilize Colorado’s cannabis market.

One of the most pressing needs is regulatory reform aimed at reducing compliance costs and simplifying licensing processes for businesses. By streamlining regulations, policymakers can create a more favorable environment for licensed retailers while discouraging illicit activity.

Educating consumers about the benefits of purchasing from licensed retailers is crucial for restoring confidence in legal markets. Public awareness campaigns can highlight product safety standards, quality assurance measures, and the economic benefits of supporting local businesses.

Encouraging innovation within product offerings can help attract a broader customer base and stimulate demand within the legal market. Retailers may explore new product lines or unique experiences that differentiate them from competitors.

Conclusion

Colorado’s cannabis industry stands at a critical juncture as it faces its weakest January sales since 2017. The combination of rising prices, increased competition from unlicensed sellers, changing consumer preferences, and complex regulatory challenges poses significant hurdles for retailers and regulators alike.

As stakeholders work collaboratively to address these issues, it will be essential to implement supportive policies that foster both public infrastructure needs and economic growth within the cannabis community. The future of Colorado’s once-thriving cannabis market hangs in balance as it navigates these bleak times—an opportunity exists for reform and revitalization if stakeholders commit to working together toward sustainable solutions.

HOW WAS 4/20 IN COLORADO, READ ON…

Cannabis News

SEO for Cannabis? – How to Build Top Rankings for Your Cannabis Brands in 2025

Published

1 day agoon

February 26, 2025By

admin

How to Cannabis SEO in 2025 like a Pro!

Running a cannabis brand online is like trying to play Monopoly with one hand tied behind your back while the banker keeps changing the rules. Trust me, I’ve been in this game long enough to know the frustrations. You can’t advertise on Facebook, Instagram treats you like a digital pariah, and Google Ads? Forget about it. One wrong move and poof – your social media accounts vanish faster than a fresh batch of edibles at a music festival.

But here’s the kicker: while traditional advertising channels remain firmly closed to our industry, there’s one path that’s still wide open – organic search traffic. That’s right, I’m talking about SEO (Search Engine Optimization), the art and science of getting your website to show up when people search for cannabis-related content.

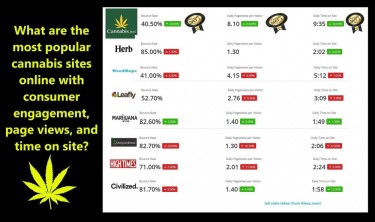

Now, I know what you’re thinking. “But Reg, how am I supposed to compete with giants like Marijuana.com who’ve been hoarding prime keyword real estate since before some of us were born?” Well, my friend, this is where things get interesting. You see, while the big players might have a stranglehold on broad terms like “marijuana” and “cannabis,” there’s a whole world of untapped potential in long-tail keywords and niche topics.

The challenge isn’t just about showing up in search results – it’s about showing up in front of the right people. And let’s be honest, if you’re not on the first page of Google, you might as well be selling oregano in a dark alley. The drop-off rate from page one to page two is steeper than that time I tried to explain terpenes to my grandmother.

But fear not! Today, I’m going to share something that could be a game-changer for smaller cannabis brands operating on a shoestring budget: how to leverage artificial intelligence for SEO. That’s right – we’re going to turn the tables on our corporate overlords by using their own tools against them.

So grab your favorite strain, settle in, and let’s dive into how AI can help level the playing field in the cannabis industry’s digital landscape.

Alright, before we dive into the wonderful world of AI-powered cannabis SEO, we need to get our fundamentals straight. Think of SEO as a digital game of hide and seek, except you’re trying to help Google find you while playing by an ever-changing set of rules.

Let’s start with the basics. Meta tags are like the ingredients list on your favorite edible – they tell search engines what your content is about. These include your title tags (what shows up in search results), meta descriptions (that little preview text), and headers (those H1s, H2s, etc. that break up your content). Keywords are the specific terms you want to rank for, while long-tail keywords are more specific phrases – think “best organic CBD oil for anxiety” versus just “CBD oil.”

Now, here’s where many cannabis brands get it wrong – they stuff their content with keywords like a rookie packing their first bowl. “Cannabis dispensary near me cannabis products buy cannabis cannabis deals cannabis cannabis cannabis…” You get the idea. This is what we call “black hat” SEO, and let me tell you, Google hates this more than the DEA hates fun. Pull this stunt, and your site might disappear from search results faster than your stash during a drought.

There’s a crucial difference between organic keyword ranking and paid advertising. Organic ranking is like growing your own – it takes time, patience, and proper care, but the results are worth it. Paid advertising (which isn’t available to cannabis brands anyway) is like buying from a dispensary – quick results but costly. Since we’re locked out of paid channels, organic is our best friend.

Remember this golden rule: while you’re optimizing for search engines, you’re writing for humans. Your content needs to be the digital equivalent of premium flower – high quality, well-cured, and delivering real value. Think of your website as a budtender who needs to both attract customers and keep them coming back.

Google tracks various metrics to determine your site’s quality. Time on page (how long visitors stick around) is like customer retention at a dispensary. Bounce rate (how quickly people leave) is like customers walking out without buying anything. Click-through rate (how many people click your link in search results) is like foot traffic. All these metrics tell Google whether your content is worth recommending to others.

The tricky part? Google’s algorithm is more mysterious than your dealer’s “special” strain. It uses over 200 ranking factors, and they change more often than dispensary daily specials. But one thing remains constant: quality content that serves user intent will always win in the long run.

Now that we’ve covered the fundamentals, let’s talk about crafting an SEO strategy specifically for cannabis brands. Because in this industry, we’re not just competing with other businesses – we’re fighting against decades of stigma, restrictive policies, and platforms that treat us like we’re selling contraband instead of a legal product.

Listen up, cannabis entrepreneurs – before you start throwing keywords around like confetti at a dispensary grand opening, you need to understand exactly who you’re trying to reach. And I’m not talking about some vague notion of “people who like weed.” We need to get specific.

Enter the buyer persona – your ideal customer’s digital avatar. Let me give you an example: Meet “Mindful Michelle,” a 35-year-old yoga instructor who uses cannabis to manage anxiety and enhance her meditation practice. She’s health-conscious, researches products thoroughly before buying, and values organic, sustainably produced cannabis. She shops primarily at boutique dispensaries and follows wellness influencers on Instagram. Her annual income is $65,000, and she’s willing to pay premium prices for quality products.

See what I did there? We’ve created a detailed profile that helps us understand not just who our customer is, but how they think and what they’re looking for. This brings us to user intent – the holy grail of SEO strategy.

Let’s say Michelle is looking for information about CBD for anxiety. She might start with a broad search like “CBD for anxiety,” but as she learns more, her searches become more specific. She might eventually search for “organic full-spectrum CBD oil dosage for meditation” – that’s a long-tail keyword gold mine right there. Why? Because it shows high intent (she’s looking for specific information), and there’s likely less competition for this precise phrase than broader terms.

When crafting content around these keywords, you’ll want to follow some best practices:

-

Use your target keyword in the title (naturally, not forced)

-

Include it in the first 50 words of your content

-

Sprinkle related terms throughout (think “anxiety relief,” “mindfulness,” “natural remedy”)

-

Include outbound links to reputable sources (like scientific studies)

-

Create internal links to your other relevant content

-

Use header tags (H1, H2, H3) to structure your content logically

But here’s the thing about content length – Google loves comprehensive content that thoroughly addresses user questions. We’re talking 1,500+ words for main pages and blog posts. “But Reg,” you might say, “isn’t that a bit much?” Not if you’re actually solving problems and providing value.

Think about it this way: if Michelle lands on your page about CBD and anxiety, and you’ve got a thorough, well-researched article that addresses dosing, different consumption methods, potential interactions, and the science behind how CBD affects anxiety – she’s likely to stick around. More importantly, she’s likely to bookmark your site and come back when she’s ready to make a purchase.

This is how you build trust in the cannabis space – by becoming a reliable source of information first, and a seller second. Remember, in an industry where traditional advertising is restricted, your content needs to work twice as hard.

Now, I know what you’re thinking – “Reg, this sounds like a lot of work!” And you’re right. Creating comprehensive, SEO-optimized content that actually provides value is no small task. But that’s where our AI friends come in handy. Let me show you how to make this process a whole lot easier…

Alright, my cannabis-loving friends, it’s time to unleash the robots! Not the terrifying kind that might take over the world, but the helpful ones that’ll make your SEO efforts smoother than a well-cured top shelf bud.

Let me tell you, creating high-quality, media-rich content used to be harder than explaining terpenes to your grandma. You’d need a writer, photographer, graphic designer, video editor – the works. But now? We’ve got an entire digital army at our disposal, and it’s surprisingly affordable.

Here’s my tried-and-true workflow that’ll have you pumping out content faster than a hydroponic setup on steroids:

First stop: Perplexity.AI. This bad boy is like having a research assistant who never sleeps and actually remembers everything they read. Feed it your topic, and it’ll spit out relevant scientific studies, market research, and questions you wouldn’t have thought to ask. Want to write about CBD and sleep? It’ll dig up everything from clinical trials to user demographics.

Next, slide into your favorite AI chatbot – whether that’s ChatGPT, Claude, or Grok. If you’re feeling fancy, hit up Openrouter and sample them all like you’re at a cannabis cup. These tools will help you craft content that’s more engaging than your local budtender’s strain recommendations. (I could write a whole article just on prompt engineering, but that’s a story for another day.)

Now, here’s where it gets fun. Need images? Leonardo.ai or MidJourney are your new best friends. Want a stunning visual of cannabinoids interacting with neural receptors? Or maybe a chill lifestyle shot of someone enjoying their evening routine? These AI tools can create custom, copyright-free images that look better than most stock photos. Pro tip: Have your AI writing assistant generate image prompts based on your article – it’s like having a creative director in your pocket.

But why stop at text and images? Let’s get audio in the mix with Elevenlabs. Turn your article into a podcast-style recording that people can listen to during their commute. Then, take those AI-generated images, throw them into Capcut with your audio, and boom – you’ve got a video ready for YouTube. That’s three different ways for people to consume your content, and three different chances to keep them engaged.

Here’s the real kicker – you can “spin” your article (that’s industry speak for rewriting while maintaining the core message) a few times and publish it on platforms like Substack, Medium, or Reddit. Link these back to your original piece, and you’re building a web of high-authority backlinks that’ll make Google happier than a kid in a candy store.

The best part? This entire process takes about 2-3 hours once you get the hang of it. You’re creating a content ecosystem that provides value across multiple platforms and formats, all while building those precious SEO signals that Google loves.

Remember though, always keep your target keywords in mind throughout this process. Have your AI assistants strategically place them in your content, headers, and meta descriptions. It’s like leaving a trail of breadcrumbs that leads straight to your website.

And this, my friends, is just scratching the surface. The robots are here to help, and they’re making premium content creation more accessible than ever. Time to embrace the future and let AI help you climb those search rankings!

What I’ve shared here is just the tip of the cannabis cola, if you will. It’s like I’ve taught you how to pack a bowl, but there’s still so much to learn about the whole grow operation. However, these fundamentals should be enough to get you started on your SEO journey.

Here’s the deal: aim to post 2-3 solid pieces of content each week. And I mean solid – not that schwag content that’s just recycled from other sites. We’re talking premium, home-grown content that your users will actually want to consume. Share it across your social platforms (where allowed, of course – we all know how touchy these platforms can be about cannabis content), and weave your products or services into the narrative naturally. Nobody likes a pushy salesperson, but everyone appreciates genuine expertise and helpful advice.

Think of it like growing a healthy cannabis plant – you need consistent care, the right nutrients, and most importantly, patience. Keep feeding your audience valuable content, and they’ll reward you with engagement. When Google sees users spending time on your site, sharing your content, and coming back for more, it’s like getting a five-star review from the most important dispensary rating system in the digital world.

Remember, success in cannabis SEO isn’t about gaming the system – it’s about actually being useful to your target audience. Solve their problems, answer their questions, and become their trusted source of information. Do this consistently, and Google will naturally want to recommend you to others searching for similar content.

And here’s a final nugget of wisdom: the cannabis industry is constantly evolving, and so should your SEO strategy. Stay curious, keep testing new approaches, and don’t be afraid to experiment with different content formats and topics.

Now get out there and start creating some killer content. Your future customers are out there searching for you – it’s time to help them find you.

Good luck, and may your rankings be high and your bounce rates low!

https://www.reddit.com/r/weedbiz/comments/1ig1nwq/why_are_most

_cannabis_seo_agencies_scams_anyone/

CANNABIS SEO GOES HIGH TECH, READ ON…

Cannabis News

Pot for Potholes? – Michigan Plans to Let Cannabis Tax Revenue Fix the Growing Pothole Problem in the State

Published

2 days agoon

February 25, 2025By

admin

In recent months, Michigan has found itself at the intersection of two significant issues: the deteriorating state of its roads and the burgeoning cannabis industry. Governor Gretchen Whitmer’s ambitious plan to allocate funds from marijuana taxes to repair potholes has ignited a lively debate within both the political and cannabis communities. As the state grapples with aging infrastructure, the proposal raises questions about funding priorities, industry sustainability, and consumer impact. This article delves into the details of the plan, its implications for Michigan’s cannabis sector, and the broader conversation it has sparked.

The State of Michigan’s Roads

Michigan is notorious for its rough roads. According to a report from the American Society of Civil Engineers, nearly 40% of Michigan’s roads are in poor condition, leading to increased vehicle damage and safety concerns for drivers. The state has long struggled with funding for road repairs, often relying on gas taxes and federal funds that have proven insufficient to address the growing backlog of maintenance needs.

The Economic Impact of Poor Infrastructure

The economic ramifications of poor road conditions are profound. Businesses face higher transportation costs due to vehicle wear and tear, while residents experience longer commute times and reduced quality of life. Additionally, inadequate infrastructure can deter new businesses from setting up shop in Michigan, further stifling economic growth.

Governor Whitmer’s Proposal

In response to these pressing issues, Governor Whitmer announced a comprehensive $3 billion plan aimed at revitalizing Michigan’s roads. The proposal focuses on innovative funding strategies, including a significant increase in taxes on marijuana products.

Funding Breakdown

The proposed funding plan includes:

-

$1.7 billion from corporate taxes and technology companies.

-

$1.2 billion from increased gas taxes.

-

$500 million cut from unspecified spending areas.

-

A 32% wholesale tax on marijuana products projected to generate $470 million annually.

This ambitious approach aims not only to repair potholes but also to create a more sustainable funding model for ongoing infrastructure needs.

The Role of Cannabis Tax Revenue

Michigan legalized recreational marijuana in 2018, leading to a rapid expansion of the cannabis market. With over 400 licensed dispensaries and a thriving cultivation sector, tax revenue from cannabis sales has become a significant source of income for the state. Currently, marijuana products are subject to a 10% excise tax and a 6% sales tax; however, Governor Whitmer’s proposal seeks to elevate this wholesale tax substantially.

Reactions from the Cannabis Community

The announcement has elicited mixed reactions from various stakeholders within Michigan’s cannabis community. While some applaud the idea of using cannabis tax revenue for public goods like road repairs, others express concern about the potential negative consequences for the industry.

Support for the Initiative

Many proponents argue that using cannabis tax revenue for infrastructure improvements is a logical step forward. They contend that as one of the most lucrative sectors in Michigan’s economy, the cannabis industry should contribute significantly to public services.

-

Public Good Argument: Advocates argue that better roads benefit everyone, including those in the cannabis industry who rely on transportation for distribution and customer access.

-

Community Investment: Some believe that investing in infrastructure will enhance overall community well-being and support local businesses.

Concerns About Increased Taxes

On the other hand, several dispensary owners and industry advocates express serious concerns about the proposed tax increase:

-

Impact on Consumers: Many fear that raising taxes on marijuana products will lead to higher prices for consumers. One dispensary owner noted that some products could see price increases close to 90%, making legal cannabis less competitive against black market alternatives.

-

Market Viability: There is apprehension that higher prices could drive consumers back into the black market, undermining years of progress made in legalizing and regulating cannabis sales.

-

Small Business Struggles: Smaller dispensaries may struggle more than larger corporations to absorb increased costs, potentially leading to business closures and reduced competition in the market.

Broader Economic Implications

The intersection of road funding and cannabis taxation raises broader questions about economic policy in Michigan. As states across the U.S. grapple with similar challenges—balancing public needs with industry growth—Michigan’s approach may serve as a case study for others.

Balancing Act: Public Needs vs. Industry Growth

Governments must find ways to fund essential services while fostering economic growth in emerging industries like cannabis. The challenge lies in ensuring that taxation does not stifle innovation or drive consumers away from legal markets.

Potential Alternatives

Some industry representatives have called for alternative funding solutions that do not rely solely on increased taxation:

-

Reallocation of Existing Funds: Advocates suggest examining current budget allocations to identify areas where funds can be redirected toward road repairs without imposing new taxes.

-

Public-Private Partnerships: Collaborations between government entities and private companies could provide innovative solutions for funding infrastructure projects without burdening taxpayers or industries.

-

Incentives for Local Businesses: Offering incentives or tax breaks for local businesses involved in road repair projects could stimulate job creation while addressing infrastructure needs.

Political Landscape

Governor Whitmer’s proposal has also ignited discussions within Michigan’s political landscape. Republican lawmakers have voiced opposition to increasing taxes on marijuana products as part of road funding strategies.

Republican Counterproposal

In response to Whitmer’s plan, Republican lawmakers have proposed an alternative $3 billion road funding strategy that does not rely on tax increases. This plan emphasizes reallocating existing funds rather than imposing new taxes on any industry.

Bipartisan Cooperation Challenges

While both parties agree on the need for better roads, finding common ground on how to fund these improvements remains elusive. The debate over using marijuana tax revenue highlights broader ideological differences regarding taxation and government spending priorities.

The Future of Cannabis Regulation in Michigan

As discussions around Governor Whitmer’s proposal continue, they underscore broader trends in cannabis regulation across the United States. States that have legalized marijuana are increasingly looking at how best to leverage tax revenue generated from this burgeoning industry.

Lessons Learned from Other States

States like Colorado and California have faced similar challenges regarding how best to utilize cannabis tax revenue. In Colorado, funds have been allocated toward education initiatives and public health programs; however, debates continue over how effectively these funds are being utilized.

Ensuring Transparency and Accountability

For Michigan’s approach to be successful, it will be essential to establish transparency and accountability measures regarding how cannabis tax revenues are spent. Ensuring that funds are directed toward meaningful infrastructure improvements will be critical in maintaining public support for both road repairs and continued investment in the cannabis industry.

Conclusion

Governor Gretchen Whitmer’s plan to fix potholes using marijuana tax revenue has sparked an important conversation about infrastructure funding and its relationship with emerging industries like cannabis. While many see this as an innovative solution to longstanding issues with road conditions in Michigan, others raise valid concerns about potential negative impacts on consumers and small businesses within the cannabis sector.

As discussions evolve, it will be crucial for stakeholders from government officials to industry representatives to engage collaboratively in seeking solutions that benefit both public infrastructure needs and economic growth within the cannabis community. The outcome of this debate may not only shape Michigan’s future but also serve as a model for other states navigating similar challenges as they balance public service needs with burgeoning industries’ growth potential.

MICHIGAN GOES CANNABIS GREEN, READ ON…

The Cannabis Industry is in a Free Fall

Trump research cuts threaten cannabis studies, poses rescheduling questions

Cocaine Hub Seized by Rebels, Thwarting Colombia’s ‘Total Peace’

SEO for Cannabis? – How to Build Top Rankings for Your Cannabis Brands in 2025

Montanans must activate to protect legalization in 2025

Analysis: Don’t hold your breath for legalization under Trump 2.0

Pot for Potholes? – Michigan Plans to Let Cannabis Tax Revenue Fix the Growing Pothole Problem in the State

Karma Koala Podcast 232: Karina Bashir, Antithesis Law. Her work developing ESG & Corporate Practice Blueprint In The New Psychedelics Ecosystem

Medical cannabis registries show steep decline after launch of adult-use sales

Benefits and Uses of THCA Flower

Distressed Cannabis Business Takeaways – Canna Law Blog™

United States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

What you Need to Know

Drug Testing for Marijuana – The Joint Blog

NCIA Write About Their Equity Scholarship Program

It has been a wild news week – here’s how CBD and weed can help you relax

Cannabis, alcohol firm SNDL loses CA$372.4 million in 2022

A new April 20 cannabis contest includes a $40,000 purse

Your Go-To Source for Cannabis Logos and Designs

UArizona launches online cannabis compliance online course

Trending

-

Cannabis News2 years ago

Cannabis News2 years agoDistressed Cannabis Business Takeaways – Canna Law Blog™

-

One-Hit Wonders2 years ago

One-Hit Wonders2 years agoUnited States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

-

Cannabis 1012 years ago

Cannabis 1012 years agoWhat you Need to Know

-

drug testing1 year ago

drug testing1 year agoDrug Testing for Marijuana – The Joint Blog

-

Education2 years ago

Education2 years agoNCIA Write About Their Equity Scholarship Program

-

Cannabis2 years ago

Cannabis2 years agoIt has been a wild news week – here’s how CBD and weed can help you relax

-

Marijuana Business Daily2 years ago

Marijuana Business Daily2 years agoCannabis, alcohol firm SNDL loses CA$372.4 million in 2022

-

California2 years ago

California2 years agoA new April 20 cannabis contest includes a $40,000 purse