Cannabis News

Should Cannabis Consumption Be Banned in Public Like Drinking Alcohol?

Published

2 years agoon

By

admin

In July 2023, New York State Senator George Borello (R) introduced a measure to ban cannabis smoking and consumption in public places, except for locations with special authorization. Senator George Borrello (R) has served New York State Senate District 57 since November 26, 2019. His political career, however, began much earlier, as a Chautauqua County Legislator, where he faithfully served from 2010 until 2017.

Following that, he served as County Executive for Chautauqua County, New York, from 2018 to 2019, refining his leadership talents even more. Senator Borrello’s Republican Party influence extends to sections of Western New York, including the city of Jamestown, which is inside his District 57. His persistent commitment to the well-being of his fellow citizens has shaped his illustrious political career.

Borello highlighted concerns from constituents regarding the increase in public cannabis consumption since the enactment of the Marijuana Regulation and Taxation Act (MRTA) in 2021. He argued that the pungent odor of marijuana on public sidewalks and in other spaces is affecting residents, including children.

This proposal aims to apply similar rules to cannabis use as those in effect for tobacco.

The GOP Senator’s Proposal and Its Implications

Senate Bill 7604 seeks to prohibit the public use of cannabis while granting cities and towns the authority to create precise guidelines for permissible locations for marijuana consumption. Presently, the bill is pending review in the Senate Rules Committee.

Currently, the state law allows public cannabis use wherever tobacco smoking is permitted, a comparison many find unsuitable. For instance, New York introduced the Clean Indoor Air Act in 1989, which strictly forbids smoking tobacco and using vapor products in most indoor and certain outdoor public areas and workplaces.

Assemblyman Borello argues that cannabis use and tobacco consumption are fundamentally different and should not be governed by the same rules. The comparison drawn by Senator Borello is between cannabis use and alcohol consumption, as he argues that both can lead to cognitive and motor impairment.

If the bill becomes law, violators will face a fine of $125.

Borello highlights that in most states with legal adult-use cannabis programs, consumption is limited to private properties, reflecting a more responsible approach. However, he points out that New York’s leaders have often favored reckless choices, as demonstrated by the recent recreational marijuana law.

Republicans in the state Legislature have supported the ban, aiming to prohibit smoking and consumption of marijuana in public places. The proposal has raised debates about individual rights, public health concerns, and balancing cannabis regulation and personal freedoms.

Trends in Cannabis Consumption and Culture

New York’s cannabis culture has evolved significantly since its legalization. There’s now increased acceptance and integration of cannabis use throughout society. This move has given customers access to various cannabis products, including flowers, edibles, vapes, and concentrates, all available through regulated shops and licensed firms.

Consequently, consumers in New York have broadened their consumption habits, embracing the variety of cannabis offerings now accessible to them. While some prefer traditional smoking methods, others prefer discreet and convenient options like edibles and vape pens. Moreover, introducing higher-potency strains has also been observed, appealing to different market segments.

Cannabis tourism has also become a prominent trend in New York. Tourists from neighboring states, where cannabis is still prohibited, journey to New York to indulge in legal cannabis products and immerse themselves in the state’s vibrant cannabis culture. This influx of visitors has brought about favorable economic effects, benefiting local businesses and boosting tax revenues in the region.

With increased acceptance and mainstream exposure, cannabis education and advocacy have become more prevalent in New York. Organizations and activists work to promote responsible cannabis use, educate the public about its benefits and risks, and support sensible cannabis policies.

The Cannabis Market in New York Since Legalization

In 2021, New York took a significant step by officially legalizing adult-use cannabis by enacting the Marijuana Regulation and Taxation Act (MRTA). This groundbreaking legislation allowed individuals aged 21 and above to possess, use, and sell cannabis, making New York the 15th state in the U.S. to embrace recreational marijuana.

The legalization triggered a boom in interest and investment in the state’s cannabis business. Businesses and consumers alike realized the enormous potential of this new business, resulting in more significant expenses in cultivation, processing, retail, and related services to meet the rising client base.

In the wake of legalization, many cannabis companies entered the New York market, ranging from licensed dispensaries to innovative startups offering diverse cannabis products and services. The regulated market and the promise of legal sales motivated significant investment, creating fresh employment opportunities and contributing to the state’s overall economic growth.

Moreover, the legalization of cannabis brought forth a substantial revenue stream for New York. The state could now generate significant income through taxation and licensing fees from the thriving cannabis industry. This revenue infusion presented opportunities to enhance public services, support education, and invest in infrastructure, further bolstering the state’s economy.

Recognizing the historical injustices linked to cannabis prohibition, New York, like several other states, embraced social equity initiatives alongside legalization. These programs aimed to rectify past disparities by ensuring equitable access to cannabis industry opportunities for communities disproportionately impacted by the war on drugs. Social equity initiatives prioritized licenses and support for minority-owned businesses and individuals with prior cannabis-related convictions, fostering a more inclusive and fair cannabis landscape in the state.

Conclusion

The potential ban on public cannabis use in New York holds substantial implications for the state’s burgeoning cannabis market and culture. While the measure seeks to address valid concerns regarding public consumption, its implementation could also impact cannabis businesses and consumer behaviors. Since the legalization of cannabis, New York’s market has experienced remarkable growth, fostering new businesses, boosting tax revenue, and promoting social equity initiatives.

With consumption habits diversifying and cannabis culture becoming increasingly normalized, the proposed legislation’s progression necessitates close monitoring to assess its potential effects on the state’s evolving cannabis landscape. Striking the right balance between public interests and industry growth will be vital for the continued success of the cannabis sector in New York.

SHOULD YOU BE ABLE TO SMOKE WEED IN PUBLIC, READ ON…

You may like

-

Karma Koala Podcast 234: Tom Church Litigator, Atlanta. Georgia is notorious on the law enforcement front….. “Our Firm Gets Charges Dismissed in Delta-8-THC Prosecution”

-

Virginia governor expected to veto recreational marijuana sales legislation

-

Just Say No to Marijuana!

-

Star signs and cannabis strains: March 2025 horoscopes

-

12 States That Could Legalize Cannabis in 2025

-

The Cannabis Industry is in a Free Fall

In a move that has reignited debates about federal drug policy, former President Donald Trump has appointed Terrance Cole as the new head of the Drug Enforcement Administration (DEA). Cole, a veteran DEA official with over two decades of experience, is known for his staunch opposition to marijuana legalization. His appointment signals a return to the Reagan-era “Just Say No” approach to drug enforcement, with Cole publicly linking cannabis use to an increased risk of suicide and schizophrenia, particularly among young users.

The announcement has drawn sharp reactions from both sides of the political aisle, with advocates for cannabis reform expressing concern that Cole’s leadership could roll back progress made in recent years. Meanwhile, proponents of stricter drug enforcement have hailed the appointment as a necessary step to combat what they see as the growing normalization of marijuana in American society.

This article delves into Terrance Cole’s background, his controversial views on cannabis, and what his appointment could mean for the future of marijuana policy in the United States.

A Return to Hardline Drug Policies?

Terrance Cole’s appointment comes at a pivotal time for cannabis policy in the United States. Over the past decade, there has been a seismic shift in public attitudes toward marijuana. As of 2025, 23 states have legalized recreational cannabis use, and 38 states allow medical marijuana. Public opinion polls consistently show that a majority of Americans support federal legalization. Despite this momentum, marijuana remains classified as a Schedule I drug under the Controlled Substances Act—a category reserved for substances with a high potential for abuse and no accepted medical use.

Cole’s nomination appears to signal a departure from the more reform-oriented approach taken by previous administrations. During President Joe Biden’s tenure, there were significant discussions about rescheduling marijuana to a lower classification or even decriminalizing it at the federal level. However, Trump’s decision to appoint Cole suggests that his administration is doubling down on traditional drug enforcement strategies.

In his first public statement following his nomination, Cole said:

”We cannot afford to ignore the science. Marijuana is not the harmless substance that many claim it to be. It poses serious risks to mental health and public safety.”

This rhetoric echoes the anti-drug messaging of the 1980s, when First Lady Nancy Reagan spearheaded the “Just Say No” campaign as part of the broader War on Drugs. Critics argue that such policies disproportionately targeted minority communities and contributed to mass incarceration without effectively addressing substance abuse issues.

Who is Terrance Cole?

Terrance Cole is no stranger to the DEA or its mission. Over his 22-year career with the agency, he rose through the ranks, earning a reputation as a tough-on-crime enforcer. Before his nomination as DEA Administrator, Cole served as Special Agent in Charge of the agency’s Washington Field Division, where he oversaw high-profile operations targeting drug trafficking organizations.

Cole has long been an outspoken critic of marijuana legalization efforts. In 2021, he testified before Congress against proposals to decriminalize cannabis at the federal level. During his testimony, he cited studies suggesting that heavy marijuana use among adolescents could lead to long-term cognitive impairment and an increased likelihood of developing psychosis or schizophrenia.

”The data is clear,” Cole said during his testimony. ”Marijuana today is far more potent than it was 30 years ago. We are not dealing with Woodstock weed anymore; we are dealing with a substance that can have devastating effects on young minds.”

Cole has also linked cannabis use to rising suicide rates among teenagers and young adults. While some studies have explored potential correlations between heavy cannabis use and mental health issues, critics argue that such claims oversimplify complex issues and ignore other contributing factors like socioeconomic conditions and access to mental health care.

The Science Behind Cole’s Claims

Cole’s assertions about marijuana’s risks are not without precedent but remain highly contested within the scientific community. Some research has suggested a potential link between heavy cannabis use and mental health disorders like schizophrenia in individuals predisposed to such conditions. For example:

A 2019 study published in The Lancet Psychiatry found that daily use of high-potency cannabis was associated with an increased risk of psychotic disorders.

Other studies have suggested that early and frequent cannabis use may exacerbate symptoms in individuals already vulnerable to mental health issues.

However, many experts caution against drawing causal conclusions from these findings. Dr. Susan Weiss, director of the ”ivision of Extramural Research at the National Institute on Drug Abuse (NIDA), has stated:

”While there is evidence of an association between cannabis use and certain mental health outcomes, it is important to consider other variables that may contribute to these risks.”

Moreover, proponents of legalization argue that regulating marijuana can mitigate some of these risks by ensuring product safety and providing education about responsible use.

Implications for Federal Marijuana Policy

Cole’s appointment could have far-reaching consequences for federal marijuana policy. As head of the DEA, he will play a key role in determining how federal law enforcement approaches cannabis-related offenses. This includes decisions about whether to prioritize crackdowns on state-legal cannabis businesses or focus resources on other drug enforcement efforts.

One immediate concern among advocates is how Cole’s leadership might impact efforts to reschedule or deschedule marijuana under federal law. In October 2022, President Biden directed federal agencies to review marijuana’s classification as a Schedule I drug—a move widely seen as a step toward reform. However, with Cole at the helm of the DEA, such efforts could face significant resistance.

Kevin Sabet, president of Smart Approaches to Marijuana (SAM), praised Cole’s appointment as a victory for public health:

”Terrance Cole understands that we cannot sacrifice our youth’s well-being on the altar of Big Marijuana profits.”

On the other hand, organizations like NORML (National Organization for the Reform of Marijuana Laws) have expressed alarm over what they see as a regressive turn in federal policy. In a statement following Cole’s nomination, NORML Executive Director Erik Altieri said:

”This appointment represents an outdated approach to drug policy that ignores decades of progress and overwhelming public support for legalization.”

State vs. Federal Tensions

Cole’s hardline stance could exacerbate tensions between state governments that have legalized marijuana and federal authorities tasked with enforcing prohibition laws. While Congress passed legislation in 2023 protecting state-legal cannabis businesses from federal interference, these protections are not permanent and could be revisited under new leadership.

In states like Colorado and California—where legal cannabis industries generate billions in revenue annually—there is growing concern about how aggressive federal enforcement might disrupt local economies. Additionally, medical marijuana patients who rely on cannabis for conditions like chronic pain or epilepsy worry about potential restrictions on access.

The Broader Debate: Public Safety vs. Personal Freedom

At its core, Cole’s appointment reignites broader debates about how society should balance public safety concerns with individual freedoms when it comes to drug use. Supporters of stricter enforcement argue that normalizing marijuana sends mixed messages about its risks—particularly to young people—and undermines efforts to address substance abuse more broadly.

Opponents counter that criminalizing cannabis does more harm than good by perpetuating systemic inequalities and diverting resources away from addressing more pressing public health crises like opioid addiction.

Dr. Ethan Russo, a neurologist and prominent cannabis researcher, argues:

”We need policies grounded in science rather than fear-mongering rhetoric. Demonizing cannabis ignores its potential benefits while failing to address legitimate concerns about misuse.”

Conclusion

Terrance Cole’s appointment as DEA Administrator marks a significant shift in federal drug policy under former President Donald Trump’s administration. With his “Just Say No”-style rhetoric and firm opposition to marijuana legalization, Cole represents a return to more traditional approaches to drug enforcement—ones that many hoped were relics of the past.

As debates over cannabis reform continue to unfold at both state and federal levels, one thing is clear: Terrance Cole’s leadership will be closely watched by advocates on all sides of this contentious issue. Whether his tenure will lead to meaningful progress or further polarization remains an open question—but its impact on America’s evolving relationship with marijuana is likely to be profound.

THE DEA ON HEMP AND MARIJUANA, READ ON…

Cannabis News

The Cannabis Industry is in a Free Fall

Published

2 days agoon

February 27, 2025By

admin

The cannabis industry in Colorado, once heralded as a model for legal marijuana markets across the United States, finds itself grappling with significant challenges. The latest sales figures reveal that January 2025 marked the weakest sales performance for the state since 2017, raising alarm bells among industry stakeholders and policymakers alike. This article delves into the factors contributing to this downturn, the implications for the cannabis market, and potential pathways forward as Colorado navigates these turbulent times.

A Closer Look at the Sales Figures

According to data released by the Colorado Department of Revenue, total cannabis sales for January 2025 reached approximately $92.79 million. This figure represents a 7.3% decline compared to January 2024 and an 8.2% decrease from December 2024. The downward trend is particularly concerning given that Colorado has been a pioneer in the legal cannabis space since the state legalized recreational marijuana in 2012.

Key Sales Statistics

-

Total Sales for January 2025: $92.79 million

-

Year-over-Year Decline: 7.3%

-

Month-over-Month Decline: 8.2%

-

Comparison with Previous Years: January 2024 sales were significantly higher, indicating a stark contrast in consumer spending.

This decline marks a troubling trend for an industry that has experienced robust growth over the past decade. The current figures highlight a stark contrast to January 2024 when sales were considerably higher, raising questions about consumer behavior and market dynamics.

Understanding the Market Dynamics

The decline in cannabis sales can be attributed to several interrelated factors that have reshaped the landscape of Colorado’s cannabis market.

As the market matures, consumer preferences are evolving. Many consumers are becoming more discerning about their purchases, seeking quality over quantity. This shift has led to increased competition among dispensaries, pushing prices down and forcing retailers to adapt their offerings to meet changing demands.

Price Adjustments

In January 2025, the average price of cannabis items in Colorado rose slightly to $14.54, up from $13.49 in December 2024. Despite this increase, overall sales volume did not meet expectations, suggesting that consumers may be more price-sensitive than before. The rising costs may deter budget-conscious consumers from making purchases at licensed dispensaries.

Increased Competition from Illicit Markets

One of the most pressing challenges facing Colorado’s legal cannabis market is competition from unregulated sellers. The illicit market continues to thrive, offering consumers lower prices and greater accessibility than licensed retailers can provide.

The Impact of Illicit Sales

The presence of unlicensed sellers undermines the efforts of licensed dispensaries to maintain profitability. Many consumers are drawn to these illicit sources due to lower prices and convenience, which can lead to significant revenue losses for legal businesses. As a result, licensed retailers are struggling to compete in an increasingly saturated market.

Regulatory Challenges

The regulatory environment surrounding cannabis in Colorado is complex and often burdensome for businesses. High compliance costs and stringent regulations can create barriers for new entrants while placing additional pressure on existing businesses.

Compliance Costs

Licensed dispensaries face significant costs associated with compliance with state regulations, including fees for licensing, testing requirements, and security measures. These expenses can eat into profit margins and make it difficult for retailers to remain competitive against unlicensed sellers who do not face such stringent requirements.

Broader Implications for the Cannabis Market

The decline in Colorado’s cannabis sales is not an isolated incident; it reflects broader trends observed across several states where legalized marijuana markets are experiencing fluctuations in revenue.

National Trends in Cannabis Sales

According to BDSA’s analysis, cannabis sales decreased by 1.3% sequentially across multiple states in January 2025. This decline indicates that Colorado’s struggles may be part of a larger pattern affecting legal cannabis markets nationwide.

The Rise of New Markets

As more states legalize cannabis, competition increases not only within individual states but also between states vying for cannabis tourism and consumer spending. Neighboring states like New Mexico and Arizona have launched their own legal markets, further eroding Colorado’s position as a leading destination for cannabis consumers.

Economic Pressures on Retailers

Retailers in Colorado are facing increasing economic pressures as they navigate this challenging landscape. Many licensed dispensaries report struggling to maintain profitability amid rising costs and declining sales.

Profitability Challenges

With declining revenues and rising operational costs, many dispensaries are forced to make difficult decisions regarding staffing, inventory management, and marketing strategies. Some businesses may even consider downsizing or closing their doors altogether if conditions do not improve.

Industry Reactions: Voices from Within

The current state of Colorado’s cannabis market has prompted reactions from industry experts and stakeholders who express concern over the future of legal marijuana in the state.

Expert Opinions

Jonatan Cvetko, executive director of the United Cannabis Business Association (UCBA), stated that the current market conditions reflect a “complete failure” of regulatory frameworks designed to support licensed businesses. He emphasizes that without meaningful reforms and support from policymakers, many businesses may struggle to survive.

Calls for Change

Industry advocates are calling for changes that could help stabilize the market and support licensed businesses:

-

Regulatory Reforms: Streamlining regulations to reduce operational burdens on licensed businesses.

-

Consumer Education: Initiatives aimed at educating consumers about the benefits of purchasing from licensed retailers versus illicit sources.

-

Market Diversification: Encouraging innovation within product offerings to attract a broader customer base.

Challenges Faced by Retailers

Retailers are facing increasing pressure from both regulatory burdens and competition from unlicensed sellers who often offer lower prices. Many licensed dispensaries report struggling to maintain profitability as consumer spending shifts away from legal sources.

Potential Pathways Forward

As stakeholders work to address these challenges, several potential pathways forward could help stabilize Colorado’s cannabis market.

One of the most pressing needs is regulatory reform aimed at reducing compliance costs and simplifying licensing processes for businesses. By streamlining regulations, policymakers can create a more favorable environment for licensed retailers while discouraging illicit activity.

Educating consumers about the benefits of purchasing from licensed retailers is crucial for restoring confidence in legal markets. Public awareness campaigns can highlight product safety standards, quality assurance measures, and the economic benefits of supporting local businesses.

Encouraging innovation within product offerings can help attract a broader customer base and stimulate demand within the legal market. Retailers may explore new product lines or unique experiences that differentiate them from competitors.

Conclusion

Colorado’s cannabis industry stands at a critical juncture as it faces its weakest January sales since 2017. The combination of rising prices, increased competition from unlicensed sellers, changing consumer preferences, and complex regulatory challenges poses significant hurdles for retailers and regulators alike.

As stakeholders work collaboratively to address these issues, it will be essential to implement supportive policies that foster both public infrastructure needs and economic growth within the cannabis community. The future of Colorado’s once-thriving cannabis market hangs in balance as it navigates these bleak times—an opportunity exists for reform and revitalization if stakeholders commit to working together toward sustainable solutions.

HOW WAS 4/20 IN COLORADO, READ ON…

Cannabis News

SEO for Cannabis? – How to Build Top Rankings for Your Cannabis Brands in 2025

Published

3 days agoon

February 26, 2025By

admin

How to Cannabis SEO in 2025 like a Pro!

Running a cannabis brand online is like trying to play Monopoly with one hand tied behind your back while the banker keeps changing the rules. Trust me, I’ve been in this game long enough to know the frustrations. You can’t advertise on Facebook, Instagram treats you like a digital pariah, and Google Ads? Forget about it. One wrong move and poof – your social media accounts vanish faster than a fresh batch of edibles at a music festival.

But here’s the kicker: while traditional advertising channels remain firmly closed to our industry, there’s one path that’s still wide open – organic search traffic. That’s right, I’m talking about SEO (Search Engine Optimization), the art and science of getting your website to show up when people search for cannabis-related content.

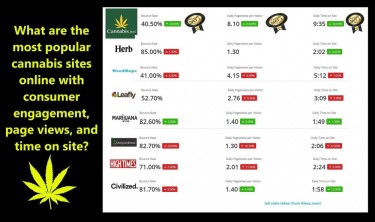

Now, I know what you’re thinking. “But Reg, how am I supposed to compete with giants like Marijuana.com who’ve been hoarding prime keyword real estate since before some of us were born?” Well, my friend, this is where things get interesting. You see, while the big players might have a stranglehold on broad terms like “marijuana” and “cannabis,” there’s a whole world of untapped potential in long-tail keywords and niche topics.

The challenge isn’t just about showing up in search results – it’s about showing up in front of the right people. And let’s be honest, if you’re not on the first page of Google, you might as well be selling oregano in a dark alley. The drop-off rate from page one to page two is steeper than that time I tried to explain terpenes to my grandmother.

But fear not! Today, I’m going to share something that could be a game-changer for smaller cannabis brands operating on a shoestring budget: how to leverage artificial intelligence for SEO. That’s right – we’re going to turn the tables on our corporate overlords by using their own tools against them.

So grab your favorite strain, settle in, and let’s dive into how AI can help level the playing field in the cannabis industry’s digital landscape.

Alright, before we dive into the wonderful world of AI-powered cannabis SEO, we need to get our fundamentals straight. Think of SEO as a digital game of hide and seek, except you’re trying to help Google find you while playing by an ever-changing set of rules.

Let’s start with the basics. Meta tags are like the ingredients list on your favorite edible – they tell search engines what your content is about. These include your title tags (what shows up in search results), meta descriptions (that little preview text), and headers (those H1s, H2s, etc. that break up your content). Keywords are the specific terms you want to rank for, while long-tail keywords are more specific phrases – think “best organic CBD oil for anxiety” versus just “CBD oil.”

Now, here’s where many cannabis brands get it wrong – they stuff their content with keywords like a rookie packing their first bowl. “Cannabis dispensary near me cannabis products buy cannabis cannabis deals cannabis cannabis cannabis…” You get the idea. This is what we call “black hat” SEO, and let me tell you, Google hates this more than the DEA hates fun. Pull this stunt, and your site might disappear from search results faster than your stash during a drought.

There’s a crucial difference between organic keyword ranking and paid advertising. Organic ranking is like growing your own – it takes time, patience, and proper care, but the results are worth it. Paid advertising (which isn’t available to cannabis brands anyway) is like buying from a dispensary – quick results but costly. Since we’re locked out of paid channels, organic is our best friend.

Remember this golden rule: while you’re optimizing for search engines, you’re writing for humans. Your content needs to be the digital equivalent of premium flower – high quality, well-cured, and delivering real value. Think of your website as a budtender who needs to both attract customers and keep them coming back.

Google tracks various metrics to determine your site’s quality. Time on page (how long visitors stick around) is like customer retention at a dispensary. Bounce rate (how quickly people leave) is like customers walking out without buying anything. Click-through rate (how many people click your link in search results) is like foot traffic. All these metrics tell Google whether your content is worth recommending to others.

The tricky part? Google’s algorithm is more mysterious than your dealer’s “special” strain. It uses over 200 ranking factors, and they change more often than dispensary daily specials. But one thing remains constant: quality content that serves user intent will always win in the long run.

Now that we’ve covered the fundamentals, let’s talk about crafting an SEO strategy specifically for cannabis brands. Because in this industry, we’re not just competing with other businesses – we’re fighting against decades of stigma, restrictive policies, and platforms that treat us like we’re selling contraband instead of a legal product.

Listen up, cannabis entrepreneurs – before you start throwing keywords around like confetti at a dispensary grand opening, you need to understand exactly who you’re trying to reach. And I’m not talking about some vague notion of “people who like weed.” We need to get specific.

Enter the buyer persona – your ideal customer’s digital avatar. Let me give you an example: Meet “Mindful Michelle,” a 35-year-old yoga instructor who uses cannabis to manage anxiety and enhance her meditation practice. She’s health-conscious, researches products thoroughly before buying, and values organic, sustainably produced cannabis. She shops primarily at boutique dispensaries and follows wellness influencers on Instagram. Her annual income is $65,000, and she’s willing to pay premium prices for quality products.

See what I did there? We’ve created a detailed profile that helps us understand not just who our customer is, but how they think and what they’re looking for. This brings us to user intent – the holy grail of SEO strategy.

Let’s say Michelle is looking for information about CBD for anxiety. She might start with a broad search like “CBD for anxiety,” but as she learns more, her searches become more specific. She might eventually search for “organic full-spectrum CBD oil dosage for meditation” – that’s a long-tail keyword gold mine right there. Why? Because it shows high intent (she’s looking for specific information), and there’s likely less competition for this precise phrase than broader terms.

When crafting content around these keywords, you’ll want to follow some best practices:

-

Use your target keyword in the title (naturally, not forced)

-

Include it in the first 50 words of your content

-

Sprinkle related terms throughout (think “anxiety relief,” “mindfulness,” “natural remedy”)

-

Include outbound links to reputable sources (like scientific studies)

-

Create internal links to your other relevant content

-

Use header tags (H1, H2, H3) to structure your content logically

But here’s the thing about content length – Google loves comprehensive content that thoroughly addresses user questions. We’re talking 1,500+ words for main pages and blog posts. “But Reg,” you might say, “isn’t that a bit much?” Not if you’re actually solving problems and providing value.

Think about it this way: if Michelle lands on your page about CBD and anxiety, and you’ve got a thorough, well-researched article that addresses dosing, different consumption methods, potential interactions, and the science behind how CBD affects anxiety – she’s likely to stick around. More importantly, she’s likely to bookmark your site and come back when she’s ready to make a purchase.

This is how you build trust in the cannabis space – by becoming a reliable source of information first, and a seller second. Remember, in an industry where traditional advertising is restricted, your content needs to work twice as hard.

Now, I know what you’re thinking – “Reg, this sounds like a lot of work!” And you’re right. Creating comprehensive, SEO-optimized content that actually provides value is no small task. But that’s where our AI friends come in handy. Let me show you how to make this process a whole lot easier…

Alright, my cannabis-loving friends, it’s time to unleash the robots! Not the terrifying kind that might take over the world, but the helpful ones that’ll make your SEO efforts smoother than a well-cured top shelf bud.

Let me tell you, creating high-quality, media-rich content used to be harder than explaining terpenes to your grandma. You’d need a writer, photographer, graphic designer, video editor – the works. But now? We’ve got an entire digital army at our disposal, and it’s surprisingly affordable.

Here’s my tried-and-true workflow that’ll have you pumping out content faster than a hydroponic setup on steroids:

First stop: Perplexity.AI. This bad boy is like having a research assistant who never sleeps and actually remembers everything they read. Feed it your topic, and it’ll spit out relevant scientific studies, market research, and questions you wouldn’t have thought to ask. Want to write about CBD and sleep? It’ll dig up everything from clinical trials to user demographics.

Next, slide into your favorite AI chatbot – whether that’s ChatGPT, Claude, or Grok. If you’re feeling fancy, hit up Openrouter and sample them all like you’re at a cannabis cup. These tools will help you craft content that’s more engaging than your local budtender’s strain recommendations. (I could write a whole article just on prompt engineering, but that’s a story for another day.)

Now, here’s where it gets fun. Need images? Leonardo.ai or MidJourney are your new best friends. Want a stunning visual of cannabinoids interacting with neural receptors? Or maybe a chill lifestyle shot of someone enjoying their evening routine? These AI tools can create custom, copyright-free images that look better than most stock photos. Pro tip: Have your AI writing assistant generate image prompts based on your article – it’s like having a creative director in your pocket.

But why stop at text and images? Let’s get audio in the mix with Elevenlabs. Turn your article into a podcast-style recording that people can listen to during their commute. Then, take those AI-generated images, throw them into Capcut with your audio, and boom – you’ve got a video ready for YouTube. That’s three different ways for people to consume your content, and three different chances to keep them engaged.

Here’s the real kicker – you can “spin” your article (that’s industry speak for rewriting while maintaining the core message) a few times and publish it on platforms like Substack, Medium, or Reddit. Link these back to your original piece, and you’re building a web of high-authority backlinks that’ll make Google happier than a kid in a candy store.

The best part? This entire process takes about 2-3 hours once you get the hang of it. You’re creating a content ecosystem that provides value across multiple platforms and formats, all while building those precious SEO signals that Google loves.

Remember though, always keep your target keywords in mind throughout this process. Have your AI assistants strategically place them in your content, headers, and meta descriptions. It’s like leaving a trail of breadcrumbs that leads straight to your website.

And this, my friends, is just scratching the surface. The robots are here to help, and they’re making premium content creation more accessible than ever. Time to embrace the future and let AI help you climb those search rankings!

What I’ve shared here is just the tip of the cannabis cola, if you will. It’s like I’ve taught you how to pack a bowl, but there’s still so much to learn about the whole grow operation. However, these fundamentals should be enough to get you started on your SEO journey.

Here’s the deal: aim to post 2-3 solid pieces of content each week. And I mean solid – not that schwag content that’s just recycled from other sites. We’re talking premium, home-grown content that your users will actually want to consume. Share it across your social platforms (where allowed, of course – we all know how touchy these platforms can be about cannabis content), and weave your products or services into the narrative naturally. Nobody likes a pushy salesperson, but everyone appreciates genuine expertise and helpful advice.

Think of it like growing a healthy cannabis plant – you need consistent care, the right nutrients, and most importantly, patience. Keep feeding your audience valuable content, and they’ll reward you with engagement. When Google sees users spending time on your site, sharing your content, and coming back for more, it’s like getting a five-star review from the most important dispensary rating system in the digital world.

Remember, success in cannabis SEO isn’t about gaming the system – it’s about actually being useful to your target audience. Solve their problems, answer their questions, and become their trusted source of information. Do this consistently, and Google will naturally want to recommend you to others searching for similar content.

And here’s a final nugget of wisdom: the cannabis industry is constantly evolving, and so should your SEO strategy. Stay curious, keep testing new approaches, and don’t be afraid to experiment with different content formats and topics.

Now get out there and start creating some killer content. Your future customers are out there searching for you – it’s time to help them find you.

Good luck, and may your rankings be high and your bounce rates low!

https://www.reddit.com/r/weedbiz/comments/1ig1nwq/why_are_most

_cannabis_seo_agencies_scams_anyone/

CANNABIS SEO GOES HIGH TECH, READ ON…

Karma Koala Podcast 234: Tom Church Litigator, Atlanta. Georgia is notorious on the law enforcement front….. “Our Firm Gets Charges Dismissed in Delta-8-THC Prosecution”

Virginia governor expected to veto recreational marijuana sales legislation

Just Say No to Marijuana!

Star signs and cannabis strains: March 2025 horoscopes

12 States That Could Legalize Cannabis in 2025

The Cannabis Industry is in a Free Fall

Trump research cuts threaten cannabis studies, poses rescheduling questions

Cocaine Hub Seized by Rebels, Thwarting Colombia’s ‘Total Peace’

SEO for Cannabis? – How to Build Top Rankings for Your Cannabis Brands in 2025

Montanans must activate to protect legalization in 2025

Distressed Cannabis Business Takeaways – Canna Law Blog™

United States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

What you Need to Know

Drug Testing for Marijuana – The Joint Blog

NCIA Write About Their Equity Scholarship Program

It has been a wild news week – here’s how CBD and weed can help you relax

Cannabis, alcohol firm SNDL loses CA$372.4 million in 2022

A new April 20 cannabis contest includes a $40,000 purse

Your Go-To Source for Cannabis Logos and Designs

UArizona launches online cannabis compliance online course

Trending

-

Cannabis News2 years ago

Cannabis News2 years agoDistressed Cannabis Business Takeaways – Canna Law Blog™

-

One-Hit Wonders2 years ago

One-Hit Wonders2 years agoUnited States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

-

Cannabis 1012 years ago

Cannabis 1012 years agoWhat you Need to Know

-

drug testing1 year ago

drug testing1 year agoDrug Testing for Marijuana – The Joint Blog

-

Education2 years ago

Education2 years agoNCIA Write About Their Equity Scholarship Program

-

Cannabis2 years ago

Cannabis2 years agoIt has been a wild news week – here’s how CBD and weed can help you relax

-

Marijuana Business Daily2 years ago

Marijuana Business Daily2 years agoCannabis, alcohol firm SNDL loses CA$372.4 million in 2022

-

California2 years ago

California2 years agoA new April 20 cannabis contest includes a $40,000 purse