David Rabinovitz recently visited his local retailer in Massachusetts. He bought two eighths of flower and was immediately struck by the price. A product that used to be $60 per eighth rang up at $31.25 after a discount.

Like anyone else, Rabinowitz loves a bargain. But as a cannabis-industry veteran who has worked in business planning, deal structuring, and other corporate roles over many years, he also felt a sense of dismay.

New cultivation operations are flooding the market with supply, and there’s no end in sight.

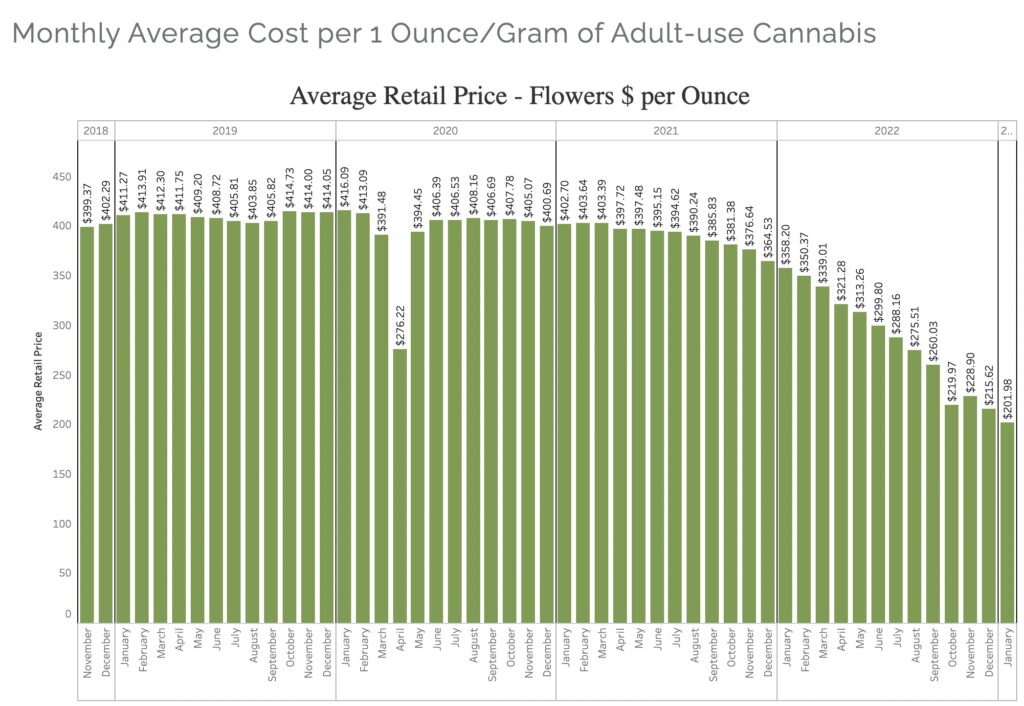

Cannabis prices in Massachusetts are in free fall. After touching $403 per ounce in March 2021, prices have steadily plummeted for two straight years, hitting a historic low of $202 per ounce this January—and many, including Rabinovitz, believe they have yet to bottom out.

Here’s what that looks like in a chart published by the Massachusetts Cannabis Control Commission:

What’s up with that?

An obvious explanation appears on the first page of every economics 101 textbook: Supply is overrunning demand. It’s an experience that Oregon and California have been struggling with, and now it looks like it’s arrived in Massachusetts.

To understand how that happened—and why it’s a problem that is expected to get worse— rewind to 2018, when Massachusetts was transitioning from a medical-only market to a recreational industry.

At the time, there was little infrastructure in place for such a pivot. Building up indoor grow operations—from permitting to construction to the actual grow—takes a couple of years. That’s far longer than it takes to open a retail space. At the same time, Massachusetts was the only Northeastern state to open for recreational use, bringing high in-state and out-of-state demand to those early storefronts. It was a formula for soaring prices.

Good news for consumers, bad news for farmers and retailers.

Those high prices attracted investors eager to get in and fund more grow operations, some of which are now coming online. The only limit the state has placed on cultivation licensing is the size of the operation—100,000 square feet per license.

“It only takes a dozen or so people with the same idea to build out a 50,000-square-foot, 100,000-square-foot canopy cultivation site,” says Brendan Pollock, CEO of Theory Wellness, which operates retail locations in Massachusetts, Maine, and Vermont. “And once those came online, they already were not really needed, and they’ve really just kind of flooded the market.”

Shop highly rated dispensaries near you

Showing you dispensaries near

There could be a lot more supply on its way

And here we are.

As of Dec. 8, 2022, 95 cultivators were operational, licensed for 2.1 to 2.86 million square ft. of canopy. Behind them are 24 final licenses approved for an additional 570,000 to 765,000 square ft. of canopy (over half of these licenses are tiers 1, 2, or 3), while 180 provisional licensees are seeking approval for 3.6 to 4.975 million square ft. of canopy. That’s a lot of potential supply in the pipeline.

“It’s been a pretty dramatic shift from when it was a very expensive, undersupplied market,” Pollock says. “That sort of created this artificial bottleneck in the beginning.” Now, he says, “we’ve sort of flipped in the other direction.”

Too many cultivation licenses?

Rabinovitz says that unfortunately, things are likely to get far worse—and for that, there’s plenty of blame to go around. That glut of product? Most people have no idea how much flower is now in the pipeline, he says—in large part because Massachusetts regulators don’t disseminate such information, and haven’t cut back on licensing even as the current dilemma has begun to unfold.

“So they’re allowing folks to continue to overgrow,” Rabinovitz says. “And the underlying problem is, people don’t understand the market. They’re not doing the research before they get into the market. And the regulator’s not regulating the market and providing the market with the right intelligence. So everybody just keeps plowing forward.”

Farmers chasing falling wholesale prices

Giannone saw this coming as well, which is why Trade Roots passed up on a special permit that would have allowed the business to double the size of its grow. About six months ago, his board authorized him to go on social media and sounds alarms to the industry, but no one at the time wanted to listen, and instead labeled him “Calamity Carl.” He is no more bullish now; he had one conversation with a multi-state operator whose only concern was market share. “They’re just gonna race to the bottom,” he says.

Adding to the state’s woes, Massachusetts is no longer the only game in town. Three nearby states—Maine, Rhode Island, and Vermont—now sell recreational products. Connecticut and New York also have their recreational markets open.

Most of the state’s crop is grown indoors

Meanwhile, whenever the federal government gets around to lifting the ban on interstate commerce, all Massachusetts producers will have to pit their product, grown in costly indoor facilities, against comparatively inexpensive cultivation sites elsewhere. “As soon as those walls come down,” Rabinovitz says, “prices are not going to roll back up. Prices are going to come down even more.”

As a result, many indoor grow facilities could become albatrosses. “The cultivators have the most expensive facilities, they take the longest to put together, and they have the shortest life, because their economic life is going to end soon after you can ship [cannabis] across state lines,” Rabinovitz says. “That’s what nobody seems to want to fess up to.”

Planning for a small-farm, high-quality future

Despite all of this, even more cultivation sites are now under construction in Massachusetts—a fact that Pollock says “is going to cause a lot of pain, unfortunately, for folks who are just trying to get in now.”

Pollock says Theory Wellness plans to focus on small-scale, high-quality operations, to avoid getting stuck with large grows in the long term. The company was close to moving forward with a new Massachusetts production site last year and pulled the plug because of market concerns. “We’re really happy we did that at this point,” Pollock says. “So it’s really focusing on just building up the best brands we can, and building that brand loyalty as things get more competitive. I think that’s our best course forward for the long term.”