Cannabis News

Trump is a Businessman, He Will Legalize and Tax Marijuana

Published

3 months agoon

By

admin

The two biggest reasons why Trump supporters have said that Trump supports legalization is that he is a businessman and will legalize cannabis and tax it at the Federal level, and that since he will not be up for re-election in 4 years, he will legalize it and not worry about the pushback. Both are terrible reasons because the US government already makes $2.5 billion a year (and growing!) by keeping the 280E tax code in place for cannabis businesses, and since he isn’t running for re-election means he has no incentive to come back to the middle or please Democrats on the weed issue.

Also, taxes are the #1 killer of the legal weed industry right now, so adding a Federal tax to the consumers’ bill will just push more people to the illicit and gray markets.

How bad are taxes in the weed industry you may ask?

The legalization of marijuana has ushered in a new era of cannabis consumption, transforming it from an illicit substance into a mainstream product. As states across the U.S. and countries around the world embrace this change, they are also capitalizing on the opportunity to generate significant tax revenue. However, while the legalization of marijuana has many benefits—including increased access, reduced criminalization, and economic growth—there is a hidden cost that consumers often overlook: the heavy taxation on legal weed. This article delves into the complexities of marijuana taxes, how they impact consumers, and why they may be hitting your wallet harder than you think.

The Landscape of Legal Marijuana

A Brief History of Marijuana Legalization

The journey toward marijuana legalization has been a long and winding road. In the United States, the movement gained momentum in the late 20th century, with California becoming the first state to legalize medical marijuana in 1996. Since then, more states have followed suit, with Colorado and Washington leading the way in 2012 by legalizing recreational use.

As of now, over 20 states have legalized recreational marijuana, while many others allow medical use. This shift has not only changed public perception but also created a new market that states are eager to tax.

The Economic Boom

Legalizing marijuana has proven to be an economic boon for many states. According to reports from various state governments, cannabis sales have generated billions in revenue. For instance, Colorado reported over $2 billion in sales in 2020 alone, contributing more than $387 million in tax revenue to state coffers. These funds are often earmarked for education, infrastructure, and public health programs—benefiting communities and justifying the high tax rates.

Understanding Marijuana Taxes

Types of Taxes Imposed on Cannabis

Marijuana taxes can be categorized into several types:

-

Excise Taxes: These are taxes imposed on specific goods and services. In many states where marijuana is legal, excise taxes are levied on cannabis sales at both the wholesale and retail levels. Rates can vary significantly; for example, California imposes a 15% excise tax on retail sales.

Variability Across States

The structure and rates of marijuana taxes vary widely from state to state:

-

California: A combination of a 15% excise tax and local sales taxes can lead to total taxes exceeding 30%.

-

Colorado: Recreational marijuana is subject to a 15% excise tax plus a 2.9% state sales tax and local taxes that can add up to another 5%.

-

Illinois: The state has one of the highest cannabis tax rates in the nation, with recreational marijuana taxed at rates ranging from 10% to 25%, depending on the potency.

This variability creates confusion among consumers and can lead to significant price differences between states.

The Impact on Consumers

The most immediate effect of these taxes is the increased cost of legal marijuana products. Consumers may find themselves paying significantly more for legal weed compared to what they would pay for illicit products. For example:

-

A gram of cannabis that might cost $10 on the black market could cost upwards of $15 or more in a legal dispensary due to taxes.

-

For consumers who regularly purchase cannabis for medical or recreational use, these additional costs can add up quickly.

Disparities Between Medical and Recreational Use

In many states, medical marijuana patients benefit from lower tax rates compared to recreational users. This disparity raises questions about equity within the legal cannabis market:

-

Patients often rely on cannabis for therapeutic reasons and may struggle with higher prices due to taxation.

-

Some states exempt medical marijuana from certain taxes entirely or offer reduced rates, but this is not universal.

The Psychological Effect of Pricing

The psychological impact of pricing cannot be underestimated. Higher prices driven by taxes may discourage some consumers from purchasing legal cannabis altogether:

-

Consumers may revert to purchasing from illegal sources where prices are lower.

-

This undermines one of the primary goals of legalization: reducing illegal drug trade and its associated harms.

The Economic Implications

Impact on Small Businesses

While large corporations often dominate the legal cannabis market, small businesses play a crucial role as well. High taxation can create barriers for small dispensaries and growers:

-

Smaller businesses may struggle to compete with larger companies that can absorb costs more effectively.

-

High operating costs due to taxation can lead small businesses to raise prices further or limit their product offerings.

Job Creation vs. Tax Burden

Legalizing marijuana has created jobs across various sectors—from cultivation and retail to distribution and marketing. However, if consumer demand declines due to high prices caused by taxation:

The Future of Marijuana Taxation

As more states consider legalization or reevaluate their existing frameworks, there is potential for changes in how marijuana is taxed:

-

Some lawmakers are advocating for lower tax rates as a way to encourage consumer participation in the legal market.

-

Others argue that maintaining high taxes is necessary for funding public services and addressing social equity issues related to past drug enforcement practices.

The Role of Federal Legislation

Currently, marijuana remains classified as a Schedule I substance under federal law, complicating taxation at that level:

Conclusion

The hidden costs associated with marijuana taxation are significant and multifaceted, presenting both challenges and opportunities. While these taxes generate essential revenue for public services and help regulate an emerging industry, they also impose financial burdens on consumers that can deter participation in the legal market. As legalization expands globally, it is crucial for lawmakers to find a balance between generating revenue and ensuring accessibility for all consumers. By recognizing these hidden costs, consumers can make informed decisions about their cannabis purchases and advocate for fairer tax policies that promote equity within this burgeoning industry. Ultimately, while legal cannabis offers numerous benefits—from improved public health outcomes to enhanced economic opportunities—the taxes associated with it pose a complex challenge that demands careful consideration from both policymakers and consumers. Moving forward into this new era of cannabis consumption, transparency regarding these costs will be essential in shaping a fairer and more equitable market for all stakeholders involved.

CANNABIS AND TAX BURDENS, READ ON…

THE #1 REASON CANNABIS BUSINESS FAIL? A. TAXES B. NON-PAYMENTS C. 280E?

You may like

Cannabis News

How Worried Should You Be about Schizophrenia and Psychosis if You Smoke Weed?

Published

2 days agoon

March 15, 2025By

admin

Should You Really Be Worried About Schizophrenia and Psychosis If You Smoke Weed?

Occasionally, a study on cannabis and schizophrenia or psychosis makes its way to the internet and becomes viral for a few weeks. It gets republished and circulated across numerous news channels and social media sites, spreading often unnecessarily alarming news and fear-mongering.

So what’s the truth behind it? Should you really worry about developing schizophrenia and psychosis if you smoke weed?

Let’s get the facts sorted first.

Schizophrenia

Schizophrenia is a chronic mental health disorder characterized by hallucinations, delusions, cognitive distortion, trouble thinking straight, and lack of motivation. Extreme cases of schizophrenia can also lead to episodes of psychosis or delusion, which is what occurs when an individual can no longer tell the difference between reality and fiction. Being severely disconnected from reality can occur among patients of schizophrenia and psychosis, but these can be caused by a wide range of physical or mental conditions.

What Causes Schizophrenia?

There is no one known cause for schizophrenia, though several environmental and genetic factors can contribute to its symptoms. It’s also known to run in families, so if someone in your family tree has had schizophrenia, it’s important to practice caution when using drugs and alcohol.

Certain environmental triggers can cause psychotic or schizophrenic episodes, particularly going through extremely stressful life events. Stressful environments, such as fast-paced cities, may also trigger symptoms. Other factors include the experience of childhood trauma, or certain changes in brain chemistry.

Cannabis: Treatment Or Cause?

The symptoms of schizophrenia can be managed or reduced through the use of antipsychotic medications, which are typically the first line of defense for this condition. First-generation antipsychotics, such as Chlorpromazine, Perphenazine, and Fluphenazine, are examples of widely-used schizophrenia treatments. Second-generation antipsychotic treatments include Aripiprazole, Lurasidone, Clozapine, Quetiapine, and several others. In some occasions, doctors may also prescribe antidepressants if antipsychotic drugs don’t help with the depressive episodes that may be associated with schizophrenia.

However, many antipsychotic medications come with unwanted side effects. They commonly include sexual dysfunction, weight gain, sedation, heart problems, difficulty urinating, and many more.

The use of cannabis-based medications for treating the symptoms of schizophrenia has been gaining traction in the medical and scientific community over the past few years. That said, we must differentiate the compounds used in cannabis because we can’t generalize all the compounds in the plant and its effects on the human body. Tetrahydrocannabinol (THC), the psychoactive compound in marijuana, and cannabidiol (CBD), a relaxing, non-psychoactive compound, both work differently in the human body.

What The Research Says

Several studies have shown that CBD could be promising for treating and even mitigating the symptoms of schizophrenia and psychosis. This is especially true if the condition is in its early stages.

For example, in a review conducted in 2021, scientists found that CBD may be beneficial in adjusting the levels of different brain chemicals which have been associated with symptoms of psychosis. One of these is anandamide – and the study found that CBD can increase its levels in the brain.

Anandamide is an endocannabinoid, and it’s believed to help reduce psychotic episodes through several mechanisms in the brain. For one, high levels of anandamide have been observed as successful in mitigating acute cases of schizophrenia.

Meanwhile, another review discovered minor albeit significant evidence that CBD could possibly reduce the symptoms of schizophrenia when administered in high doses. In the review, the researchers noted that 800 mg of CBD were given to patients over the course of 4 weeks. The results were similar to those yielded by amisulpride, an antipsychotic drug which is used in the treatment of psychosis. A similar trial found that 1,000 mg of CBD given to patients over 6 weeks was effective in reducing schizophrenia symptoms.

The results of a 2024 clinical trial also found that CBD was successful in mitigating the symptoms of patients who were at high risk for psychosis. For the study, there were 31 patients involved; they were given either 600 mg of CBD or a placebo everyday for 3 weeks. However, they weren’t given any prescription drugs during the course of the study. Researchers analyzed their baseline at 7 and then again at 21 days.

“Short-term treatment with CBD can ameliorate the symptoms of CHR state for psychosis and is well tolerated. These results highlight the potential of CBD as a novel treatment for psychosis, and the need for large-scale efficacy studies to further evaluate its clinical utility,” concluded the study’s authors.

So Who Needs To Worry About Schizophrenia and Cannabis Use?

Smoking pot won’t make you go psychotic. It doesn’t cause schizophrenia per se.

That said, those with pre-existing mental health conditions must tread lightly and be very cautious when it comes to using high THC products. In other words, if you already have a family history of schizophrenia or have had a history of psychotic episodes, THC may not be the medicine or recreational drug for you. Individuals with bipolar disorder, delusional disorder, or other similar personality and mood disorders with a tendency to have episodes of psychosis should first seek out medical attention.

Products containing high levels of THC may not be recommended in these situations, though CBD may help reduce symptoms. If you aren’t sure, it’s always best to consult with your medical provider.

Conclusion

Even if there is promising evidence that CBD can be beneficial for schizophrenia, we must be careful not to consider it as a substitute for any kind of medical treatment. There are many different types of cannabis products out there but there isn’t one-size-fits-all solution for mental health disorders. So while most people wouldn’t have a problem smoking weed, there is a small subset of the population as mentioned earlier – who do have to be careful.

PSYCHOSIS AND WEED, WHAT WE KNOW…

Cannabis News

What are Cannabis Dissolvables? Are These Products Trendy, or are They Worth Trying?

Published

2 days agoon

March 15, 2025By

admin

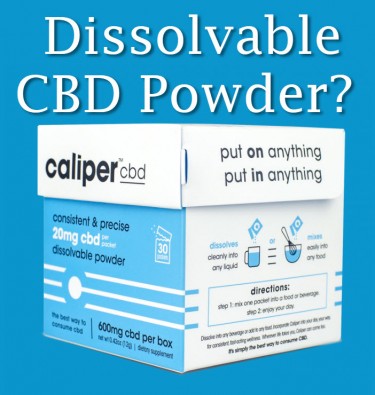

What are Cannabis Dissolvables? Are These Products Trendy, or are They Worth Trying?

For cannabis enthusiasts who enjoy experimenting with consumption in an array of forms, or even for medical marijuana patients who simply want to look for the most convenient way to medicate, we’re spoiled with choices these days.

From vaping to smoking, edibles and beverages, tinctures, topicals, pills, and suppositories, there’s a way to medicate for everyone. But recently, a new way to consume marijuana has had some people talking: cannabis dissolvables! You might have heard about them as dissolvable cannabis powder or THC powder; these revolutionary powders are manufactured with cannabinoids and designed to be mixed into your food or drink. Upon consumption, you can enjoy the effects of cannabis within minutes.

But they work just like edibles, then, don’t they?

Nope!

Dissolvable cannabis powders are known for their fast-acting effects, which means that you can expect to feel the impact of the cannabinoids within minutes of consuming it in your food and drink. That’s because cannabis powders are water-soluble, allowing almost immediate absorption of the cannabinoids in your bloodstream. On the other hand, edibles can sometimes take up to 90 minute to take effect.

Why You Should Try Dissolvable Cannabis Powders

There are several reasons why you should give dissolvables a try:

-

There are odorless and flavorless options in the market: Marijuana dissolvable powders that are neutrally flavored make it a breeze to add to your favorite drinks and food, without worrying about altering its flavor. Gone are the days when you’d be surprised by the often-undesirable flavors of supplement powders; now with flavorless cannabis powders, you can easily medicate while still enjoying the taste of your favorite food and drinks.

Smoothies, baked goods, juices, coffee, and oatmeal are just some examples of common items you can easily add THC powders to. That said, you can also find flavored options in the market if that’s what you prefer.

-

High bioavailability: Cannabis powders are formulated to be absorbed efficiently. This way, your body can metabolize and absorb all or most of the cannabinoids in the product. Thanks to enhanced absorption, you can maximize the benefits of the cannabinoids.

-

Accurate dosing: For consumers who prioritize precision dosing in cannabis, powders are superior when it comes to this. Getting an accurate dose is so easy, since packets are already pre-measured. Meanwhile, powders can also easily be measured using a spoon. This offers total control over how much you’re ingesting, which is particularly important for medical users who require consistent dosing for symptom relief.

-

Discretion: When you add cannabis powders to your food or beverages, they don’t have that notorious smell that cannabis smoke is known for. Because they are either odorless or have a neutral odor, there’s no need to worry that taking it out and mixing it into a drink will alert people around you.

-

Low or no calories: Most cannabis powders have little to no calories, so it’s a healthy choice for calorie-conscious individuals. Whether you are looking to make a healthier choice or simply want to experiment with cannabis formulations in the kitchen, dissolvable cannabis powders are an easy way to do so.

What Conditions Can Cannabis Powders Help With?

While dissolvable cannabis can benefit all patients, cannabis powders have a particular advantage for patients of certain conditions:

-

Nausea and vomiting: Patients who are undergoing chemotherapy, or recovering from eating disorders, may find that medicating with cannabis simply through food and drink is an efficient way to medicate. These conditions make it difficult to keep nutrients down due to the constant urge to vomit, but that makes it even more important to eat – in order to have the necessary vitamins and minerals to recover. Mixing cannabis powders in water or juices provides a gentle alternative to medicating and keeping food down.

-

Pain: Fast-acting cannabis works so well for pain relief. If you suffer from chronic pain and rely on cannabis for symptom relief, you can explore using cannabis powders. Thanks to its excellent bioavailability and quick results, there’s no need to wait several minutes to feel better. Powder can interact with the endocannabinoid system fast in order to reduce inflammation within minutes and positively affect the pain perception pathways.

-

Insomnia and sleep problems: Cannabis is an excellent natural medication for treating insomnia and other sleep problems. This is especially true if symptoms from another condition can cause difficulty falling or staying asleep, such as pain or general discomfort caused by inflammatory conditions. Consuming cannabis powders a few minutes before bedtime can help you hit two birds with one stone: enjoy relief from your symptoms, while easing into a comfortable state of sleep.

-

Anxiety relief: Many cannabis drink mixes are made with CBD, which provides excellent relief from anxiety. Start your day with a healthy dose of CBD to mitigate anxiety, and help you get through the day with some peace of mind.

In addition, many powder mixes are also formulated with other healthy ingredients. These vary from one product to another, and may include electrolytes, functional ingredients, hemp, terpenes, and other cannabinoids.

Conclusion

Dissolvable cannabis powders are innovative, but they are also accessible and inclusive, offering a convenient way to medicate. Whether you are a recreational cannabis consumer or a medical marijuana patient, the benefits of cannabis dissolvable powders are endless. Check out your neighborhood dispensary to explore dissolvable cannabis and share with us your favorite way to consume it.

CAN YOU HAVE A DISSOLVABLE WEED PRODUCT? READ ON…

Cannabis News

If You are over 50, Should You Switch from Alcohol to Cannabis ASAP?

Published

2 days agoon

March 15, 2025By

admin

If You’re Over 50, You Should Consider Switching From Alcohol To Weed

Alcohol is one of the most dangerous substances on earth. Despite being notorious for its carcinogenic properties, alcohol has become part of society and culture, accepted in nearly every western nation as a means of relaxing or having fun.

While there were several decades wherein alcohol enjoyed a spotless reputation, more people are now becoming educated about the dangers of drinking even a few glasses a week. Yet, it can be so difficult to quit drinking completely because booze is literally everywhere: it’s easily accessible in shops, groceries, and bars all over. Society has normalized drinking alcohol as a way to unwind and bond with loved ones.

That said, the dangers of drinking alcohol begin to creep up as you get older. Even a few drinks can pose serious health risks, so if you’re approaching 50 and still drinking, it’s time for you to reconsider the substances you use to unwind.

Here’s why:

-

As you get older, your body becomes increasingly sensitive to the impact of alcohol. It’s more serious than hangovers getting worse: once you hit your 30’s, muscle mass gradually declines each decade, and it speeds up after you hit your 60’s. The reduction in your body mass and body water causes higher blood alcohol concentrations in your system, in other words, you’ll get drunk faster, even if you’ve always drank the same amount.

The consequences for this mean a greater risk of injury and falls.

-

Medical conditions can get worse. By the time you hit your forties, if you have had any health issues in the past, they may only get worse with continued alcohol consumption. Whether it’s high blood pressure, diabetes, or any other condition that can get worse with age, it will similarly worsen with alcohol consumption. To add salt to injury, continually drinking alcohol when you already have certain health problems can cause new complications, such as cognitive disorders, osteoporosis, and a significantly increased risk of cancer.

-

Drinking alcohol speeds up the aging process. Research shows that drinking alcohol over long periods of time has a negative impact on your biological age, most especially if you still engage in binge-drinking. Additionally, continued alcohol consumption will harm your heart, liver, and brain – putting these organs in greater risk of disease.

It may be time to give up drinking, but that doesn’t mean that the fun has to end. Just switch it up with cannabis.

Why You Should Be Consuming Weed Instead

Switching up your substance of choice from alcohol to cannabis can have profound effects on your health, particularly as you age. There are so many different ways you can consume weed discreetly; while smoking pot is not for everyone, you can experiment with capsules, oils, tinctures, edibles, and even beverages.

As you get older, it can be easy to see how you can benefit from the therapeutic effects of cannabis, especially CBD. Cannabidiol is a non-psychoactive compound in the hemp plant, which means that it won’t get you high. Its anti-inflammatory properties and calming effects make CBD the drug of choice for the middle to older aged individuals, who still need something to “take the edge off” without having to worry about any side effects.

Other benefits of cannabis for aging include:

-

Pain relief: As we get older, things suddenly start to hurt more, even for seemingly no reason. Chronic or frequent attacks of acute pain in different parts of the body become normal and even expected in your mid to late forties, but it doesn’t have to be a way of life. Cannabis provides excellent pain relieving properties, especially in cases that are related to neuropathy, arthritis, muscle pain, back pain, headaches, and much more. Making cannabis part of your lifestyle can alleviate pain and make it easy to stay active.

-

Better sleep: Older adults commonly experience sleep issues. It can be difficult to fall asleep, and even stay asleep. All of this becomes much worse if you drink alcohol. However, medicating with weed is one of the best ways to enjoy deep sleep, naturally. Many people have found that giving up over-the-counter sleep aids has helped, when they turned to weed instead, to help mitigate sleep issues.

-

Mental health: Whether it’s hormones, new types of stressors, or just life getting in the way, aging can make us prone to anxiety, depression, and other mental health concerns. Dealing with physical health problems and functional impairments can increase the risk of anxiety and depression. But medicating with cannabis can make these thoughts and problems more bearable.

-

Relaxation: You deserve to relax more in your old age. A little weed, no matter how you prefer to take it, can heighten the pleasures that come with relaxation. It can also enhance your overall well-being and reduce stress.

Conclusion

Ditch the bottle and say hello to weed!

If you’re in your 40s or 50s and are thinking about ways to improve your overall wellbeing, quitting alcohol is one of the best things you can do today. In the meantime, replacing it with marijuana can offer a vast range of benefits for your physical and menta health. In doing so, you’ll also reduce the risks involved with aging, and improve management of age-related conditions including chronic pain, high blood pressure, diabetes, and much more.

Reminder: Older adults are recommended to consult your healthcare provider about using cannabis especially if you are already on medications.

CANNABIS FOR PEOPLE OVER 50, YOU BET, READ ON…

Cannabis Helps You Enjoy Sunday And Be Ready For Monday

Golf Is Hitting A Hole In One With All Ages

How Worried Should You Be about Schizophrenia and Psychosis if You Smoke Weed?

What are Cannabis Dissolvables? Are These Products Trendy, or are They Worth Trying?

If You are over 50, Should You Switch from Alcohol to Cannabis ASAP?

5 Ideas To Have A Fun Single’s Valentine’s Day

The Best Thoughtful And Inexpensive Valentine’s Day Gifts

How Cannabis Can Help You Through Grief

If Marijuana Is Banned Will The Public Turn To Hemp

Will Marijuana Help States During Economic Uncertainty

Distressed Cannabis Business Takeaways – Canna Law Blog™

United States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

What you Need to Know

Drug Testing for Marijuana – The Joint Blog

NCIA Write About Their Equity Scholarship Program

It has been a wild news week – here’s how CBD and weed can help you relax

Cannabis, alcohol firm SNDL loses CA$372.4 million in 2022

A new April 20 cannabis contest includes a $40,000 purse

Your Go-To Source for Cannabis Logos and Designs

UArizona launches online cannabis compliance online course

Trending

-

Cannabis News2 years ago

Cannabis News2 years agoDistressed Cannabis Business Takeaways – Canna Law Blog™

-

One-Hit Wonders2 years ago

One-Hit Wonders2 years agoUnited States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

-

Cannabis 1012 years ago

Cannabis 1012 years agoWhat you Need to Know

-

drug testing1 year ago

drug testing1 year agoDrug Testing for Marijuana – The Joint Blog

-

Education2 years ago

Education2 years agoNCIA Write About Their Equity Scholarship Program

-

Cannabis2 years ago

Cannabis2 years agoIt has been a wild news week – here’s how CBD and weed can help you relax

-

Marijuana Business Daily2 years ago

Marijuana Business Daily2 years agoCannabis, alcohol firm SNDL loses CA$372.4 million in 2022

-

California2 years ago

California2 years agoA new April 20 cannabis contest includes a $40,000 purse