American Cannabis News

Verano Q3 Revenue Falls 6% – New Cannabis Ventures

Published

4 months agoon

By

admin

Verano Announces Third Quarter 2025 Financial Results

CHICAGO, Oct. 29, 2025 (GLOBE NEWSWIRE) — Verano Holdings Corp. (Cboe CA: VRNO) (OTCQX: VRNOF) (“Verano” or the “Company”), a leading multinational cannabis company, today announced its financial results for the third quarter ended September 30, 2025, prepared in accordance with US Generally Accepted Accounting Principles (“US GAAP”).

Financial highlights for the third quarter of 2025

- Revenues: $203 million net of discounts.

- Gross profit: 95 million dollars or 47% of revenue.

- SG&A expenses were $81 million or 40% of revenue.

- Net loss of $(44) million or (22)% of revenue.

- Adjusted EBITDA¹ of $53 million or 26% of revenue.

- Net cash provided by operating activities is $26 million.

- $8 million in capital expenditures.

Management Commentary

“This quarter reflects our hard work positioning Verano for long-term growth opportunities by investing in infrastructure, creating efficiencies, improving wholesale and brand performance, and strengthening our capital structure and financial foundation for the future,” said George Arcos, Verano’s founder, president and chief executive officer.

“With more exciting new product innovation in time for the busy retail holiday season, along with our valued partners and talented teams across the country, we look forward to closing the year on a high note and building on what we hope will be a transformative year for Verano and the industry in 2026.”

Financial overview for the third quarter of 2025

Revenues, net of discounts, were $203 million for the third quarter of 2025, down from $217 million in the third quarter of 2024 and $202 million in the second quarter of 2025. The decrease in revenues for the third quarter of 2025 compared to the third quarter of 2024 is primarily due to pricing and continued competition.

Gross profit for the third quarter of 2025 was $95 million, or 47 percent of revenue, down from $109 million, or 50 percent of revenue, for the third quarter of 2024, and $113 million, or 56 percent of revenue, for the second quarter of 2025. promotional activities and increases in cost of goods sold due to short-term operational improvements.

SG&A expenses for the third quarter of 2025 were $81 million, or 40% of revenue, down from $92 million, or 43% of revenue, for the third quarter of 2024, and $86 million, or 43% of revenue, for the second quarter of 2025. depreciation and amortization and efficiency arising in the business.

Net loss for the third quarter of 2025 was $(44) million or (22) percent of revenue, compared to $(43) million or (20) percent of revenue for the third quarter of 2024. The increase in net loss for the third quarter of 2025 compared to the third quarter of 2024 was primarily due to an impairment charge and impairment charge of $5 million. compared to the previous year in terms of income tax.

Adjusted EBITDA¹ for the third quarter of 2025 was $53 million, or 26% of revenue.

Net cash provided by operating activities for the third quarter of 2025 was $26 million, down from $30 million in the third quarter of 2024, primarily due to an increase in income tax payments made in the third quarter of 2025 compared to the prior year.

Capital expenditures for the third quarter of 2025 were $8 million, down from $57 million in the third quarter of 2024 and $10 million in the second quarter of 2025.

Third Quarter 2025 Operating Highlights

- It is proposed to re-domicile the company from British Columbia, Canada to the state of Nevada.

- Expanded the company’s retail footprint by opening MÜV™ Crystal River, the company’s 82nd dispensary in Florida.

- Secured a US$75,000,000 revolving credit facility, of which the Company drew US$50,000,000 to retire US$50,000,000 of higher interest rate debt from its existing senior secured credit facility without incurring any prepayment penalty, with the remainder available in amounts up to US$250.

Subsequent operational milestones

- With the opening of Antwerp’s Zen Leaf, the Ohio retail footprint has grown to six locations.

- Expanded vape product portfolio with the exclusive, first-to-market release of the HYPHEN all-in-one kit system.

- On October 27, 2025, the Company’s stockholders approved the Company’s redomiciling to Nevada, and its Board of Directors subsequently approved the completion of the redomicil.

- Due to an employee strike at the Companies Registry of British Columbia, the Company cannot provide an exact date for when the completion will occur, but will plan to finalize the redomicil as soon as possible.

- Current operations span 13 states, consisting of 158 dispensaries and 15 manufacturing facilities with more than 1.1 million square feet of processing capacity.

Balance sheet and liquidity

As of September 30, 2025, the Company’s current assets were $385 million, including $83 million in cash and cash equivalents. The company had working capital of $242 million and total debt of $401 million, net of issuance costs.

The total number of Class A Subordinate Voting Shares of the Company as of September 30, 2025 was 361,815,879.

Conference call and webcast

A conference call and webcast with analysts and investors is scheduled for October 29, 2025 at 8:30 a.m. ET / 7:30 a.m. CT to discuss the results.

Published by NCV Newswire

New Cannabis Ventures’ NCV Newswire aims to gather high-quality content and information about leading cannabis companies to help our readers filter through the noise and stay on top of the most important cannabis business news. The NCV Newswire is edited by an editor and is not, however, automated. Got a secret news tip? Get in touch.

Get our Sunday newsletter

You may like

-

Cannabis Stocks Held Steady – New Cannabis Ventures

-

New rules raise cannabis stock limits for Malta’s associations

-

WIZ KHALIFA CANNABIS FESTIVAL 2022 | BLUNTZ

-

Missouri Rolls Out Decals To Identify Licensed Cannabis Dispensaries

-

Curaleaf Q4 Revenue Grows 2% – New Cannabis Ventures

-

Data collection as an operational tool in commercial cannabis cultivation

AKAN

Cannabis Stocks Held Steady – New Cannabis Ventures

Published

4 hours agoon

February 27, 2026By

admin

Hemp stocks, as measured by the Global Hemp Stock Index, were quite volatile in 2024 and then again in 2025 as well. Although the index rose in December, it fell on the year. In January, the indicator decreased by 10.6%, reaching 5.89. February saw a drop in prices, but the market recovered with the index ending the month at 5.86, down 0.5%.

After collapsing 21.8% in late 2024 to 6.88 in Q4, the index fell heavily in Q1 and then marginally in Q2. The global hemp stock index, which now has 27 members, gained 53.0% in the third quarter but fell 14.2% in the fourth quarter, down 4.2% for the full year. In 2026, it decreased by 11.1%.

Since its peak in February 2021, the global hemp stock index is down 93.7% from a closing high of 92.48.

The 3 strongest names in February, each an MSO, were all up more than 13%;

Jazz Pharma rallied in 2026, but the other two declined.

February’s 3 weakest names are all down more than 13%;

All three have fallen significantly in 2026 so far.

We will summarize the performance of the index again in a month. In April, we historically combined the two articles, and we update here the other indexes that New Cannabis Ventures continues to maintain: the American Cannabis Operator Index, the Ancillary Cannabis Index, and the Canadian Cannabis LP Index.

American Hemp Operator Index

The ACOI sank in January, falling 12.5% to 11.53, and fell further in February, falling 5.8% to 10.87. In 2025, it increased by 57.7% to 13.18 and decreased by 17.5% in 2026. The large AdvisorShares Pure US Cannabis ETF ( MSOS ) fell 3.7% in February.

The strongest performing stock in February was TerrAscend (OTC: TSNDF ), up 7.7%. The weakest, Vireo Growth (OTC: VREOF ), fell 17.9%.

In March, the index will have seven members with the removals of Jushi Holdings (OTC: JUSHF ) and Vireo Growth.

Auxiliary cannabis index

Ancillary commodities lost 5.7% in February as the index fell to 9.84. The index decreased by 19.5% in 2025, reaching 11.09, and this year it decreased by 11.3%.

The strongest stock in February was Turning Point Brands (NASDAQ: TPB ), which rose 13.1%. The weakest iPower fell by 55.8%.

In March, the index will have seven members after the removal of GrowGeneration (NASDAQ: GRWG ), iPower (NASDAQ: IPW ) and Chicago Atlantic BDC (NASDAQ: LIEN ) during February’s low trading volume.

Canadian Hemp LP Index

Canadian LPs fell 0.9% in February as the index fell to 55.65. In 2025, the index increased by 17.8%, reaching 59.01, and in 2026, it decreased by 5.7%.

The strongest Canadian LP in February was Rubicon Organics (TSXV: ROMJ ), which rose 8.9%. Simply Insoluble Concentrates (TSXV: HASH ) was the weakest, down 27.8%.

In March, the index will have the same thirteen members.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

WILL, Akanda, HASH:, high tide, heat, capacity, ipw:, Jazz, jazz farm, Rome, Rubicon Organics, the power, rhythm, Simply for free, Terrascend:, TPB:, TSNDF:, Revolving brands, vireo growth, vreof:

Related news:

Canadian cannabis sales hit a new record high in December

Major cannabis companies are set to report Q4 financials

Hemp stocks are off to a bad start in 2026

A very large MSO is now expanding its business

American Cannabis News

Curaleaf Q4 Revenue Grows 2% – New Cannabis Ventures

Published

1 day agoon

February 26, 2026By

admin

- Q4 2025 net income of $333 million

- Q4 2025 international revenue: $51 million;

- Q4 2025 Gross Margin 49%

- Full year operating and free cash flows from continuing operations

- $152 million and $89 million, respectively

STAMFORD, Conn., Feb. 26, 2026 /PRNewswire/ — Curaleaf Holdings, Inc. (TSX: CURA) (OTCQX: CURLF) (“Curaleaf” or the “Company”), a leading international supplier of consumer cannabis products, today reported its financial and operating results for the fourth quarter and full year ended December 31, 2025. All financial information is presented in accordance with US generally accepted accounting principles” or “USGAAP” and “other USGAAP principles” are indicated.

Curaleaf President and CEO Boris Jordan said: “We closed 2025 with clear momentum, delivering fourth-quarter revenue of $333 million. Revenue increased 5% sequentially and 2% year-over-year, driven by a broad-based return to growth in nearly all of our domestic markets, despite our robust international $1 closed environment. Fourth-quarter revenue, representing 10% sequential growth and 65% year-over-year revenue growth, expanded to 49%, up 20 basis points year-over-year, as benefits from increased productivity at our growing facilities outweighed price compression.

For the year, revenue came in at $1.27 billion, with adjusted gross margin of 50% and adjusted EBITDA of $275 million, or 22% of revenue. We generated $152 million in operating cash flow and $89 million in free cash flow from continuing operations, while ending the year with $102 million in cash on the balance sheet. These results were achieved despite double-digit price compression for the third year in a row, highlighting the strength, discipline and flexibility of our operating model and the success of our Back to Our Roots programme.”

Mr. Jordan continued. “With our $500 million debt offering and Back to Our Roots plan now complete, we have re-founded our business and are transitioning from stabilization to acceleration with our Built for Growth strategy. Using the platform, we have enhanced: improved processing economy, more stringent commercial position, innovation discipline, to improve the brand. sustained organic growth augmented by opportunistic acquisitions”.

Financial highlights for the fourth quarter of 2025

Net income was $333.1 million, up 2% year over year from $327.9 million in Q4 2024. Subsequently, net income increased by 5% in 2025. compared to the third quarter: 317.9 million dollars.

Gross profit was $161.8 million and gross profit margin was 49%, up 60 basis points year-over-year.

Adjusted gross profit¹ of $161.9 million and adjusted gross profit margin¹ of 49%, up 20 basis points year over year

Net loss attributable to Curaleaf Holdings, Inc. from continuing operations of $49.3 million, or $0.06 per share from continuing operations.

Adjusted net loss¹ from continuing operations of $39.5 million or adjusted net loss¹ from continuing operations of $0.05 per share

Adjusted EBITDA¹ of $69.0 million and Adjusted EBITDA margin¹ of 20.7%, down 250 basis points year over year.

Cash at the end of the quarter was $101.6 million

Operating and free cash flows were $42 million and $25 million, respectively

Financial highlights for the full year 2025

Net income: $1,268.1 million

International revenue is $172.5 million, up 63 percent from 2024’s $105.6 million.

Gross profit $631.0 million and gross margin 50%

Adjusted gross profit¹ $632.5 million and adjusted gross profit margin¹ 50%

Operating cash flow from continuing operations of $152.0 million and free cash flow from continuing operations of $89.3 million.

Net loss from continuing operations was $201.9 million, or $0.26 per share.

Adjusted net loss¹ from continuing operations of $175.9 million, or adjusted net loss per share of $0.23 from continuing operations

Adjusted EBITDA¹ of $274.7 million and adjusted EBITDA margin of 21.7%

¹Adjusted EBITDA, adjusted net income (loss), adjusted gross profit and free cash flow are non-GAAP financial measures, and adjusted EBITDA margin, adjusted net income (loss) per share and adjusted gross profit margin are non-GAAP financial ratios, which in each case may not be used by US GAAP and other standards. See “Non-GAAP Financial Performance Measures” below for definitions and additional information regarding Curaleaf’s use of non-GAAP financial measures and non-GAAP financial ratios. See “Reconciliation of Non-GAAP Financial Measures” below for a reconciliation of each non-GAAP financial measure used in this press release to the most directly comparable US GAAP financial measure.

Published by NCV Newswire

New Cannabis Ventures’ NCV Newswire aims to gather high-quality content and information about leading cannabis companies to help our readers filter through the noise and stay on top of the most important cannabis business news. The NCV Newswire is edited by an editor and is not automated in any way. Got a secret news tip? Get in touch.

Get our Sunday newsletter

acb. canopy growth

The International Cannabis Opportunity – New Cannabis Ventures

Published

4 days agoon

February 23, 2026By

admin

You are reading this week’s edition of New Cannabis Ventures, a weekly magazine we have published since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve, as well as links to the most important news of the week. We no longer email them like we used to, but post this and all newsletters on our website here.

friends,

While the US is getting a lot of attention from cannabis investors, the industry faces many challenges in America. It’s been more than 12 years since Colorado shops opened their doors to adults beyond medical patients, and since then many states have embraced medical cannabis and adult cannabis. Although legal cannabis has expanded significantly, it remains a state-regulated market, and each state differs greatly in terms of rules and regulations. Cannabis remains illegal federally, and the industry continues to struggle 280E tax.

Cannabis markets outside the US continue to grow. Canada revised its federal medical cannabis program in 2013, with the MMPR replacing the MMAR, and the current Access to Cannabis for Public Purposes Regulations (ACMPR) replaced the MMPR in 2016. Justin Trudeau, who was elected Prime Minister in late 2015, became the first agenda item to legalize cannabis. implement adult use legalization in 2018. The program has its challenges, but the industry has grown as it has matured. StatsCan will release December sales data tomorrow, and it looks like cannabis sales are up about 4% for 2025.

Other countries have developed their own medical cannabis, including Australia, Germany and Israel, with Germany legalizing it for adult use. The Netherlands is holding trials in coffee shops. Uruguay, a small country, began legalizing cannabis sales to adults in 2017, and Germany began a program in 2024 to legalize cannabis for adults, although sales are through social clubs. While this program has not directly created commercial opportunities, it has boosted the market for medical cannabis. Unlike Canada, where cannabis is sold by the provinces, in Germany cannabis is sold in traditional pharmacies. A significant amount of medical cannabis sold in Germany is imported from Canada. David Brown of StratCann suggested this six months ago Almost 50% of German hemp imports in Q2 came from Canada.

The Global Hemp Stock Index, last recalculated at year-end, has 7 Canadian LPs, and these NASDAQ-listed companies tend to be active in international markets. Most MSOs in the US operate exclusively there, but one, Curaleaf, has international operations. Curaleaf trades on the TSX in Canada, but it trades in the US. The company reported total revenue of $320 million in its third quarter, with international operations (Canada, Germany, Portugal, Spain and the UK) accounting for just 14.4%. Year-to-date, it has registered just 12.9% as it has grown while domestic revenues have declined.

Canadian LPs in the index are Aurora Cannabis, Canopy Growth, Cronos Group, Organigram, SNDL, Tilray Brands and Village Farms. SNDL, which is more of an alcohol than cannabis retailer, has no international cannabis sales. The remaining six are active and active. This week, Organigram announced the acquisition of the rest of the German cannabis company, and it was already active in other markets. Cronos Group has announced the acquisition of CanAdelaar, a deal that is expected to close soon and will give it access to the Netherlands. Canopy Growth is acquiring MTL Cannabis, and increased exports of medical cannabis was a benefit he pointed to.

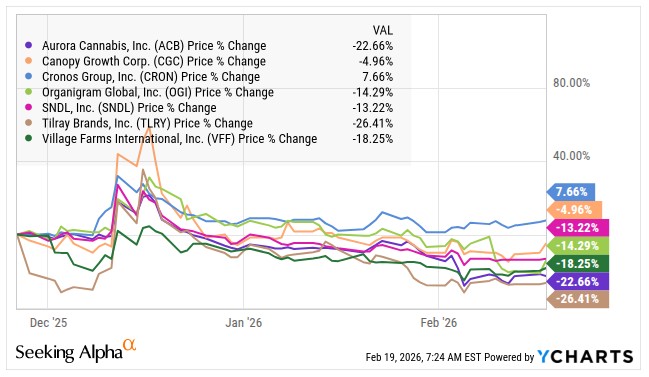

In: warned about Canadian LPs here at the end of November and I am now more optimistic about this part of the cannabis market. At the time I had 5 of the 7 GCSI members on my Focus List at 420 Investor, but I added Aurora Cannabis when they reported their financial Q3 and fell. Here’s how all 7 have performed since the end of November.

My 420 Investor model portfolio includes a small position in Tilray Brands, a large position in Aurora Cannabis, and a very large position in Organigram. These three positions represent 31.9% of the portfolio, while the GCSI has 27.4% exposure.

The Canadian LP market has certainly been cheaper than it is now, but it seems cheap enough. Balance sheets have improved dramatically, and some of these large companies are trading below tangible book value. NASDAQ listings are superior to the OTC listings that MSOs have. The Canadian market may improve, although I don’t expect it to, and international expansion may continue to help federally legal Canadian LPs export more or expand to other countries. These international operations also involve risks. I see a big international opportunity for Canadian LPs, and investors don’t seem very excited at the moment.

Sincerely,

Alan:

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we have published in the last 2 weeks.

Exclusives

Major cannabis companies are set to report Q4 financials

M&A:

Organigram Global to buy Sanity Group

Follow Alan for real-time updates X.com:. Share and discover industry news with like-minded people on the largest group of cannabis investors and entrepreneurs LinkedIn:.

View: Public Hemp Company Revenue and Earnings Trackingwhich ranks the highest-earning hemp stocks.

Stay on top of the most important communications from public companies by watching what’s coming cannabis investor calendar.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

acb. canopy growth, Aurora Cannabis, CGC:, RELIGION:, Cronos Group:, BREAD, Organization chart, SNDL:, Tilray brands, TLRY:, VFF:, Farms, MOGET:

Related news:

Canadian cannabis sales hit a new record high in December

Organigram Global to buy Sanity Group

Major cannabis companies are set to report Q4 financials

Hemp stocks are off to a bad start in 2026

Marijuana Retail Report

Cannabis Stocks Held Steady – New Cannabis Ventures

New rules raise cannabis stock limits for Malta’s associations

Trump Administration ‘Very Anxious’ To Allow Psychedelic Therapy ‘As Quickly As Possible,’ RFK Tells Joe Rogan

Tiger Bomb Marijuana Monday

MJBizCon 2024 Las Vegas LIVE Recap | Special Interviews | Technology & Product Reviews and MORE!

Tommy Chong Didn’t Deserve This

WIZ KHALIFA CANNABIS FESTIVAL 2022 | BLUNTZ

Missouri Rolls Out Decals To Identify Licensed Cannabis Dispensaries

Curaleaf Q4 Revenue Grows 2% – New Cannabis Ventures

“Our system can manage equipment across 10,000+ m² using just a few wires”

Florida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

Mazar-i-Sharif Hash Wednesday

Your Cannabis Business: Consistent Filings Are Critical

Re-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

DEA’s Cole Reverses His “priorities” ; Prohibitionists Dig In; Dead & Co Celebrates 60 years in SF

Texas DA Partakes on Tik Tok to prove a point; Boston Sheriff arrested for Extortion of $ w/ Ascend

Weak Michigan Cannabis Sales Again in July – New Cannabis Ventures

From Finance to Wellness: Brad Zerman’s Impactful Pivot

New Hampshire Governor Says Federal Marijuana Rescheduling Won’t Change Her Opposition To Legalization

Trending

-

Cannabis News6 months ago

Cannabis News6 months ago“Our system can manage equipment across 10,000+ m² using just a few wires”

-

Florida6 months ago

Florida6 months agoFlorida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

-

Video5 months ago

Video5 months agoMazar-i-Sharif Hash Wednesday

-

Best Practices6 months ago

Best Practices6 months agoYour Cannabis Business: Consistent Filings Are Critical

-

Video7 months ago

Video7 months agoRe-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

-

Video6 months ago

Video6 months agoDEA’s Cole Reverses His “priorities” ; Prohibitionists Dig In; Dead & Co Celebrates 60 years in SF

-

Video6 months ago

Video6 months agoTexas DA Partakes on Tik Tok to prove a point; Boston Sheriff arrested for Extortion of $ w/ Ascend

-

aawh7 months ago

aawh7 months agoWeak Michigan Cannabis Sales Again in July – New Cannabis Ventures