Cannabis News

What Entity Type is Best for a Cannabis Startup?

Published

7 months agoon

By

admin

At our firm, we’ve helped numerous cannabis startups navigate the complexities of choosing the right business entity. Because every startup is unique and has different goals and needs, a one-size-fits-all approach just won’t work. Below, I’ll explore some of the key considerations we focus on when finding the optimal entity type and structure for a cannabis venture.

The problem with sole proprietorships

Laypeople often mistakenly think that a business owned by a single person and a sole proprietorship are the same thing. Sole proprietorships, however, are generally unincorporated businesses. Imagine John Smith opens a lemonade stand and calls it John Smith Lemonade. It won’t be a separate legal entity unless he files a document with his state’s secretary of state.

Sole proprietorships like this completely miss out on “limited liability,” the hallmark of entities like corporations, limited liability companies (LLCs), limited liability partnerships (LLPs), and some other business types. Limited liability shields the owners of a business from the debts and liabilities of the business. In other words, an owner can’t be sued if the business breaches a contract or incurs another liability to a third party.

Without limited liability, a sole proprietor can be sued individually for the business’s conduct. In my sole proprietorship example above, that would be the case whether John Smith or one of his employees sold spoiled lemonade that made someone sick. Generally speaking, all of that goes away for business owners who form an entity offering limited liability (yes there are some exceptions for fraud and wrongful conduct, but those are the exceptions, not the norm).

With that in mind, I’ll talk about the two most common entity types we see in the cannabis space.

Corporations v. LLCs

Corporations have shareholders (owners) who elect directors to manage the big picture operations of the company. Directors hire officers to run the day-to-day affairs of the corporation. Depending on the state, there may be many different kinds of corporations. For example, California has general stock corporations, close corporations, and a host of non-profit corporations. All of them are different and may have different benefits for specific business types.

LLCs are much simpler. Where corporations have shareholders, directors, and officers, LLCs only have members (owners). They can (but don’t have to) appoint managers or even officers to run the business. But otherwise, LLC governance requirements are much simpler.

So the first big question for cannabis startups is how much governance they are prepared to deal with. Corporations can have a lot of benefits, but owners have to understand that they come with more governance baggage.

Which entity is better for taxation?

Corporations are taxed on their income at the federal corporate tax rate is 21%. Shareholders are then taxed on their dividends, if any are paid. This is known as “double taxation” and the “C-corporation” model. Corporations can also elect to be treated as “S-corporations” for tax purposes by making an election with the IRS within a certain timeframe. S-corporation taxation is similar to partnership taxation in many ways. However, S-corporations have many restrictions that make them impractical for some businesses.

Single member LLCs are “disregarded” for tax purposes. Multi-member LLCs are taxed on a pass-through basis (“partnership” taxation). This means that profits and losses of an LLC are treated as profits and losses of its members for tax purposes unless the LLC timely elects to have C-corporation taxation. [Note, there is also something called S-corporation taxation, which is similar to partnership taxation but outside the scope of this post.]

Despite “double taxation,” corporations may be the right entity for a cannabis business in some contexts. Here is an example of ours from a few years ago:

For example, a C corporation that earns $100,000 will pay tax of $21,000 ($100,000 *21%). If that same corporation dividends 100% of its earnings to shareholders, the maximum tax at the individual level is $23,800 ($100,000*23.8%). So the combined amount of tax is $44,800 ($21,000 + $23,800). In comparison, a partnership (or S corporation) results in less overall tax to the owners $37,000 ($100,000 *37%).

However, a C corporation is the preferred structure if the plan is to limit the amount of dividends paid to shareholders. For example the total tax hit to a C corporation and its shareholders that paid out dividends of $50,000 is: $32,900 [$21,000+ $11,900($50,000 * 23.8%)]. In this case, a C Corporation saves $4,100 of taxes compared to operating as a partnership. The C Corporation has the additional benefit of insulating shareholders/owners from personal liability for federal income tax.

On the other hand, partnership taxation can be ideal in some circumstances, such as:

- The individual tax brackets of the LLC members are below 37%;

- The individual member/partners qualify for the favorable 20% deduction for flow-through income under IRC section 199A;

- The business plan emphasizes distributing cash to investors over reinvesting cash into the business (growth);

- The business is not a retailer, and is able to claim a reasonable amount of costs of goods sold (COGS) in its tax reporting.

None of this is meant to be tax advice, but highlights some of the key challenges businesses face in making tax and entity type decisions.

How does the parent/subsidiary company model effect entity choice?

Many cannabis ventures are structured with separate operating companies owned by a single company. Generally speaking, the operating companies are LLCs due to simplicity of operation and pass-through taxation, whereas the “parent” is a C-corporation.

Corporations tend to be the better choice for raising equity and investments, which usually happens at the parent level. Institutional investors are more comfortable investing into corporations than LLCs, where they can secure director seats, define the classes of preferred or other equity they will get, etc. Not to say this can’t be done in an LLC, but the traditional C-corporation parent model tends to be the choice of most cannabis businesses.

You may like

-

RFK Jr. Does Champion Cannabis

-

Emotional Regulation Get Easier with Cannabis?

-

Ohio recreational marijuana market already showing signs of price contraction

-

ABC (Australia News) Victorian men jailed over attempted ‘astronomical’ cocaine import into South Australia

-

How AI Impacts The Cannabis Industry

-

Is There Any Green Left in the Green Rush?

Cannabis News

Emotional Regulation Get Easier with Cannabis?

Published

3 hours agoon

January 30, 2025By

admin

Emotional regulation refers to an individual’s ability to manage to various emotional stimuli in an appropriate manner.

When one is able to regulate their emotions, it means that they are able to withhold intense and extreme emotions, even when the situation normally calls for it. As a result, they are able to express their emotions in a proper way; it is controlled but not suppressed, it’s mindful and aware. Effective emotional regulation has been linked to emotional maturity, better relationships, and an improvement in overall well-being.

However, using certain drugs as well as alcohol have proven to negatively impact one’s ability to regulate their emotions. This is because drugs engage with the neurotransmitters in the brain, including those responsible for the production of serotonin and dopamine, which are necessary for healthy emotional regulation. When we consume central nervous system depressants such as alcohol, as well as stimulants in drugs, these severely impede our serotonin levels which can cause depression and other mental health issues. In addition, drugs have been found to affect emotional dysregulation and dependence.

But not cannabis.

According to the results of a clinical study conducted by researchers at the Oregon State University and Washington State University, inhaling weed containing over 20% THC was not found to have any impact on emotional regulation.

For the study, investigators analyzed the effects of weed smoking on 12 adults; all the participants already had experience smoking weed in the past and even used their own cannabis supply. The researchers then analyzed the mood and emotional regulation capabilities of the participants during times of sobriety as well as when they were stoned from weed. Surprisingly, they found that the subjects’ performance didn’t differ when made to undergo several tasks after smoking weed.

“There was no evidence that acute high-potency cannabis use affected participants’ implicit or explicit emotional regulation,” they said. The researchers also noted that the participants acknowledged there was an improvement in their mood and anxiety reduction after using weed.

“The current pilot study assessed whether being under the influence of high-potency cannabis flower affects emotion regulation among a sample of young adults who use cannabis regularly,” they concluded. “While participants reported more positive mood and decreases in anxiety while intoxicated, there was no evidence to suggest that intoxication from high-potency cannabis flower affected emotion regulation,” the researchers wrote.

How Else Can Cannabis Benefit Emotional Health?

Thousands of people rely on cannabis for its benefits on their emotional and mental well-being. In fact, most cannabis consumers have a positive association with cannabis and emotions, since it can effectively help them reduce encounters of negative emotions in general. For example, instead of ruminating in stress and worry, people can medicate with weed at the end of the day. This not only aids in relaxation, but also offers a natural, safe outlet for coping with the stresses of everyday life.

In the same vein, this is also why more individuals, particularly those in high-stress positions such as parents, CEO’s, and entrepreneurs, have made microdosing or getting high a part of their daily life. No longer is alcohol seen as the only way to cope: weed is in, and it’s a much healthier way of dealing with life.

While this may be something that science can’t explain just yet, cannabis does have the unique ability to slow down one’s racing thoughts and the endless mental chatter, while helping make it easier to focus on the present. For this reason and more, weed has already been widely integrated into many wellness retreats in legal cities. Weed, mindfulness, and yoga simply go together so well, enhancing the peaceful effects of one another. Cannabis consumers can also enjoy a great deal of relaxing activities with a heightened sense of enjoyment, effectively helping one forget about their negative emotions such as anger, stress, and frustration.

So the next time you’re feeling extremely irritable or pissed off, why not pop a gummy or have a toke, and spend some time outside. You’ll see how difficult it can be to stay mad.

What You Take Matters

For those who want to use cannabis to improve their emotional regulation, what you take – and how much of it – matters just as much too.

That’s why there are many more studies suggesting that low-dose THC is best especially for anxiety and stress. On the other hand, high doses of THC can be detrimental for your mental and emotional well-being.

According to a 2017 study conducted by researchers at the University of Illinois at Chicago and the University of Chicago: “We found that THC at low doses reduced stress, while higher doses had the opposite effect, underscoring the importance of dose when it comes to THC and its effects,” they said. The same is also true for psychedelics, which can partly explain the popularity of microdosing psychedelics. Meanwhile, anything that can you too high can in fact, cause intense anxiety and stress.

Conclusion

It can feel almost impossible to avoid stressful situations that can cause you to feel out of whack, emotionally. In fact, stress is just a normal part of life. But losing your temper, ruminating in negative emotions for hours, and being so upset that it affects other aspects of your life, is not normal.

That said, there are a variety of ways you can deal with stress and the negative emotions it brings. Cannabis can be a key ingredient for helping you restore balance in your emotions as well as mental health.

CANNABIS AND EMOTIONAL HOMEOSTATIS, READ ON…

CANNABIS FOR EMOTIONAL HOMESTATIS – WHAT WE NOW KNOW!

Cannabis News

Is There Any Green Left in the Green Rush?

Published

1 day agoon

January 29, 2025By

admin

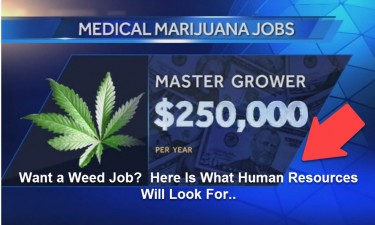

The cannabis industry has undergone a remarkable transformation over the past decade, evolving from a largely underground market to a legitimate and booming sector. As more states and countries legalize cannabis for medical and recreational use, the demand for skilled professionals has surged. This growth has led to the emergence of various high-paying cannabis job opportunities that cater to a wide range of expertise. In this article, we will explore some of the highest-paying jobs in the cannabis industry, their roles, responsibilities, and the skills required to excel in these positions.

The Cannabis Industry Landscape

Before diving into specific job roles, it’s essential to understand the current landscape of the cannabis industry. As of 2023, the global cannabis market is projected to reach over $70 billion by 2028, driven by increasing legalization, changing consumer attitudes, and growing acceptance of cannabis for both medicinal and recreational purposes. This rapid growth has created a demand and jobs for professionals across various sectors, including cultivation, retail, manufacturing, marketing, and compliance.

Factors Driving Job Growth

1. Legalization: As more regions legalize cannabis, new businesses are emerging, creating job opportunities across the supply chain.

2. Consumer Demand: The growing acceptance of cannabis products has led to increased consumer demand for quality products and services.

3. Innovation: The industry is witnessing continuous innovation in product development and technology, necessitating skilled professionals to drive these advancements.

4. Regulatory Compliance: Navigating complex regulations requires experts who can ensure compliance with local and federal laws.

With this backdrop in mind, let’s delve into some of the highest-paying jobs within the cannabis industry.

1. Chief Financial Officer (CFO)

The Chief Financial Officer (CFO) plays a critical role in any organization, and this is especially true in the cannabis industry. As companies navigate a complex financial landscape marked by fluctuating regulations and banking challenges, a skilled CFO is essential for guiding financial strategy.

Responsibilities

-

Financial Planning: Developing long-term financial strategies that align with company goals.

-

Budget Management: Overseeing budgets and ensuring efficient allocation of resources.

-

Regulatory Compliance: Ensuring adherence to financial regulations specific to the cannabis industry.

-

Investor Relations: Managing relationships with investors and stakeholders.

Salary Range

CFOs in the cannabis industry can expect to earn between $125,000 and $250,000 annually, depending on the size of the company and its location.

Skills Required

-

Strong analytical skills

-

Experience in financial management

-

Knowledge of cannabis regulations

-

Excellent communication skills

2. Chief Operations Officer (COO)

The Chief Operations Officer (COO) is responsible for overseeing daily operations within a cannabis company. This role is crucial for ensuring that all aspects of the business run smoothly and efficiently.

Responsibilities

-

Operational Strategy: Developing strategies to improve operational efficiency.

-

Team Management: Leading various departments such as cultivation, production, and sales.

-

Process Optimization: Implementing best practices for production and distribution.

-

Quality Control: Ensuring that products meet regulatory standards and quality expectations.

Salary Range

COOs typically earn between $125,000 and $200,000 annually.

Skills Required

-

Strong leadership abilities

-

Experience in operations management

-

Knowledge of supply chain logistics

-

Problem-solving skills

3. Vice President of Cultivation

The Vice President of Cultivation oversees all aspects of growing cannabis plants from seed to harvest. This role requires extensive knowledge of horticulture as well as business acumen.

Responsibilities

-

Cultivation Management: Directing cultivation operations to maximize yield and quality.

-

Research & Development: Staying updated on new cultivation techniques and technologies.

-

Staff Training: Training staff on best practices for plant care.

-

Compliance Oversight: Ensuring that cultivation practices adhere to state regulations.

Salary Range

This position typically commands a salary between $140,000 and $185,000 annually.

Skills Required

4. Cannabis Consultant

Cannabis consultants provide expert advice on various aspects of running a cannabis business. They often work with startups or established companies looking to optimize their operations or navigate regulatory challenges.

Responsibilities

-

Regulatory Guidance: Helping businesses understand local and federal regulations.

-

Business Strategy: Advising on market entry strategies or operational improvements.

-

Training Programs: Developing training programs for staff on compliance issues.

-

Market Analysis: Conducting research on market trends and consumer preferences.

Salary Range

Cannabis consultants can earn anywhere from $100,000 to over $250,000, depending on their expertise and client base.

Skills Required

5. Dispensary Manager

Dispensary managers oversee the daily operations of retail locations selling cannabis products. This role combines customer service with business management skills.

Responsibilities

-

Staff Management: Hiring, training, and supervising dispensary staff.

-

Inventory Control: Managing inventory levels to ensure product availability.

-

Customer Service: Ensuring high levels of customer satisfaction through excellent service.

-

Sales Strategy: Developing sales strategies to increase revenue.

Salary Range

Dispensary managers typically earn between $60,000 and $120,000, depending on location and experience.

Skills Required

-

Strong leadership qualities

-

Experience in retail management

-

Knowledge of cannabis products

-

Excellent interpersonal skills

6. Extraction Technician

Extraction technicians play a vital role in producing concentrated cannabis products such as oils and edibles. This position requires technical expertise in extraction methods.

Responsibilities

-

Extraction Processes: Performing extraction using various techniques (e.g., CO2 extraction).

-

Equipment Maintenance: Maintaining extraction equipment to ensure safety and efficiency.

-

Quality Assurance: Testing products for potency and purity.

-

Documentation: Keeping detailed records of extraction processes for compliance purposes.

Salary Range

Extraction technicians can earn between $50,000 and $90,000, depending on their level of experience.

Skills Required

-

Technical knowledge of extraction methods

-

Attention to detai Ability to work with laboratory equipment

-

Strong problem-solving skills

7. Marketing Manager

Marketing managers in the cannabis industry are responsible for developing marketing strategies that promote products while adhering to strict advertising regulations unique to this sector.

Responsibilities

-

Brand Development: Creating a strong brand identity that resonates with consumers.

-

Campaign Management: Planning and executing marketing campaigns across various channels.

-

Market Research: Analyzing market trends to identify opportunities for growth.

-

Social Media Management: Engaging with customers through social media platforms while complying with advertising regulations.

Salary Range

Marketing managers can expect salaries ranging from $70,000 to $150,000, depending on experience and company size.

Skills Required

-

Strong understanding of digital marketing

-

Creativity

-

Excellent communication skills

-

Ability to analyze market data

8. Compliance Officer

Compliance officers ensure that cannabis businesses adhere to all local, state, and federal regulations governing their operations. This role is crucial for avoiding legal issues that could jeopardize a business’s future.

Responsibilities

-

Regulatory Monitoring: Keeping up-to-date with changes in laws affecting the cannabis industry.

-

Policy Development: Creating internal policies that align with legal requirements.

-

Training Staff: Educating employees about compliance issues related to their roles.

-

Auditing Practices: Conducting regular audits to ensure adherence to regulations.

Salary Range

Compliance officers typically earn between $70,000 and $120,000, depending on experience level.

Skills Required

9. Product Development Scientist

Product development scientists are responsible for creating new cannabis products or improving existing ones. Their work involves research into formulations that meet consumer needs while adhering to safety standards.

Responsibilities

-

Researching new product formulations

-

Conducting stability testing

-

Collaborating with marketing teams

-

Ensuring compliance with health regulations

Salary Range

Product development scientists can earn between $80,000 and $130,000, depending on their expertise level.

Skills Required

-

Strong background in chemistry or biology

-

Creativity

-

Problem-solving abilities

-

Knowledge of regulatory standards

Check for open jobs in the cannabis industry near you on our job board by clicking here!

Conclusion

The cannabis industry presents an array of high-paying job opportunities across various sectors—from finance and operations management to marketing and compliance. As legalization continues to spread globally, skilled professionals will be essential for navigating this rapidly evolving landscape. Whether you’re an experienced professional looking for a career change or someone entering the job market for the first time, there are numerous pathways available within this exciting field. By acquiring relevant skills and knowledge about the industry’s unique challenges and opportunities, you can position yourself for success in one of today’s most dynamic job markets.

HIGHEST PAYING JOBS IN WEED, READ ON…

Cannabis News

Not Just Alcohol Sales Dropping, Anxiety Medication Prescriptions Plummet in States with Legal Cannabis Programs

Published

2 days agoon

January 28, 2025By

admin

The legalization of marijuana has sparked a significant shift in the landscape of mental health treatment, particularly concerning anxiety disorders. Recent studies have indicated a notable decrease in prescriptions for anti-anxiety medications, especially benzodiazepines, in states where marijuana has been legalized. This phenomenon raises important questions about the implications for pharmaceutical companies that have long dominated the market for anxiety treatments. In this article, we will explore the connection between legal marijuana and the decline in anxiety medication prescriptions, delve into the broader implications for the pharmaceutical industry, and consider what this means for patients and healthcare providers.

Understanding Anxiety Disorders and Current Treatment Options

The Prevalence of Anxiety Disorders

Anxiety disorders are among the most common mental health issues affecting millions of individuals worldwide. According to the World Health Organization (WHO), anxiety disorders affect approximately 264 million people globally. These disorders encompass a range of conditions, including generalized anxiety disorder (GAD), social anxiety disorder, panic disorder, and specific phobias. Symptoms can vary widely but often include excessive worry, restlessness, fatigue, difficulty concentrating, and physical symptoms such as increased heart rate and sweating.

Traditional Treatments for Anxiety

Historically, treatment options for anxiety disorders have included psychotherapy and pharmacotherapy. Common pharmacological treatments include:

-

Benzodiazepines: Medications such as diazepam (Valium), lorazepam (Ativan), and alprazolam (Xanax) are frequently prescribed for short-term relief of acute anxiety symptoms. While effective, these medications carry risks of dependency and withdrawal symptoms.

-

Selective Serotonin Reuptake Inhibitors (SSRIs): Drugs like sertraline (Zoloft) and fluoxetine (Prozac) are often used as first-line treatments for chronic anxiety disorders. They work by increasing serotonin levels in the brain but can take several weeks to show effects.

-

Cognitive Behavioral Therapy (CBT): This form of psychotherapy is widely regarded as an effective treatment for anxiety disorders. CBT focuses on changing negative thought patterns and behaviors associated with anxiety.

Despite their effectiveness, many patients experience side effects from these medications or find them insufficient in managing their symptoms. As a result, there is growing interest in alternative treatments, including legal marijuana.

The Rise of Legal Marijuana

In recent years, various states in the U.S. have moved toward legalizing marijuana for both medical and recreational use. As of 2023, over 30 states have legalized medical marijuana, while several others have legalized it for recreational use. This trend reflects changing public attitudes toward cannabis and increasing recognition of its potential therapeutic benefits.

Medical Marijuana and Anxiety Relief

Cannabis contains numerous compounds known as cannabinoids, with tetrahydrocannabinol (THC) and cannabidiol (CBD) being the most studied. THC is responsible for the psychoactive effects associated with marijuana use, while CBD is non-psychoactive and has garnered attention for its potential therapeutic properties.

Research suggests that CBD may help alleviate anxiety symptoms without the side effects commonly associated with traditional anti-anxiety medications. A 2019 study published in The Permanente Journal found that CBD significantly reduced anxiety scores in a group of patients within a month of treatment.

The Connection Between Legal Marijuana and Reduced Anxiety Medication Prescriptions

A groundbreaking study published in JAMA Network Open examined prescription data from states that legalized marijuana. The researchers found that states with medical cannabis laws experienced a 12.4% reduction in benzodiazepine prescriptions, while those with recreational laws saw a 15.2% decrease. This data suggests that patients may be substituting cannabis for traditional anti-anxiety medications.

Patient Behavior and Preferences

Several factors may contribute to patients’ decisions to turn to legal marijuana instead of pharmaceuticals:

1. Perceived Safety: Many individuals view cannabis as a safer alternative to benzodiazepines due to the latter’s association with dependency and withdrawal issues.

2. Efficacy: Patients often report positive experiences with cannabis in managing their anxiety symptoms, leading them to prefer it over conventional medications.

3. Holistic Approach: Cannabis is often perceived as part of a more holistic approach to health that includes lifestyle changes, mindfulness practices, and alternative therapies.

4. Accessibility: In states where cannabis is legal, obtaining it may be easier than navigating the healthcare system to secure prescriptions for traditional medications.

Implications for Pharmaceutical Companies

The decline in benzodiazepine prescriptions linked to legal marijuana poses significant challenges for pharmaceutical companies that produce these medications. Here are some key implications:

Market Dynamics

As more patients seek cannabis as an alternative treatment for anxiety, pharmaceutical companies may face reduced demand for their products. This shift could lead to decreased revenue from anti-anxiety medications, prompting companies to reevaluate their market strategies.

Research and Development Focus

Pharmaceutical companies may need to adapt by investing in research related to cannabis-based therapies or developing new products that incorporate cannabinoids. Some companies are already exploring synthetic cannabinoids or formulations that combine traditional pharmaceuticals with cannabis extracts.

Regulatory Challenges

The evolving legal landscape surrounding cannabis presents regulatory challenges for pharmaceutical companies. As more states legalize marijuana, there may be increased scrutiny regarding its safety and efficacy compared to traditional medications.

Broader Implications for Mental Health Treatment

The rise of legal marijuana as a treatment option signals a potential shift in how mental health care is approached:

1. Integration of Cannabis into Treatment Plans: Healthcare providers may begin incorporating cannabis into treatment plans alongside traditional therapies. This integration could lead to more individualized care tailored to patients’ preferences.

2. Increased Focus on Patient-Centered Care:The growing acceptance of cannabis reflects a broader trend toward patient-centered care models that prioritize patient preferences and experiences in treatment decisions.

3. Need for Education: As patients increasingly seek information about cannabis as a treatment option, healthcare providers must be equipped with knowledge about its benefits and risks to guide informed decision-making.

Potential Risks and Considerations

While legal marijuana offers promising alternatives for managing anxiety, it is essential to consider potential risks:

1. Lack of Regulation:The cannabis industry is less regulated than pharmaceuticals, leading to concerns about product quality, dosing accuracy, and potential contaminants.

2. Individual Variability: Responses to cannabis can vary widely among individuals due to factors such as genetics, tolerance levels, and underlying health conditions.

3. Potential for Misuse: While many individuals use cannabis responsibly, there is potential for misuse or over-reliance on it as a coping mechanism.

Conclusion

The link between legal marijuana and decreased prescriptions for anti-anxiety medications marks a significant development in mental health treatment paradigms. As more patients turn to cannabis as an alternative therapy, pharmaceutical companies must adapt to this changing landscape by reevaluating their strategies and investing in research related to cannabinoid-based treatments. For patients grappling with anxiety disorders, this shift could herald a new era of treatment options that prioritize safety, efficacy, and individual preferences. However, it also necessitates ongoing dialogue among healthcare providers about the best approaches to integrate cannabis into mental health care while ensuring patient safety.As we move forward into this evolving landscape of mental health treatment options, it is crucial to remain vigilant about the implications of these changes—both positive and negative—for patients seeking relief from anxiety disorders and the broader healthcare system at large.

—

This article provides an extensive overview of how the legalization of marijuana is linked to changes in medication prescriptions for anxiety disorders while discussing its implications on pharmaceutical companies and mental health treatment paradigms overall.

CANNABIS REPLACES BENZOS? READ ON…

RFK Jr. Does Champion Cannabis

Emotional Regulation Get Easier with Cannabis?

Ohio recreational marijuana market already showing signs of price contraction

ABC (Australia News) Victorian men jailed over attempted ‘astronomical’ cocaine import into South Australia

How AI Impacts The Cannabis Industry

Is There Any Green Left in the Green Rush?

The Best Marijuana Strains For Your Chinese Zodiac Sign

Cannabis Can Get Rid Of The Doomsday Clock Blues

Will Snoop Dogg Use His New Influence To Help Cannabis

Not Just Alcohol Sales Dropping, Anxiety Medication Prescriptions Plummet in States with Legal Cannabis Programs

Distressed Cannabis Business Takeaways – Canna Law Blog™

United States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

What you Need to Know

Drug Testing for Marijuana – The Joint Blog

NCIA Write About Their Equity Scholarship Program

It has been a wild news week – here’s how CBD and weed can help you relax

Cannabis, alcohol firm SNDL loses CA$372.4 million in 2022

A new April 20 cannabis contest includes a $40,000 purse

Your Go-To Source for Cannabis Logos and Designs

UArizona launches online cannabis compliance online course

Trending

-

Cannabis News2 years ago

Cannabis News2 years agoDistressed Cannabis Business Takeaways – Canna Law Blog™

-

One-Hit Wonders2 years ago

One-Hit Wonders2 years agoUnited States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

-

Cannabis 1012 years ago

Cannabis 1012 years agoWhat you Need to Know

-

drug testing1 year ago

drug testing1 year agoDrug Testing for Marijuana – The Joint Blog

-

Education2 years ago

Education2 years agoNCIA Write About Their Equity Scholarship Program

-

Cannabis2 years ago

Cannabis2 years agoIt has been a wild news week – here’s how CBD and weed can help you relax

-

Marijuana Business Daily2 years ago

Marijuana Business Daily2 years agoCannabis, alcohol firm SNDL loses CA$372.4 million in 2022

-

California2 years ago

California2 years agoA new April 20 cannabis contest includes a $40,000 purse