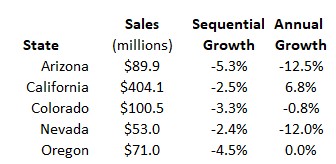

Illinois released sales figures for two months on Friday. The last time it released the data in November, the state did a major review of historical sales after a long delay, and it was updated to October. The previous report was for Cannabis for adults in May. The November document explained that the lack of data was due to the Metrc transition. “Sales tracking features in Metrc help retailers more accurately and reliably report actual sales, including all discounts and promotions at checkout. A careful review of past data shows that some initial discount prices were collected in previous months.” Here is the updated data until the end of 2025.

Statewide adult cannabis sales rose 5.6% sequentially to $116.6 million in December, up 2.2% on the day. Year-on-year growth was -23.9%, a slight improvement from November’s -26.1% growth. Here is a chart of adult sales over time:

After growing 106% in 2021, 13% in 2022 and 5% in 2023, annual sales for adults are set to grow 5.4% to $1.72 billion in 2024. In 2025, they decreased by 12.5% to $1.51 billion, which was lower than the total in 2022.

There hasn’t been an update from the state on medical cannabis in a while. The state exempts the sale separately from its medical plan, and April issue showed that sales fell 1.6% sequentially to $19.7 million, down 13.2% year over year.