Cannabis Products & Services News

IIPR Extends Beyond Cannabis – New Cannabis Ventures

Published

7 months agoon

By

admin

Industrial innovative properties announce strategic and diversification of $ 270 million in real estate platform

- Deal is expected to introduce significant earnings report for IIP shareholders

- POSITIONS IIP will benefit from long-term life in life, where IIP leadership has decades of the combined experience

San Diego- (Business Wire) –Innovative Industrial Properties, Inc. (NYSE: IIPR) (“IIP” or “Company” announced today that it has signed agreements to invest, which is $ 270 million with IQHQ, INC.

Investments (“Investment”, “Deal” or “Investment Deal” consists of two discrete investments, which are expected to average annual average interest rates a year.

- The $ 100 million assignment is dedicated to a credit institution (“RCF”) for three years, which can be extended for an additional 12 months, the extension fee after payment. RCF will be fully funded the leader, it is subject to closure to ordinary institutions.

- An obligation to buy up to $ 170 million in IQHQ. Preferred stock investments will be funded in many tranches, between the third quarter of 2025 and the second quarter of 2027, which are subject to expanding the IQHQ version.

- Guarantees at IQHQ are subject to the preferred funding of certain funding for certain funding.

“We are enthusiastic about announcing our first expansion by this high-quality transaction outside the cannabis, which diversifies our business and accelerates the trace of IIP growth,” said IIP Executive Chairman Alan Gold.

If we are committed to the canning industry, this transaction covers the deep historical experience of our team in the scientific industry of life, which we believe through the knowledge of life.

ALAN GOLD, IIP Executive Chairman

ALAN GOLD, IIP Executive Chairman

The transaction is built of key lands that include a wide range of current income in the life of the investment, which are combined with future disorderly opportunities through guarantees and potential to acquire real estate objects.

Strategic and financial advantages of the deal.

- High accumulated transaction

- Investments are expected to accumulate very much for each share, based on the average interest rate (which is expected a year).

- Capital Staple Senior Position Offers a Strong Opportunity of Risk Return

- Investments consist of RCF and preferred stock, both of which are sitting on all the total equity of the captain at IQHQ and a material discount, the cost of replacement of assets.

- Advanced portfolio diversification by industry, tenants and investment types

- Pro Forma, IIP will diversify its reserves to close the transaction and reduce the current section and the concentration of tenants. IIP believes that these funds are further improving its financial worldview.

- Revenues from the regulated cannabis’s calculation facilities will decrease by 88% of the company’s total receipt as of June 30, 2025.

- Improved value of capital potential

- The highlighted scale and diversification from the transaction can support a lower price of equity and debt capital and further accelerate its growth.

- IIP has expertise, long-term secular tail of life

- The IIP management team has decades of scientific experience in life with its leading role in the real estate industry, a leading role in the leading role of public trade.

- The point of view includes Alan Gold’s role as the founder and executive director of Biomed Realty Trust, which held its IPO in 2004 and managed $ 8 billion sales in 2016.

- According to PITCHBOK, the 2025 fundraiser for life scientific industry is intended to achieve the highest level since 2021, which was all time.

- According to the CBRE, the real property of the new life of the science is expected to decrease meaningful during the transaction, which IIP approves in the underlying sector and investment.

The company expects RCF to fund funding and shoot company from the company’s turning credit institution. The company expects to finance the preferred stock investment by manually with cash, the company’s turning credit institution and possible basebooks from future funding. The investment transaction is expected to be closed in the third quarter of 2025, subject to regular closure conditions.

About IQHQ

IQHQ, Inc. is focused on life science, which was founded in 2019.

About industrial innovative properties

Innovative Industrial Properties, Inc. Real Estate Investment Trust (REIT) is focused on the acquisition, property and management of specialized industrial properties, and for the real estate of this contemplated transaction, life science. More information is available on www.innovativindustrialproperties.com.

Published by NCV NewsWire

NCV NewsWire aims to treat high-quality content and information about cannabis companies by New Cannabis Ventures to help our readers make noise and remain the most important cannabical business news. NCV Newswire is hand treated by hand and is not automated. Have secret news tip. Contact:A number

Get our Sunday newsletter

You may like

-

FIGHTING FOR MEDICAL CANNABIS IN IRELAND | VERA TWOMEY

-

Coming up on this week’s Cannabis Coast to Coast News with Alaina Pinto

-

THE PEOPLES FUND FOR CANNABIS | CHRISTINE DE LA ROSA

-

Will GOP Control of Congress help or hurt federal reform of cannabis? Reax from NORML & NCIA

-

B Block of Cannabis Coast to Coast News – State Reports from California, Arizona, Virginia, Colorado

-

C Block Cannabis Coast to Coast News: MJBIZ Con Preview; Tribal Cannabis Conference; LPP

American Cannabis News

A Frightening Florida Medical Cannabis Market – New Cannabis Ventures

Published

5 days agoon

March 5, 2026By

admin

You are reading this week’s edition of New Cannabis Ventures, a weekly magazine we have published since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve, as well as links to the most important news of the week. We no longer email them like we used to, but post this and all newsletters on our website here.

friends,

In May 2024 warned readers about Florida hemp field. There have been many follow-ups, the latest of which was in early January, and it pointed to the fact that Florida’s medical cannabis market is shrinking. Two months later, things look bleak there as the mature market becomes more competitive.

Each month we share BDSA data and Florida is one of the markets where they provide monthly sales estimates. Florida does a fantastic job of sharing weekly data on unit volumes, but it doesn’t provide revenue data.

The BDSA estimates Florida hemp sales totaled $126.1 million in February, down 0.4% from a year ago. January sales fell 4.1% from a year earlier, and 2025 sales are expected to rise just 2.9% after rising 20.9% in 2024.

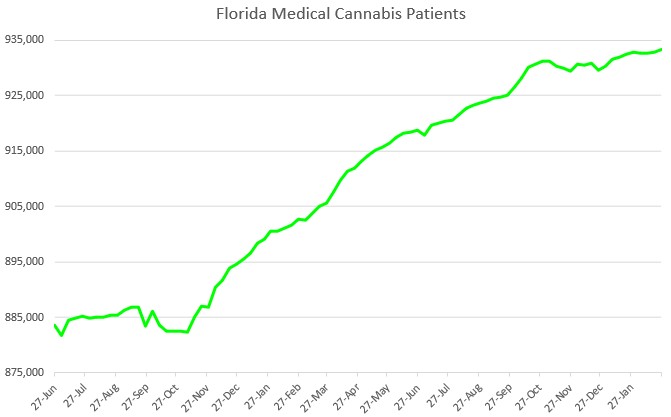

Florida provides a wealth of data that allows for a good understanding of state trends. First, they provide the number of patients, which, according to 2/27 report was 933 thousand. Growth has slowed down.

During the last year, the growth was 3.4%, and in the last three months it increased by only 0.4%. Patient growth is projected to be 3.9% in 2025 and 3.3% in 2024, following an 11% increase in 2023. The medical cannabis industry is maturing in the state, and the current number of patients is almost 4% of the total population.

Florida shares the total number of stores (742 currently), which is up 4.7% year-over-year. Ahead of the election in 2024, which could legalize cannabis for adult use, there was a big increase, with the number of shops increasing by 14%. The growth of stores has led to more competition.

The state splits the volumes, and the two largest parts are “medical marijuana” in mg for THC products and “marijuana for smoking” in ounces. Sales of medical cannabis products rose 12.6% last week, while smoking cannabis grew 11.4%. This growth was much higher than the revenue growth projected by the BDSA, suggesting that pricing is under pressure.

Florida also breaks down unit sales by licensed operator and shares how many distribution locations each operates. This data shows how concentrated the state is, as 51.2% of the state’s vertically integrated dispensaries are owned by just four companies, including Trulieve, Verano (MÜV), Curaleaf, and Ayr Wellness (which bought Liberty Health). These four companies sold 56% of medical cannabis and 61% of smokable cannabis last week. Interestingly, Trulieve, which has nearly twice as many stores as runner-up Verano, saw its medical cannabis volumes decline from a year ago.

When voters failed to approve adult-use cannabis in 2024, falling short of the required 60% affirmative vote, these major Florida operators saw their stocks decimated. It’s been the hardest for Ayr Wellness, but they’ve all come down a lot.

It’s not yet known if Florida voters will vote again this year, but things could improve if adult legalization is implemented. Also, the federal ban on THC from hemp could increase demand later this year when it is implemented. With that said, Florida’s medical cannabis market appears to be struggling. Trulieve is very large in the state and has significant influence with it compared to other states. Analysts forecast Trulieve’s 2026 revenue to decline 1% after falling less than 1% in 2025. More importantly, they forecast adjusted EBITDA to decline 6% in 2026.

Sincerely,

Alan:

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we have published in the last 2 weeks.

Exclusives

Cannabis sales remained weak in February

Financial statements

Cresco Labs saw revenue shrink again

Follow Alan for real-time updates X.com:. Share and discover industry news with like-minded people on the largest group of cannabis investors and entrepreneurs LinkedIn:.

View: Public Hemp Company Revenue and Earnings Trackingwhich ranks the highest-earning hemp stocks.

Stay on top of the most important communications from public companies by watching what’s coming cannabis investor calendar.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

ayr health, AYRWF:, Cresco Labs, CRLBF:, Curaleaf:, curly, Florida, tcnnf:, WRONG:, to truly believe, summer, WITH:

Related news:

Cresco Labs saw revenue shrink again

Cannabis sales remained weak in February

Curaleaf’s Q4 revenue rose 2%

Share buybacks aren’t always a good idea for cannabis companies

AKAN

Cannabis Stocks Held Steady – New Cannabis Ventures

Published

2 weeks agoon

February 27, 2026By

admin

Hemp stocks, as measured by the Global Hemp Stock Index, were quite volatile in 2024 and then again in 2025 as well. Although the index rose in December, it fell on the year. In January, the indicator decreased by 10.6%, reaching 5.89. February saw a drop in prices, but the market recovered with the index ending the month at 5.86, down 0.5%.

After collapsing 21.8% in late 2024 to 6.88 in Q4, the index fell heavily in Q1 and then marginally in Q2. The global hemp stock index, which now has 27 members, gained 53.0% in the third quarter but fell 14.2% in the fourth quarter, down 4.2% for the full year. In 2026, it decreased by 11.1%.

Since its peak in February 2021, the global hemp stock index is down 93.7% from a closing high of 92.48.

The 3 strongest names in February, each an MSO, were all up more than 13%;

Jazz Pharma rallied in 2026, but the other two declined.

February’s 3 weakest names are all down more than 13%;

All three have fallen significantly in 2026 so far.

We will summarize the performance of the index again in a month. In April, we historically combined the two articles, and we update here the other indexes that New Cannabis Ventures continues to maintain: the American Cannabis Operator Index, the Ancillary Cannabis Index, and the Canadian Cannabis LP Index.

American Hemp Operator Index

The ACOI sank in January, falling 12.5% to 11.53, and fell further in February, falling 5.8% to 10.87. In 2025, it increased by 57.7% to 13.18 and decreased by 17.5% in 2026. The large AdvisorShares Pure US Cannabis ETF ( MSOS ) fell 3.7% in February.

The strongest performing stock in February was TerrAscend (OTC: TSNDF ), up 7.7%. The weakest, Vireo Growth (OTC: VREOF ), fell 17.9%.

In March, the index will have seven members with the removals of Jushi Holdings (OTC: JUSHF ) and Vireo Growth.

Auxiliary cannabis index

Ancillary commodities lost 5.7% in February as the index fell to 9.84. The index decreased by 19.5% in 2025, reaching 11.09, and this year it decreased by 11.3%.

The strongest stock in February was Turning Point Brands (NASDAQ: TPB ), which rose 13.1%. The weakest iPower fell by 55.8%.

In March, the index will have seven members after the removal of GrowGeneration (NASDAQ: GRWG ), iPower (NASDAQ: IPW ) and Chicago Atlantic BDC (NASDAQ: LIEN ) during February’s low trading volume.

Canadian Hemp LP Index

Canadian LPs fell 0.9% in February as the index fell to 55.65. In 2025, the index increased by 17.8%, reaching 59.01, and in 2026, it decreased by 5.7%.

The strongest Canadian LP in February was Rubicon Organics (TSXV: ROMJ ), which rose 8.9%. Simply Insoluble Concentrates (TSXV: HASH ) was the weakest, down 27.8%.

In March, the index will have the same thirteen members.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

WILL, Akanda, HASH:, high tide, heat, capacity, ipw:, Jazz, jazz farm, Rome, Rubicon Organics, the power, rhythm, Simply for free, Terrascend:, TPB:, TSNDF:, Revolving brands, vireo growth, vreof:

Related news:

Canadian cannabis sales hit a new record high in December

Major cannabis companies are set to report Q4 financials

Hemp stocks are off to a bad start in 2026

A very large MSO is now expanding its business

acb. canopy growth

The International Cannabis Opportunity – New Cannabis Ventures

Published

2 weeks agoon

February 23, 2026By

admin

You are reading this week’s edition of New Cannabis Ventures, a weekly magazine we have published since October 2015. The newsletter includes unique insight to help our readers stay ahead of the curve, as well as links to the most important news of the week. We no longer email them like we used to, but post this and all newsletters on our website here.

friends,

While the US is getting a lot of attention from cannabis investors, the industry faces many challenges in America. It’s been more than 12 years since Colorado shops opened their doors to adults beyond medical patients, and since then many states have embraced medical cannabis and adult cannabis. Although legal cannabis has expanded significantly, it remains a state-regulated market, and each state differs greatly in terms of rules and regulations. Cannabis remains illegal federally, and the industry continues to struggle 280E tax.

Cannabis markets outside the US continue to grow. Canada revised its federal medical cannabis program in 2013, with the MMPR replacing the MMAR, and the current Access to Cannabis for Public Purposes Regulations (ACMPR) replaced the MMPR in 2016. Justin Trudeau, who was elected Prime Minister in late 2015, became the first agenda item to legalize cannabis. implement adult use legalization in 2018. The program has its challenges, but the industry has grown as it has matured. StatsCan will release December sales data tomorrow, and it looks like cannabis sales are up about 4% for 2025.

Other countries have developed their own medical cannabis, including Australia, Germany and Israel, with Germany legalizing it for adult use. The Netherlands is holding trials in coffee shops. Uruguay, a small country, began legalizing cannabis sales to adults in 2017, and Germany began a program in 2024 to legalize cannabis for adults, although sales are through social clubs. While this program has not directly created commercial opportunities, it has boosted the market for medical cannabis. Unlike Canada, where cannabis is sold by the provinces, in Germany cannabis is sold in traditional pharmacies. A significant amount of medical cannabis sold in Germany is imported from Canada. David Brown of StratCann suggested this six months ago Almost 50% of German hemp imports in Q2 came from Canada.

The Global Hemp Stock Index, last recalculated at year-end, has 7 Canadian LPs, and these NASDAQ-listed companies tend to be active in international markets. Most MSOs in the US operate exclusively there, but one, Curaleaf, has international operations. Curaleaf trades on the TSX in Canada, but it trades in the US. The company reported total revenue of $320 million in its third quarter, with international operations (Canada, Germany, Portugal, Spain and the UK) accounting for just 14.4%. Year-to-date, it has registered just 12.9% as it has grown while domestic revenues have declined.

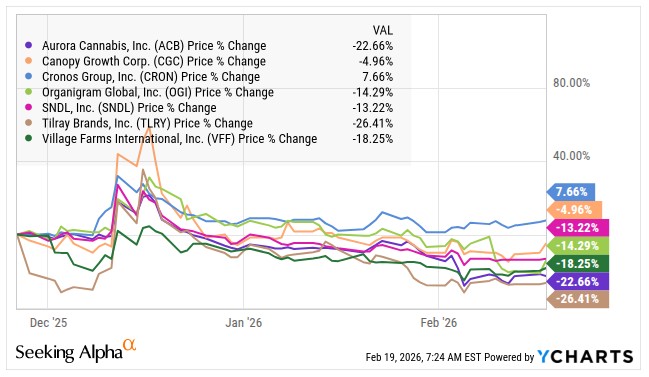

Canadian LPs in the index are Aurora Cannabis, Canopy Growth, Cronos Group, Organigram, SNDL, Tilray Brands and Village Farms. SNDL, which is more of an alcohol than cannabis retailer, has no international cannabis sales. The remaining six are active and active. This week, Organigram announced the acquisition of the rest of the German cannabis company, and it was already active in other markets. Cronos Group has announced the acquisition of CanAdelaar, a deal that is expected to close soon and will give it access to the Netherlands. Canopy Growth is acquiring MTL Cannabis, and increased exports of medical cannabis was a benefit he pointed to.

In: warned about Canadian LPs here at the end of November and I am now more optimistic about this part of the cannabis market. At the time I had 5 of the 7 GCSI members on my Focus List at 420 Investor, but I added Aurora Cannabis when they reported their financial Q3 and fell. Here’s how all 7 have performed since the end of November.

My 420 Investor model portfolio includes a small position in Tilray Brands, a large position in Aurora Cannabis, and a very large position in Organigram. These three positions represent 31.9% of the portfolio, while the GCSI has 27.4% exposure.

The Canadian LP market has certainly been cheaper than it is now, but it seems cheap enough. Balance sheets have improved dramatically, and some of these large companies are trading below tangible book value. NASDAQ listings are superior to the OTC listings that MSOs have. The Canadian market may improve, although I don’t expect it to, and international expansion may continue to help federally legal Canadian LPs export more or expand to other countries. These international operations also involve risks. I see a big international opportunity for Canadian LPs, and investors don’t seem very excited at the moment.

Sincerely,

Alan:

New Cannabis Ventures publishes curated articles as well as exclusive news. Here is what we have published in the last 2 weeks.

Exclusives

Major cannabis companies are set to report Q4 financials

M&A:

Organigram Global to buy Sanity Group

Follow Alan for real-time updates X.com:. Share and discover industry news with like-minded people on the largest group of cannabis investors and entrepreneurs LinkedIn:.

View: Public Hemp Company Revenue and Earnings Trackingwhich ranks the highest-earning hemp stocks.

Stay on top of the most important communications from public companies by watching what’s coming cannabis investor calendar.

Based in Houston, Alan leverages his experience as an online community founder 420 Investorthe first and still the largest due diligence platform focused on publicly traded stocks in the cannabis industry. With his extensive network in the cannabis community, Alan continues to find new ways to connect the industry and facilitate its sustainable growth. time New Cannabis Ventureshe is responsible for content development and strategic alliances. Before turning his attention to the cannabis industry in early 2013, Alan, who began his career on Wall Street in 1986, worked as an independent research analyst with more than two decades of research and portfolio management experience. A prolific writer, with over 650 articles published since 2007 Looking for Alphawhere he has 70,000 followers, Alan is a frequent speaker at industry conferences and frequent source Media including the NY Times, Wall Street Journal, Fox Business and Bloomberg TV. Contact Alan. Twitter: |: Facebook |: LinkedIn: |: El

Get our Sunday newsletter

In this article.

acb. canopy growth, Aurora Cannabis, CGC:, RELIGION:, Cronos Group:, BREAD, Organization chart, SNDL:, Tilray brands, TLRY:, VFF:, Farms, MOGET:

Related news:

Canadian cannabis sales hit a new record high in December

Organigram Global to buy Sanity Group

Major cannabis companies are set to report Q4 financials

Hemp stocks are off to a bad start in 2026

Purple Punch Mints #11 Marijuana Monday

Re-release of Full News Show recapping election results in a variety of states;

This Secret Journey Changed Everything

FIGHTING FOR MEDICAL CANNABIS IN IRELAND | VERA TWOMEY

Marijuana Retail Report

Smart root zone monitoring in stone wool cultivation

Hawaii Senate Passes Bill To Create Psychedelics Task Force And Study Pathways To Access Psilocybin And MDMA

Hash Kettle Hash Wednesday

Coming up on this week’s Cannabis Coast to Coast News with Alaina Pinto

What Really Causes These Insane Plant Mutations?

“Our system can manage equipment across 10,000+ m² using just a few wires”

Florida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

Mazar-i-Sharif Hash Wednesday

From Finance to Wellness: Brad Zerman’s Impactful Pivot

Your Cannabis Business: Consistent Filings Are Critical

DEA’s Cole Reverses His “priorities” ; Prohibitionists Dig In; Dead & Co Celebrates 60 years in SF

Re-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

Weak Michigan Cannabis Sales Again in July – New Cannabis Ventures

Texas DA Partakes on Tik Tok to prove a point; Boston Sheriff arrested for Extortion of $ w/ Ascend

German Retail Acquisition Pending for High Tide – New Cannabis Ventures

Trending

-

Cannabis News7 months ago

Cannabis News7 months ago“Our system can manage equipment across 10,000+ m² using just a few wires”

-

Florida7 months ago

Florida7 months agoFlorida Workshop to Discuss What Constitutes a ‘Cartoon’ in Hemp Packaging

-

Video5 months ago

Video5 months agoMazar-i-Sharif Hash Wednesday

-

Video7 months ago

Video7 months agoFrom Finance to Wellness: Brad Zerman’s Impactful Pivot

-

Video7 months ago

Video7 months agoDEA’s Cole Reverses His “priorities” ; Prohibitionists Dig In; Dead & Co Celebrates 60 years in SF

-

Best Practices7 months ago

Best Practices7 months agoYour Cannabis Business: Consistent Filings Are Critical

-

Video7 months ago

Video7 months agoRe-release of the full show of Cannabis Coast to Coast news. Republican Texas DA Fires Up vs. laws;

-

aawh7 months ago

aawh7 months agoWeak Michigan Cannabis Sales Again in July – New Cannabis Ventures