Cannabis News

Want to Reduce Your Risk of Prostate Cancer? – Smoke Weed!

Published

4 months agoon

By

admin

Cannabis Use Associated With Reduced Risk Of Prostate Cancer

Prostate cancer is the 5th leading cause of death among men around the globe, and the second most prevalent cancer. It’s responsible for some 375,000 deaths annually, and 1.4 million new cases every year.

It’s critical for men to diagnose prostate cancer early, since late diagnosis can greatly diminish survival rates. Catching prostate cancer early also helps prevent the spread, or metastasis, of cancer to other body parts which can include the lymph nodes, bones, or internal organs. Additionally, when prostate cancer is diagnosed early, it can give patients the benefit of more treatment options to consider.

Thanks to advances in medicine, there are now several effective treatment methods that patients can utilize for prostate cancer. Doctors can recommend any combination of therapies depending on the stage of the prostate cancer, as well as other factors including the patient’s overall health and any preferences he may have. Oftentimes, surgery can be the first line of defense, followed by chemotherapy, radiation, or immunotherapy.

Cannabis has also been shown to be an effective complementary tool that all cancer patients can benefit from. Integrating marijuana into a new, healthier lifestyle to combat cancer can be beneficial for pain relief, nausea and vomiting control, better sleep, improved appetite, and reduced inflammation. There are several studies to back it up, and now studies also show that cannabis use has been linked to a reduced risk in prostate cancer!

Recent Studies

The findings of a brand-new study have just been released. Researchers utilized a cross-sectional analysis with data taken from the National Survey on Drug Use and Health. Using data from more than 2,500 participants, most of whom were 65 and up. In addition, around 36% of participants were diagnosed with prostate cancer at the time they were interviewed.

Based on the sample, a little over half of the participants said they never consumed marijuana. Meanwhile, 40.8% said they were past users and 5.8% admitted to being current users. According to the researchers, there was a 21% decrease in prostate cancer occurrence among marijuana consumers compared to those who weren’t consuming the drug. Interestingly, they also saw a 22% drop in prostate cancer occurrence among marijuana users who were 65 years old and up compared to non-consumers.

In summary, the findings suggest that past cannabis users had a “significantly lower prevalence of PC compared to non-users.”

“Our findings provide corroborative data from a large national, population-based survey to strengthen the existing body of evidence suggesting a potentially protective role of marijuana against the development of PC,” wrote the researchers. “Since medical marijuana is being used more frequently in cancer patients for pain control, nausea, and abdominal pain and nearly half of oncologists report prescribing medical marijuana to patients at some point in their practice, future prospective studies in patients on medical marijuana may facilitate our further understanding of potential anticancer properties,” they added.

“These results allow us to hypothesize that the use of marijuana may have resulted in activation of cannabinoid receptors on prostate cancer cells and slowed tumor progression, resulting in lower rates of self-reported prostate cancer in the survey,” explained lead researcher, Turab J Mohammed, MD, an oncology and hematology fellow at the Moffitt Cancer Center, to Healio.

Integrating Medical Marijuana In Treatment Plans

Men who have been diagnosed with prostate cancer now have more hope than ever with cannabis. After all, cannabis is the one ‘drug’ that has made the biggest strides in terms of cancer breakthroughs and therapies over the last two decades. No other medicine has come close to what cannabis has helped countless cancer patients around the world achieve.

While we don’t have all the answers just yet, cannabis has helped shine a light for cancer patients and their families. It has been shown to help prevent certain cancers from growing at all, and for those who have been diagnosed with it, cannabis may kill, or slow down tumor growth. There is never any guarantee for anyone though the evidence we have today is definitely promising.

That goes for many kinds of cancer, including prostate cancer. The prostate makes up part of the human endocannabinoid system, which is why it makes total sense for the prostate gland to be receptive to cannabinoid treatment. Furthermore, prostate cancer cells have been found to contain more CB1 and CB2 receptors compared to normal cells in other parts of the body. This enables these cells to be more receptive to cannabinoids, and laboratory studies have showed that prostate cancer cells are more likely to die off when treated with cannabinoids.

What To Do If You Have Prostate Cancer And Want To Use Cannabis

Cancer is a qualifying health condition in a majority of states that have legalized medical marijuana. https://docmj.com/cannabis-and-prostate-cancer-facts-you-need-to-know/ If you live in a state where cancer is a qualifying condition, you can be eligible for a cannabis card,making it simpler for doctors to treat you with marijuana. Different studies on which cannabis strains to try for prostate cancer are out and published.

Pot can also help you cope with the side effects of chemotherapy and treatment. These include neuropathy, appetite loss, nausea, vomiting, headaches, and chronic pain.

It’s recommended to speak with a licensed healthcare provider with experience using marijuana for treating prostate cancer. Thankfully, there are more options than ever when it comes to symptom management and treatment. As with other conditions, early detection is key – so even if you don’t have cancer yet, do consider getting screened on a regular basis.

PROSTATE CANCER AND MEDICAL MARIJUANA, READ ON…

You may like

-

Daylight saving time ends next weekend. This is how to prepare for the potential health effects.

-

4 killed in fiery two-car crash in Thornton

-

Pedestrian killed in fatal Denver crash

-

Broncos vs. Panthers: Live updates and highlights from the NFL Week 8 game

-

Keeler: CU Buffs QB Shedeur Sanders torched Cincinnati while battling a bad leg and flu bug. So where’s the Heisman Trophy love?

-

Colorado Big Brothers, Big Sisters guides kids, combats “epidemic of loneliness”

Cannabis News

What’s the Most Dangerous Drug on the Market?

Published

12 hours agoon

October 27, 2024By

admin

Since the dawn of civilization, humans have had an insatiable appetite for altering their consciousness. From the ancient Sumerians writing about beer to the shamanic use of psychedelics in the Americas, our relationship with drugs is as old as humanity itself. It’s woven so deeply into the fabric of human society that virtually every major religion and legal system has attempted to regulate, control, or outright ban various substances.

For the past century, governments worldwide have been chasing the pipe dream of a “drug-free society.” The War on Drugs, launched in the 1970s, promised to rid the world of the scourge of drug abuse. Yet, here we are fifty years later, with more drugs, more potent substances, and more problems than ever before.

History has taught us an undeniable lesson: prohibition doesn’t work. As long as there’s demand, supply will always find a way. The only real achievements of prohibition have been to enrich criminal organizations and grant governments unprecedented powers over their citizens’ personal choices. From Al Capone during alcohol prohibition to modern-day cartels, we’ve seen this story play out time and time again.

But what if I told you that the most dangerous drug isn’t what you think it is? If you stopped random people on the street and asked them to name the most harmful substance, you’d likely hear responses like “heroin,” “crack,” or “meth.” However, a fascinating study by Professor David Nutt and his colleagues reveals a far different reality.

Today, we’ll dive into this groundbreaking research that challenged conventional wisdom about drug dangers. We’ll explore why current drug scheduling might be completely backward, and how legalization, rather than prohibition, could actually make drug use safer through proper regulation and quality control.

The results might surprise you – and they certainly surprised many in the scientific and political communities when they were first published. Let’s take a closer look at what the data really tells us about drug dangers in our society.

When it comes to drug research and policy, few names carry as much weight as Professor David Nutt. As a neuropsychopharmacologist specializing in the research of drugs affecting the brain, including addiction, anxiety, and sleep, Nutt has dedicated his career to understanding how various substances impact human health and society.

His credentials are impeccable: Fellow of the Royal College of Physicians, Royal College of Psychiatrists, and the Academy of Medical Sciences. He’s held prestigious positions at Imperial College London, the University of Bristol, and the University of Oxford. As a former chairman of the UK’s Advisory Council on the Misuse of Drugs (ACMD), he was literally the government’s top drug advisor – until controversy struck.

In 2009, Nutt was famously dismissed from his position by Home Secretary Alan Johnson for speaking scientific truth to power. His offense? Publishing research showing that alcohol and tobacco were more harmful than many illegal drugs, including LSD, ecstasy, and cannabis. Johnson claimed Nutt had “crossed the line from science to policy,” essentially admitting that evidence-based research took a backseat to political agendas.

The dismissal sparked outrage in the scientific community. Multiple ACMD members resigned in protest, including Dr. Les King and Marion Walker. Even the government’s own Chief Scientific Adviser, John Beddington, sided with Nutt, stating “the scientific evidence is absolutely clear cut. I would agree with it.”

Rather than back down, Nutt doubled down on his commitment to evidence-based drug policy by founding Drug Science, an independent scientific committee providing objective information about drugs. His dedication to scientific truth earned him the 2013 John Maddox Prize for “promoting sound science and evidence on a matter of public interest, whilst facing difficulty or hostility in doing so.”

The controversy highlighted a crucial point: drug policy should be based on scientific evidence, not political convenience. As Nutt himself wrote in The Lancet: “The repeated claims by Gordon Brown’s government that it had scientific evidence that trumped that of the ACMD and the acknowledgment that it was only interested in scientific evidence that supported its political aims was a cynical misuse of scientific evidence.”

Needless to say, David Nutt is someone who knows his stuff. His groundbreaking research into drug harms provides us with an unbiased, evidence-based assessment of how different substances affect both individuals and society. When we look at his findings, we’re not seeing political spin or moral panic – we’re seeing cold, hard data analyzed by one of the world’s foremost experts in the field.

Now, let’s take a look at what his research actually revealed about drug dangers in our society…

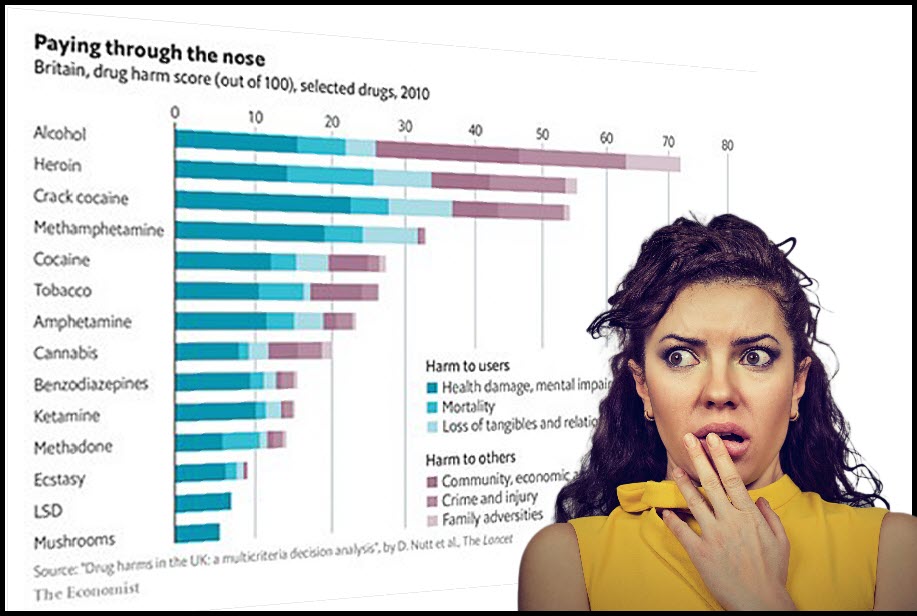

Professor Nutt’s groundbreaking study, published in The Lancet, aimed to create an evidence-based ranking of drug harms in the UK. Unlike previous approaches that relied on political assumptions or moral panic, Nutt and his team developed a comprehensive multicriteria decision analysis (MCDA) to evaluate 20 different drugs based on 16 specific harm criteria.

The methodology was rigorous. Nine criteria focused on direct harm to the user, including mortality, physical damage, and addiction potential. The remaining seven examined broader societal impacts like crime, economic costs, and family disruption. Each criterion was weighted to reflect its relative importance, allowing for a nuanced understanding of both personal and societal harms.

The results were shocking – and flew in the face of conventional drug classification systems. Alcohol emerged as the most harmful drug overall, scoring a staggering 72 out of 100 points. This was significantly higher than heroin (55) and crack cocaine (54), two substances generally considered among the most dangerous. When looking specifically at harm to others, alcohol’s dominance was even more pronounced, scoring nearly three times higher than crack cocaine.

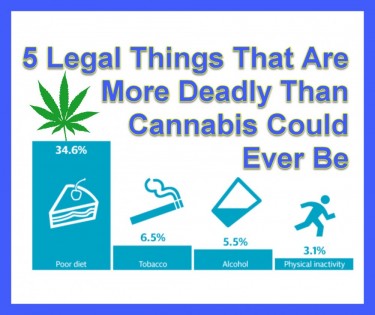

What makes this finding particularly striking is the legal status of these substances. Alcohol, despite being the most harmful drug by a significant margin, remains widely available and culturally celebrated. Meanwhile, less harmful substances like psychedelics (LSD scored 7, mushrooms scored 6) are classified as Schedule I drugs, carrying severe legal penalties for possession or use.

Nutt’s recommendations based on these findings were clear: our drug laws need serious revision. The current classification system, he argued, bears little relationship to actual drug harms. Instead of basing drug policy on scientific evidence, we’ve created a system that criminalizes less harmful substances while normalizing the use of more dangerous ones.

Perhaps most importantly, Nutt’s research highlighted that harm reduction strategies should focus more on alcohol than currently illegal drugs. As he pointed out, if we’re genuinely interested in reducing drug-related harm to society, we should be more concerned about Friday night at the pub than about someone taking mushrooms in their living room.

The implications are profound. We’ve built entire legal and social frameworks around drug classifications that don’t reflect reality. Billions are spent enforcing laws against substances that, according to the data, pose relatively minimal risks to society. Meanwhile, alcohol – a drug that causes massive social harm through violence, health impacts, and family disruption – remains virtually unquestioned as a cornerstone of social life.

Now, with this understanding of Professor Nutt’s work, we must ask ourselves: isn’t it time to renegotiate our societal relationship with mind-altering substances? Can we justify maintaining the current system when it’s so clearly at odds with scientific evidence? As we’ll explore next, perhaps the path forward lies not in doubling down on failed prohibition policies, but in developing a more rational, evidence-based approach to drug regulation…

There’s a profound irony in our society’s relationship with drugs: one of the substances classified as Schedule I – DMT – is produced naturally in our own bodies. As Terence McKenna famously quipped, “Everybody’s holding.” This endogenous psychedelic, dubbed “the spirit molecule,” isn’t just some recreational chemical – recent research suggests it may be fundamental to our perception of reality itself. Rather than simply causing hallucinations, DMT might actually help stabilize our baseline consciousness, with additional doses allowing us to “break through” these perceptual barriers.

But this isn’t about DMT specifically. It’s about the absurdity of criminalizing a substance our bodies naturally produce while celebrating alcohol – a drug that, according to Professor Nutt’s research, causes more societal harm than heroin or crack cocaine. You can’t watch a football game without being bombarded by beer commercials, yet people sit in prison cells for possessing substances that are demonstrably less harmful.

As we approach another presidential election, both candidates have suddenly discovered their support for cannabis reform, despite long histories of opposition. But why stop at cannabis? Nutt’s research shows that psychedelics like LSD and psilocybin mushrooms pose even less risk to society than marijuana. We’ve spent half a century fighting to legalize one relatively benign plant while maintaining prohibition on substances that could potentially revolutionize mental health treatment.

The evidence is clear: legalization works. Even without full nationwide legalization, cannabis use among youth has declined in states with legal markets. Why? Because regulated markets require ID checks, while drug dealers don’t care about age verification. Legal markets also ensure product quality, generate tax revenue, and create legitimate jobs – all while undermining criminal enterprises.

When Professor Nutt presented scientific evidence challenging the established narrative about drug dangers, he wasn’t celebrated for his rigorous research – he was fired. This tells us everything we need to know about the real motivations behind drug prohibition. It was never about public health or safety; it was about control and profit.

The pharmaceutical industry has effectively captured the entire drug market, turning prohibition into their private monopoly. They’ve spent decades funding politicians, shaping media narratives, and influencing medical education. The result? A system where dangerous but profitable drugs are pushed through legal channels while safer alternatives remain criminalized.

The true danger isn’t any particular substance – it’s the unholy alliance between Big Pharma and government power. Perhaps Professor Nutt’s harm assessment missed the most addictive and destructive drug of all: Power. It’s the one substance corporate executives and politicians can’t seem to get enough of, and their addiction has shaped drug policy for generations.

It’s time to admit that the “war on drugs” was never about protecting public health – it was about protecting profits and power. The science is clear. The evidence is overwhelming. The only question that remains is: how many more lives must be ruined before we finally embrace a rational, evidence-based approach to drug policy?

5 THINGS WAY WORSE THAN CANNABIS, READ ON…

Cannabis News

If The FDA Approves It, 5 Million Depressed Americans Could Benefit From a New Psychedelic Therapy

Published

3 days agoon

October 25, 2024By

admin

With millions of people around the world suffering from depression, it’s a seriously worrying condition that affects countless families and societies as a whole.

It’s also still so highly stigmatized, hindering people from seeking help, a proper diagnosis, and treatment. And for those who do get treated, recovery may be futile. That’s because depression is so multifaceted – and it is such a complex condition. There are several social, familial, environmental, and biological factors at play at any given time. In addition, factors such as genetics, trauma, stress, and substance use also play a role.

When it comes to treating depression, responses are highly individual too. A medication and dosage that works well for some, may not work as well for others. Additionally, individuals with co-existing conditions including PTSD and anxiety, or people with specific genetic differences and brain chemistry, will respond differently to pharmaceutical medications. Even those who do respond, may find it takes a long time to work – and antidepression medications are notorious for their harmful side effects.

Enter: Psychedelic Mushrooms For Depression

Over the last few years, psychedelic drugs have become increasingly popular for their ability to effectively manage treatment-resistant mental health disorders including depression. Thanks to a growing acceptance of the therapeutic potential of psychedelics, individuals suffering from depression now have more hope than ever with a safe, natural choice.

And while there are many popular psychedelics to choose from, it’s none other than the psilocybin magic mushrooms which are the most famous of all. It’s also the most well-researched out of all other psychedelics whne it comes to depression, and there is a solid body of research proving its efficacy for treatment-resistant depression.

During a recent study from Emory University, UC Berkeley, and the University of Wisconsin-Madison, investigators sought out to better understand the demand for psilocybin therapy focusing on depression in the United States. The researchers analyzed data on the prevalence of depression, which were taken from national polls. From this data, they determined that roughly 5 million Americans would meet the criteria for psilocybin therapy if it were ever to be approved.

“Our findings suggest that if the FDA gives the green light, psilocybin-assisted therapy has the potential to help millions of American who suffer from depression,” explained Syed Fayzan Rab, the study’s lead author and an Emory MD candidate in a press release. “This underscores the importance of understanding the practical realities of rolling out this novel treatment on a large scale,” he said. The figures are also based on the FDA’s inclusion criteria taking into consideration factors such as regional variation, insurance coverage, and variability.

“While our analysis is a crucial first step, we’ve only scratched the surface in understanding the true public health impact psilocybin therapy may have,” explained Charles Raison, one of the study’s collaborators. Raison is also a lead researcher for one of the biggest clinical trials studying psilocybin therapy for depression. “Ultimately, the realizable potential of this treatment rests in the hands of regulatory bodies, policymakers, insurers, and the healthcare community at large,” he added.

“It’s our hope that these findings spur productive discussions and proactive preparations to optimize the benefit to patients while minimizing unintended consequences,” he said.

Why Psilocybin-Assisted Therapy Is Promising

There are many ways one can medicate with psilocybin. Some cosmonauts who already have had previous experience with recreational or spiritual use of psychedelics may feel confident enough to engage in psilocybin therapy through standard dosing or microdosing; there are several well-established protocols that one can utilize to do so safely without supervision of a medical professional.

However, for individuals who suffer from severe and treatment-resistant depression, psilocybin-assisted therapy may be the better route. It involves the administration of psychedelics (in this case, psilocybin mushrooms) under the supervision of a medical professional. Basically, it’s like replacing conventional antidepressant drugs with psilocybin mushrooms; in either case you’d be monitored by your doctor and you can participate in psychotherapy sessions with them while taking the drug.

Psilocybin Even More Effective Than Antidepressants?

Not only is there an increasingly solid body of research proving the efficacy of magic mushrooms, but now the studies also say that they’re safer and more effective than antidepressants. And when you combine it with the fact that it has little to no side effects, who wouldn’t want to take psilocybin magic mushrooms for depression?

A recent study demonstrated just this.

Researchers at the Centre for Psychedelic Research at Imperial College in London found that taking magic mushrooms were more successful at treating depression compared to the widely prescribed SSRI antidepressants. For the study, they focused on escitalopram, an SSRI antidepressant, and psilocybin.

“This is important because improving connectedness and having greater meaning in life can significantly enhance a person’s quality of life and long-term mental health,” explained David Erritzoe, the study’s co-first author and a clinical director at the Imperial College in London.

“The study suggests that psilocybin therapy might be a more holistic treatment option for depression, addressing both the symptoms of depression and overall well-being. This could make a substantial difference in the overall happiness and daily activities of those suffering from depression, providing a more joined-up approach to mental health treatment,” Erritzoe added.

The study’s authors also reported that the patients who were in psilocybin therapy reported better outcomes compared to those who were being treated with escitalopram.

Conclusion

There’s no doubt that psilocybin therapy already helps so many people with depression and other mental health conditions – imagine if the FDA approved psilocybin-assisted therapy? We hope this is the kind of medical and regulatory breakthrough we can look forward to in the near future – stay tuned!

PSYCHEDELICS FOR DEPRESSION BEGINS, READ BELOW…

Cannabis News

Oregon Cracks Down on THC Inflation and Testing Labs

Published

3 days agoon

October 24, 2024By

admin

On September 25th, the Oregon Liquor and Cannabis Commission (OLCC) sent notices to seven licensed testing laboratories, proposing license cancellation in some cases and suspension or fines in others. The notices center on alleged THC inflation, and extend back to instances identified in 2023. We only have eleven labs in Oregon accredited to do this mandatory work, so OLCC chasing seven of them is a big deal.

This story broke yesterday afternoon in the Portland Business Journal (“Journal”). See: Oregon cannabis labs face shutdown in testing crackdown. I’m guessing that link is paywalled for most of our readers, so I’m glad to have this platform to share some thoughts below.

The proposed suspension and cancellation notices

An obvious question here is why OLCC has proposed to expel some of these licensees, but only suspend or fine others. We’re talking about Category I violations across the board, after all, and the default sanction for any Category I violation is license revocation.

Here, though, the Commission seems to be looking at conduct in two distinct camps: a) conduct that simply could be negligence (and specifically, lazy sampling); and b) attempts to rig results by adulterating products. All seven labs got dinged on “a”, while three also got dinged on “b.”

In the “a” notices, charges include: i) failures to ensure an entire batch of marijuana was available for sampling, and ii) insufficient sampling increments. In the “b” notices, OLCC alleges that “the Licensee’s employees, agents or representatives intentionally added a cannabinoid concentrate, kief [], to the samples taken for testing.” Which is not great.

A long time coming

Controversy around cannabis testing is an old story in Oregon. Prior to OLCC regulation, we had “medical marijuana” from 1998 to 2014 with no testing requirements whatsoever. In 2014, after dispensary licensing commenced, the Oregon Health Authority (OHA) issued poorly-written testing rules that no one really followed. In those days lab shopping was common, dozens of harmful pesticides were allowed, and OHA didn’t even have the authority to regulate producers or labs, anyway.

In 2015, the Oregonian published a landmark investigative piece called “A Tainted High” exposing all of this and more. In 2016, the OLCC program launched, with more testing rules and more enforcement authority, at which point a serious testing bottleneck ensued. Once things cleared up, focus shifted to microbiological and heavy metal contaminants, alongside inflated THC numbers. In 2019, the Secretary of State recommended shelf audits at dispensaries, which eventually did occur.

The latest noise around testing was the aspergillus litigation, where the Cannabis Industry Alliance of Oregon (CIAO) won a temporary stay of enforcement on testing for that mold, and OHA abandoned rules on the topic. In 2023, we also got House Bill 2931, which creates a state-run cannabis reference lab. In June of last year, I wrote:

Why did everyone, including industry, feel a state cannabis reference lab was needed? First, for as long as the OLCC program has existed (and even before that, in the OHA medical program), agencies have fielded complaints from cannabis licensees around testing. Those complaints include allegations of labs spiking potency levels on test samples, and of labs falsifying failed test results. From there, you have the related concepts of “lab shopping” by licensees and “pay to play” testing with labs.

State agencies have argued that to properly regulate licensed labs, an independent mechanism to verify test results is needed. Audits have similarly recommended this. The newly created reference lab will provide: a) a neutral, third-party source for testing and re-testing; b) quality assurance review for licensed labs; and c) a mechanism to audit complaints from licensees about faulty lab testing. This is a positive development.

So, everyone has been looking at this for a while. And now we’re full circle on this inflated THC thing– a problem that is not unique to Oregon.

What happens next?

All of the OLCC labs that received the September 25th notices have until tomorrow, October 25th, to request a hearing before an administrative law judge. This is a critical deadline; hopefully all of them have done so. The rules also require an answer to be filed with any hearing request, but traditionally OLCC affords licensees up to two weeks prior to any prehearing conference to make the submission. (This is not advice.)

You’re here for the big question, though, which is: does OLCC plan to go to the mat on this, with massive fines, suspensions and license cancellations? I don’t think so, necessarily, but it’s obviously a case-by-case thing. Much will depend on the underlying testimony and reports; whether a lab owner knew what their employees were allegedly doing; how the licensees respond; etc. But as I told the Journal: “They can’t have no labs. OLCC may push for labs to come to them and say we’re sorry, it will never happen again, and show internal (standard operating procedures) and maybe creative solutions” in order to safeguard testing.

Is this just a problem for labs?

No. I told the Journal that “it’s not fair just to blame the labs.” And it’s not. With kiefing, in particular, the lab employees would have received the concentrate from customers in most or all cases. This behavior is ultimately driven by market pressures: for whatever stupid reason, the strongest weed tends to attract the most interest and highest prices. (Thankfully, alcohol doesn’t work this way.)

But I digress. Before signing off, I’d like to highlight one final quote I gave the Journal. It’s this: “They’re going after the labs, then the employees involved, then all the producers and wholesalers who are implicated. You saw the first wave, but you’re going to see more.”

Anyone else receiving a violation notice from OLCC will have the same opportunity to respond, and hopefully settle, as the labs. All of this will take some time to play out.

___________

If, in the coming weeks and months, you are one of the unfortunate licensees or permittees on the receiving end of an OLCC charging document, I recommend you start your reading here. Then, give us a call. We can help.

Daylight saving time ends next weekend. This is how to prepare for the potential health effects.

4 killed in fiery two-car crash in Thornton

Pedestrian killed in fatal Denver crash

Broncos vs. Panthers: Live updates and highlights from the NFL Week 8 game

Keeler: CU Buffs QB Shedeur Sanders torched Cincinnati while battling a bad leg and flu bug. So where’s the Heisman Trophy love?

Colorado Big Brothers, Big Sisters guides kids, combats “epidemic of loneliness”

Westminster nonprofit Growing Home pivots to prevent families from becoming homeless

What’s the Most Dangerous Drug on the Market?

In The Haze: Candid Thoughts From a Girl’s Trip To The Woods Cannabis Lounge

User Insights On Cannabis Use

Distressed Cannabis Business Takeaways – Canna Law Blog™

United States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

What you Need to Know

Drug Testing for Marijuana – The Joint Blog

NCIA Write About Their Equity Scholarship Program

It has been a wild news week – here’s how CBD and weed can help you relax

Cannabis, alcohol firm SNDL loses CA$372.4 million in 2022

A new April 20 cannabis contest includes a $40,000 purse

Your Go-To Source for Cannabis Logos and Designs

UArizona launches online cannabis compliance online course

Trending

-

Cannabis News2 years ago

Cannabis News2 years agoDistressed Cannabis Business Takeaways – Canna Law Blog™

-

One-Hit Wonders2 years ago

One-Hit Wonders2 years agoUnited States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

-

Cannabis 1012 years ago

Cannabis 1012 years agoWhat you Need to Know

-

drug testing10 months ago

drug testing10 months agoDrug Testing for Marijuana – The Joint Blog

-

Education2 years ago

Education2 years agoNCIA Write About Their Equity Scholarship Program

-

Cannabis2 years ago

Cannabis2 years agoIt has been a wild news week – here’s how CBD and weed can help you relax

-

Marijuana Business Daily2 years ago

Marijuana Business Daily2 years agoCannabis, alcohol firm SNDL loses CA$372.4 million in 2022

-

California2 years ago

California2 years agoA new April 20 cannabis contest includes a $40,000 purse