Cannabis News

Will Medicare Ever Cover Medical Marijuana?

Published

2 years agoon

By

admin

Medical marijuana is becoming increasingly popular among older adults as a treatment for various conditions. However, despite its growing acceptance, uncertain safety standards, conflicting laws, and complex regulations could delay Medicare coverage for years.

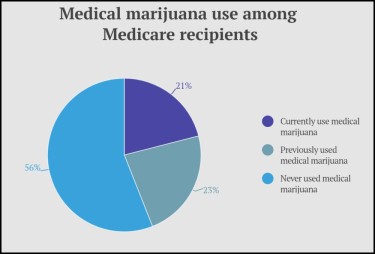

In April 2022, the Medicare Plans Patient Resource Center conducted a survey showing that 20% of Medicare beneficiaries presently use medical marijuana, and nearly a quarter has used it before. The study revealed that 66% of the respondents believe Medicare should cover the drug, underlining a growing interest in this substitute treatment among the elderly. Consequently, the uncertain status of medical marijuana’s federal legalization and FDA approval has left Medicare coverage in doubt, leaving patients without this treatment option.

What are the Reasons for Providing Medicare Coverage for Medical Marijuana to Senior Citizens?

According to a study published in the journal Cannabis and Cannabinoid Research in April 2022, a significant proportion of patients (60%) visiting a major cannabis dispensary in New York were aged 50 or above. These patients relied on medical marijuana to alleviate various conditions, including cancer, severe or chronic pain, neuropathy, and Parkinson’s disease.

Medical marijuana is also expensive, with edible products priced at around $5 per dose and plant buds ranging from $5 to $20 per gram, according to New York Cancer & Blood Specialists, a healthcare provider for patients with blood disorders and cancer. This translates to roughly $142 to $567 per ounce, making it an expensive treatment option. Unfortunately, even in states where medical marijuana is legal, patients may struggle to afford the prescription.

According to the executive director of Americans for Safe Access, Debbie Churgai, “medical cannabis isn’t cheap .” Americans for Safe Access is a nonprofit organization promoting safe and lawful access to therapeutic cannabis and research. While some states may cover the cost of doctor visits or medical marijuana cards, insurance coverage for the products remains elusive.

What are the Federal-Level Obstacles Impeding Medical Marijuana Coverage?

The road to Medicare coverage for medical marijuana faces two significant hurdles. The first is the federal government’s classification of marijuana as a Schedule I drug. The Drug Enforcement Administration defines Schedule I drugs as having “no current medical use and a high potential for abuse” in the United States. This presents a significant barrier to the drug’s legalization and acceptance as a medical treatment.

According to Paul Armentano, the deputy director of the National Association for the Reform of Marijuana Laws (NORML), the federal government will not reimburse medical marijuana through a federal program since they classify it as an illegal substance.

The second obstacle stems from Medicare’s requirement that the Food and Drug Administration deems a covered drug safe and effective. While the FDA has approved one cannabis-derived drug and three synthetic cannabis-related drugs for prescription use, the agency has yet to approve cannabis for medical treatment.

What is the Situation in States Where Medical Marijuana is Legal?

While medical marijuana remains illegal at the federal level, 37 states and Washington, D.C., have legalized its use for medical purposes. This raises the question of whether private insurers, such as those that offer Medicare Advantage plans, might choose to cover medical marijuana.

According to Kyle Jaeger, a senior editor and cannabis policy reporter at Marijuana Moment, it is unlikely that significant health insurers will cover medical marijuana. Like banks’ reluctance to offer services to cannabis businesses, health insurers will probably refrain from covering cannabis as long as it remains a Schedule I drug under federal law.

In addition, private insurers typically follow the FDA’s guidance when determining which drugs to cover. However, the FDA has recently declared that current regulatory pathways are inadequate for classifying CBD as a dietary supplement. Kyle Jaeger explains this situation can frustrate consumers seeking safe and reliable products.

What is the Threshold for Medical Marijuana Coverage?

According to Dr. Benjamin Caplan, founder, and chief medical officer of CED Clinic, which provides cannabis treatment services, insurers require more data on the medical use of marijuana. He notes that insurers need sufficient evidence to demonstrate that cannabis care produces results comparable to or better than those offered by existing options they cover.

Caplan explains that the free-market dispensary system, where patients can buy any cannabis product, partly complicates the issue. He suggests that the system needs to be adjusted since insurance companies cannot be responsible for covering any product that patients want to buy.

According to Jaeger, the obstacles in the way of cannabis coverage are numerous and complex, including legal and regulatory issues and changes to the dispensary system. As a result, the path to coverage for Medicare is likely to be a long and complicated one, with many years potentially passing before significant progress is made.

The path to cannabis legalization is long and involves major regulatory and policy reform. To overcome the obstacles and establish a system that assures those who need medical marijuana the most have safe, legal, and cheap access, lawmakers, regulators, healthcare professionals, and patients must work together.

Conclusion

The topic of medical marijuana and Medicare coverage is complex, multi-faceted, and riddled with legal and regulatory obstacles. Despite the growing acceptance and legalization of medical marijuana in several states, the federal government’s classification of marijuana as a Schedule I drug has made it difficult for Medicare to cover the cost of medical marijuana.

Moreover, private insurers are unlikely to cover medical marijuana as long as it remains a Schedule I drug under federal law. The lack of FDA approval for the marketing of cannabis for medical treatment further complicates matters.

Despite these challenges, the healthcare industry is progressing toward making medical marijuana accessible and affordable for patients who need it. As the stigma around cannabis continues to fade and research on its medicinal properties continues to emerge, there is hope that one day, medical marijuana will be covered by Medicare and private insurers.

CANNABIS AND MEDICARE OR MEDICAID, READ ON…

You may like

Cannabis News

Should Medical Marijuana Be Allowed in Worker’s Comp Claims?

Published

1 week agoon

March 6, 2025By

admin

A recent proposal in California has sparked debate among lawmakers, medical professionals, and cannabis advocates. The proposed legislation seeks to prevent insurance companies from covering medical marijuana expenses in workers’ compensation cases. This move has raised concerns about the impact on injured workers who rely on medical marijuana to manage their chronic pain and other work-related health issues.

Background on Medical Marijuana in California

California has been at the forefront of medical marijuana legalization, with voters approving Proposition 215 in 1996. The law allows patients to use medical marijuana with a doctor’s recommendation. Since then, the state has expanded its medical marijuana program, and recreational cannabis use was legalized in 2016.

The Proposal: Assembly bill 566

Assembly Bill 566, introduced by Assemblyman Henry Perea (D-Fresno), aims to amend the California Labor Code to exclude medical marijuana from coverage under workers’ compensation insurance. The bill argues that medical marijuana is not a “medically necessary” treatment, as it is still classified as a Schedule I controlled substance under federal law.

Implications for Injured Workers

Proponents of the bill argue that it would help reduce costs for employers and insurance companies. However, opponents claim that it would unfairly deny injured workers access to a treatment option that has proven effective in managing chronic pain and other work-related health issues.

Medical marijuana has been shown to be a safer alternative to opioids, which are often prescribed to injured workers. By excluding medical marijuana coverage, critics argue that the proposal would push workers towards more addictive and potentially deadly opioid-based treatments.

Cannabis Advocates and Medical Professionals Weigh In

Cannabis advocates and medical professionals have expressed concerns about the proposal, citing the need for further research and the importance of patient access to alternative treatments.

“The proposal is misguided and ignores the growing body of evidence supporting the therapeutic benefits of medical marijuana,” said Dr. David Bearman, a physician and cannabis expert. “Injured workers deserve access to all available treatment options, including medical marijuana.”

Here are the concerns from the medical community and potential consequences of the proposal to exclude medical marijuana from workers’ compensation coverage:

Concerns from the Medical Community

-

Denial of Access to Alternative Treatment: Medical professionals and cannabis advocates argue that the proposal would deny injured workers access to a safer, alternative treatment for chronic pain. Medical marijuana has been shown to be an effective treatment option for managing chronic pain, inflammation, and other work-related health issues.

-

Increased Risk of Opioid Addiction: By excluding medical marijuana coverage, workers may be pushed towards more addictive and potentially deadly opioid-based treatments. This could lead to a rise in opioid addiction and overdose cases among injured workers.

-

Reduced Quality of Life: Injured workers who rely on medical marijuana to manage their chronic pain and other health issues may experience a reduced quality of life if they are denied access to this treatment option. This could lead to decreased productivity, increased absenteeism, and a range of other negative outcomes.

-

Negative Impact on Mental Health: Medical marijuana has been shown to have a positive impact on mental health, reducing symptoms of anxiety, depression, and post-traumatic stress disorder (PTSD). By denying access to medical marijuana, injured workers may experience a decline in their mental health and well-being.

-

Lack of Alternative Treatment Options: Medical professionals may be forced to prescribe alternative treatments that are less effective or have more severe side effects. This could lead to a range of negative outcomes, including decreased patient satisfaction, increased healthcare costs, and a range of other negative consequences.

Potential Consequences

-

Increased Healthcare Costs: By denying access to medical marijuana, injured workers may be forced to seek more expensive treatment options, leading to increased healthcare costs for employers, insurance companies, and taxpayers.

-

Reduced Productivity: Injured workers who are denied access to medical marijuana may experience a decline in their productivity, leading to decreased economic output and increased costs for employers.

-

Negative Impact on Worker Retention: Employers who deny access to medical marijuana may experience a negative impact on worker retention, as injured workers seek employment with companies that offer more comprehensive benefits.

-

Increased Litigation: The proposal may lead to increased litigation, as injured workers seek to challenge the denial of medical marijuana coverage. This could lead to increased costs for employers, insurance companies, and taxpayers.

Conclusion

The proposal to exclude medical marijuana from workers’ compensation coverage in California raises important concerns about the impact on injured workers, employers, and the healthcare system as a whole. While the proposal’s proponents argue that it would reduce costs and align with federal law, the medical community and cannabis advocates warn that it would deny injured workers access to a safer, alternative treatment for chronic pain and other work-related health issues. Ultimately, the decision should be based on scientific evidence and a commitment to providing injured workers with the most effective and compassionate care possible, prioritizing their needs and recognizing the therapeutic value of medical marijuana.

WORKER’S AND WEED, READ ON…

Cannabis News

The Rise and Fall of the Cannabis Industry

Published

1 week agoon

March 3, 2025By

admin

The Rise and Fall of the Cannabis Industry

The cannabis industry has undergone a radical transformation over the past forty years. What began as an obscure and illegal activity hidden in the shadows has blossomed into a multi-billion dollar industry that spans across multiple states and even countries. However, this evolution hasn’t come without significant growing pains. Is Trump 2.0 part of a new avenue for cannabis?

Throughout this journey, we’ve witnessed both tremendous benefits and troubling issues emerge from a complex web of factors: overregulation that strangles small businesses, persistent black market competition that undercuts legal operators, and federal government interference that creates a patchwork of contradictory policies.

Today, we’re going to explore a region that could be considered the birthplace of American cannabis culture – Humboldt County and the broader Emerald Triangle of Northern California. This legendary growing region helped put cannabis on the map long before dispensaries dotted urban landscapes and corporate cannabis became a reality.

Let’s dive into how this iconic marijuana mecca rose to prominence, flourished during the golden years, and now faces an uncertain future as the industry continues to evolve beneath the weight of legalization’s complicated aftermath.

Let’s go!

Though I’ve never personally visited Humboldt County, its reputation in cannabis culture is legendary. Those winding roads through towering redwoods and misty mountains have become almost mythical in the stories told by those who’ve made the pilgrimage to America’s most famous growing region.

The cannabis industry in Humboldt didn’t spring up overnight. It has roots stretching back to the counterculture movement of the 1960s, when idealistic young people fled urban centers in search of simpler, more authentic lives. These back-to-the-landers discovered that the region’s remote location and ideal growing conditions made it perfect for cultivating cannabis—a crop that could actually sustain their pursuit of alternative lifestyles.

What began as a means of self-sufficiency for hippie communes soon evolved into something much more substantial. According to Paul Modic’s historical account of Humboldt’s cannabis industry, the price per pound jumped from $1,000 in 1975 to a staggering $5,000 by the early ’90s. With these kinds of returns, cannabis cultivation in the Emerald Triangle transformed from a countercultural statement into a serious economic engine.

Modic refers to this economic boon as “the Green Nipple,” a colorful term suggesting how the industry nourished an entire regional economy. Growers were able to build homes, raise families, support local businesses, and create a unique culture that blended environmental consciousness with a fiercely independent spirit. During these boom years, cannabis money flowed freely through communities like Garberville, Redway, and Willits, supporting everything from hardware stores to schools.

But as with any gold rush, the good times couldn’t last forever. The passage of Proposition 215 in 1996, which legalized medical marijuana in California, marked the beginning of significant change. While seemingly a victory for cannabis advocates, it inadvertently opened the floodgates for increased production. As more people jumped into cultivation, supply increased and prices began their long, steady decline.

By the early 2010s, according to Modic, the “Green Nipple” had transformed into what he aptly calls the “Green Monkey”—were you riding it, or was it riding you? Growers had to dramatically scale up operations just to maintain their previous income levels. Where once a modest garden could support a family, now multiple light-deprivation greenhouses and larger grows became necessary.

The stress of managing larger operations brought new challenges: more workers to supervise, increased risk of crop failure from pests or mold, and the perennial challenge of finding buyers for ever-larger harvests. As Modic points out, these stresses replaced the previous concerns about “cops and helicopters,” which had “mostly disappeared from the list of stresses by then.”

Little did these growers know that the real challenges were still to come, as full legalization loomed on the horizon and would forever change the landscape they had helped create.

On November 8, 2016, California voters passed Proposition 64, legalizing recreational cannabis use throughout the state. For decades, legalization had been the rallying cry for cannabis activists, the holy grail that would end prohibition and usher in a new era of freedom and prosperity. But for many small farmers in Humboldt County, legalization would prove to be a poisoned chalice.

The promise of legalization was seductive: no more helicopter raids, no more fear of prison, and legitimate business status. What wasn’t as apparent was the bureaucratic nightmare awaiting those who chose to enter the legal market.

Modic’s account provides several telling examples of farmers who attempted to navigate the new legal landscape, only to find themselves drowning in expenses and red tape. He writes about “one grower from Salmon Creek” who went to the bank and reported, “Estelle told me it would cost $20,000 to go legal, now I’ve got $100,000 into it and it’s a big hassle, but I’m in too deep to stop and have to keep trying to finish the paperwork.”

Another farmer from Ettersburg, according to Modic, was “complaining that it had already cost him a few hundred thousand dollars to ‘come into compliance,’ he was still far from getting his license, and if he could do it all over, he wouldn’t.” Modic later observed that this once “handsome and youthful-looking” farmer was later spotted “looking old and haggard, and still struggling with his large weed farm.”

The regulatory requirements for legal operation proved to be prohibitively complex and expensive. Environmental impact reports, water rights documentation, building permits for structures that had existed for decades, application fees, consultancy costs—the list went on and on.

The California Department of Fish and Wildlife became a particular obstacle for many farmers. Modic tells the story of “a former clone dealer from Sprowel Creek” who had a property with a spring that “started and stopped on his forty acres, one of the state requirements for licensing.” Despite this seemingly perfect setup, when Fish and Wildlife examined his land, they “discovered damage from logging decades before he bought it back in the seventies, and the expensive remediation costs would be more than the land was worth.” The farmer had no choice but to dump the property “at a loss.”

Meanwhile, as small farmers struggled to navigate the regulatory labyrinth, large corporations with significant financial backing moved in. These operations could afford compliance costs and were positioned to produce cannabis at scale, driving prices even lower. The pound price, which had already fallen to around $1,000 post-medical legalization, plummeted to $500 and then to a devastating $250 after recreational legalization, according to Modic’s account.

For context, when prices were $5,000 per pound, a farmer could make a good living with just 20 pounds per year. At $250 per pound, that same farmer would need to produce 400 pounds just to maintain their income—a scale impossible for many small operations and certainly not feasible within the constraints of legal permits for small grows.

The cruel irony wasn’t lost on the community: the very plant that had enabled generations to live independently in this rural paradise was now, under legalization, becoming the instrument of their economic demise. For many, the choice became stark: attempt to operate legally and face financial ruin, continue growing illicitly with increased risk, or abandon cannabis cultivation altogether.

As Modic notes, “businesses in town have closed, the hills have emptied out, and would-be farmers who got in late and have large land payments are abandoning their land.” The promise of legalization was revealing itself to be a complex and often devastating reality for the very communities that had built California’s cannabis industry.

When California voters approved recreational cannabis, many predicted the black market would quickly fade away. After all, why would consumers take risks with illegal purchases when they could simply walk into a licensed dispensary? Why would growers continue operating in the shadows when they could run legitimate businesses?

The reality has proven far more complicated, and the black market hasn’t just survived—in many ways, it’s thrived.

Industry analysts estimate that in 2022, California’s legal cannabis market generated approximately $5.3 billion in sales—impressive until you consider that the state’s illicit market was estimated to be worth $8 billion or more. Despite legalization, the majority of cannabis consumption in California still occurs outside the regulated system.

For Humboldt farmers, the persistence of the black market presents both an opportunity and a dilemma. As Modic observes in his historical account, “Many of those who are able to stay are looking for regular jobs with which to survive in this depressed economy, as the pound price plummets to $250.” However, he also notes that “there’s still farmers with good connections growing and selling like it’s 2008, and may have a few good years left.”

This suggests a divided industry where those with established out-of-state connections can still find buyers willing to pay premium prices, especially in prohibition states where cannabis remains scarce. However, this path comes with significant risks. Federal enforcement remains a threat, especially for interstate trafficking. Furthermore, as more states legalize and develop their own cannabis industries, these out-of-state markets become increasingly competitive.

The more troubling aspect of the thriving black market is what it reveals about the legal framework California has created. When licensed businesses struggle to compete with illicit operations, it suggests fundamental flaws in the regulatory system. The excessive taxation—which can reach 40% when combining state excise tax, local taxes, and other fees—creates an insurmountable price gap between legal and illegal cannabis.

Additionally, the limited number of licensed retail outlets throughout the state means many consumers don’t have convenient access to legal cannabis. With approximately 75% of California municipalities banning cannabis businesses, vast “cannabis deserts” exist where consumers have no choice but to turn to the black market.

For Humboldt’s legal growers, this dynamic is particularly frustrating. They’ve invested heavily in compliance, only to watch their illicit competitors undercut them without consequence. Many legal operations resort to what industry insiders sometimes call “diversion”—selling a portion of their crop into the illicit market to remain financially viable.

This reality points to a broader failure in California’s approach to legalization. Rather than creating a functioning legal market that could absorb and transform existing cannabis operations, the state has inadvertently strengthened the very black market it sought to eliminate.

For Humboldt County, this means the cannabis economy continues to operate in a precarious gray zone—neither fully legal nor completely illicit, with participants forced to navigate an increasingly complex and risky landscape.

Perhaps the most important question raised by the transformation of Humboldt’s cannabis industry concerns the fate of the pioneers who built it. As Modic asks in his historical account, “What’s going to happen to all those back-to-the-landers and old growers, now in their seventies and eighties, still living in their off-grid cabins in the middle of nowhere, without the steady income they had over the last forty years, and no retirement plan?”

It’s a profound question that highlights the human cost of this industrial transformation. For decades, these growers operated outside traditional economic systems. They didn’t have 401(k)s or pensions. Their retirement plan was their land and their annual cannabis crop. Now, with prices at historic lows and their physical ability to manage farms diminishing with age, many face an uncertain future.

Some have managed to sell their properties to younger growers or to transplants seeking rural lifestyles, but the collapse in cannabis prices has significantly devalued land throughout the region. Properties that might have sold for millions during the boom years now struggle to find buyers at a fraction of those prices.

Others have attempted to transition to different crops or businesses, with varying degrees of success. There are nascent efforts to develop Humboldt as a cannabis tourism destination, leveraging the region’s storied reputation. Some farms have opened for tours, created farm-stay experiences, or developed educational programs about cannabis cultivation.

Local support networks have emerged as well. Community organizations provide assistance to aging growers, helping them access social services they might have avoided during their years operating in the illegal market. There are food banks specifically serving rural communities and mutual aid networks where neighbors help neighbors.

County and state officials have largely failed to address this looming crisis. The same regulators who created nearly impossible compliance requirements for small farmers have offered little in terms of support for those displaced by the industry’s transformation. There are no pension programs for retired cannabis farmers, no transitional assistance for those whose livelihoods have evaporated.

The situation represents a broader ethical question about legalization: what responsibility do we have to those who built an industry while it was still illegal? These pioneers took significant risks, faced potential imprisonment, and developed the cannabis varieties and cultivation techniques that the legal industry now profits from. Yet they’ve been largely abandoned in the rush toward corporate cannabis.

For communities throughout Humboldt County, the human cost of this transition is impossible to ignore. Empty storefronts in once-thriving towns, properties reclaimed by banks, and elderly residents struggling to survive are the visible manifestations of an economic collapse that could have been mitigated with more thoughtful regulation.

The pioneers of Humboldt’s cannabis industry didn’t just grow a plant—they created a culture and an economy that sustained thousands of people for generations. As that era comes to a close, we must confront difficult questions about what we owe to those who came before and how we might create a more inclusive cannabis industry moving forward.

After reviewing historical accounts like Modic’s and analyzing reports from throughout the region, I’ve come to a sobering conclusion: what we’re witnessing isn’t simply market evolution but rather a deliberate transfer of wealth and opportunity from small independent producers to large corporate interests.

The cannabis industry that sustained generations of Humboldt residents wasn’t perfect. It operated outside the law, sometimes attracted unsavory elements, and certainly had environmental impacts. But it also represented something uniquely American—a decentralized economy where individuals with limited capital could build sustainable livelihoods through their own labor and ingenuity.

The promise of legalization was that it would bring these operations into the light, providing consumer protection while allowing the existing industry to thrive legally. Instead, the regulatory framework that emerged seems almost perfectly designed to eliminate small producers while creating opportunities for well-capitalized newcomers.

This doesn’t appear to be accidental. The excessive regulatory requirements, the high cost of compliance, the limited retail licenses, and the heavy tax burden combine to create insurmountable barriers for small operators. Meanwhile, large multi-state operators can absorb these costs while scaling up production to maintain profitability despite falling prices.

For consumers, this transformation means less diversity in cannabis products, as corporate cultivation favors high-yield strains over the unique varieties developed by Humboldt’s craft growers. For communities, it means the loss of an economic engine that supported everything from schools to social services through the circulation of cannabis dollars.

Most troublingly, the current regulatory regime has failed to achieve even its stated goals. The black market remains robust, suggesting that the legal framework hasn’t created a functioning alternative. Environmental issues persist, both from non-compliant grows and from the massive legal operations that have replaced smaller farms.

Looking forward, there are potential paths to improvement. Reduced tax burdens could help legal operators compete with the black market. Streamlined regulations could make compliance achievable for small farmers. Interstate commerce, if eventually permitted, could open new markets for California’s producers. Craft cannabis designations, similar to wine appellations, could help small farmers distinguish their products in the marketplace.

But for many of Humboldt’s original cannabis families, these changes would come too late. The community and culture they built over decades is already unraveling, a casualty of well-intentioned but fundamentally flawed legalization policies.

The rise and fall of Humboldt’s cannabis industry serves as a cautionary tale for other regions pursuing legalization. It demonstrates that how we legalize matters just as much as whether we legalize. If we truly value diversity, sustainability, and opportunity in the cannabis space, we must create regulatory frameworks that support these values rather than undermining them.

For those of us who care about cannabis culture and the communities built around it, the challenge now is to advocate for policies that preserve what was valuable about the legacy market while addressing its legitimate problems. The alternative—a cannabis industry dominated by the same corporate interests that control so many other sectors of our economy—would represent a profound loss, not just for cannabis consumers but for American culture as a whole.

INSPIRATION:

kymkemp.com/2025/02/21/sohum-history-the-rise-and-fall-of-the-marijuana-industry/

https://kymkemp.com/2025/02/21/sohum-history-the-rise-and-fall-of-the-marijuana-industry/

TRUMP ON CANNABIS THE SECOND TIME AROUND, READ ON…

WHAT DOES TRUMP’S NEW CANNABIS POLICY LOOK LIKE?

Cannabis News

America is Rethinking Marijuana Legalization

Published

2 weeks agoon

March 1, 2025By

admin

Rethinking Marijuana Legalization: A Response to the National Review

Cannabis legalization has swept across America in waves, creating a patchwork of policies that vary dramatically from state to state. Some jurisdictions embrace full recreational use, others permit medical applications only, while some maintain total prohibition. This inconsistent legal landscape makes it nearly impossible to accurately measure the success or failure of legalization efforts. Without uniform policies and implementations, any cost-benefit analysis becomes murky at best.

In this fragmented environment, opinions about cannabis legalization remain sharply divided. Some celebrate newfound freedoms and opportunities, while others lament perceived social costs and unintended consequences. The National Review recently published an opinion piece questioning whether we should reconsider marijuana legalization altogether, citing several issues they believe undermine the case for legal cannabis.

Today, I’m going to examine these claims with a critical eye. While I agree that we absolutely should “rethink” marijuana legalization, my conclusion differs dramatically from the National Review’s perspective. Rather than retreating from legalization, I believe we need to push forward with more comprehensive reforms that address the legitimate concerns while delivering on the promised benefits.

The current half-measures and regulatory inconsistencies have created a situation where neither prohibitionists nor advocates are satisfied with the outcomes. Only through thoughtful, evidence-based policy adjustments can we realize the full potential of legalization while minimizing downsides. So yes, let’s rethink marijuana legalization – but let’s make sure we’re using all the available data and considering the root causes of any implementation problems.

The National Review piece relies heavily on arguments from Manhattan Institute Senior Fellow Steven Malanga, who suggests legalization has failed to deliver on its promises. The article highlights several key complaints:

-

The pervasive smell of marijuana in public spaces

-

Failure to eliminate black markets

-

Disappointing tax revenue that sometimes requires taxpayer subsidies

-

Increased usage rates contrary to predictions

-

Health concerns, particularly regarding psychosis

-

Perceived connections between cannabis and “social breakdown”

Let’s tackle these points one by one:

The Smell: While cannabis odor can be noticeable, this concern fundamentally misunderstands the concept of liberty in a diverse society. If someone is consuming cannabis in their private residence or in designated areas, their personal choices shouldn’t be criminalized simply because others find the smell unpleasant. Just as we accommodate cigarette smokers in designated areas and don’t ban cooking pungent foods, cannabis consumption can be managed through reasonable time, place, and manner restrictions. The development of cannabis social clubs, similar to cigar lounges, would further localize any odor concerns.

Black Markets:

The persistence of illicit markets isn’t a failure of legalization itself but rather of its incomplete implementation. Black markets thrive precisely because cannabis remains federally illegal, creating banking restrictions, interstate commerce prohibitions, and excessive regulatory burdens that drive up costs for legal operators. States with more reasonable tax structures and fewer arbitrary licensing caps have seen significantly less illicit market activity.

Tax Revenue:

Despite claims to the contrary, legal cannabis has generated billions in tax revenue. Colorado alone has collected over $1.6 billion in marijuana taxes since 2014, funding education, public health, and infrastructure projects. Washington state has generated over $3 billion. While projections may have been overoptimistic in some jurisdictions, this hardly constitutes a failure – it simply indicates a need for more realistic forecasting and better-designed tax structures.

Health Risks:

Cannabis, like any substance, carries certain risks. However, comparative risk assessments consistently show it’s less harmful than legal substances like alcohol and tobacco. Dr. David Nutt’s famous study published in The Lancet ranked alcohol as far more harmful to users and society than cannabis. To focus on potential cannabis risks while ignoring the well-documented devastation of legal substances reveals a problematic double standard.

Usage Patterns:

Youth cannabis use has actually declined or remained stable in many states following legalization, contradicting prohibitionist predictions. Meanwhile, increased use among adults reflects exactly what legalization was designed to accomplish – providing adults with safe, legal access to a substance many find beneficial for relaxation, creativity, or medical symptoms. The decline in youth consumption likely stems partly from reduced novelty and rebellion appeal once cannabis becomes a regulated product rather than a forbidden fruit.

To fully realize the promises of cannabis legalization, we need a more comprehensive approach that addresses the legitimate concerns while removing the artificial constraints that have hampered success.

First and foremost, federal legalization is essential. The current federal prohibition creates unnecessary complications for banking, research, interstate commerce, and taxation. It forces businesses to operate on a cash basis, creating security risks and inefficiencies. It prevents the development of national brands and economies of scale that could drive down consumer costs. And it maintains the Schedule I classification that hampers medical research and perpetuates stigma.

Second, home cultivation rights must be protected. Allowing adults to grow limited amounts of cannabis for personal use provides a safety valve against monopolistic market structures and excessive pricing. It empowers consumers, reduces black market incentives, and recognizes that cannabis is, fundamentally, a plant that people have grown for thousands of years. States that have embraced home grow rights like Michigan and Colorado have seen thriving legal markets alongside personal cultivation.

Third, we need sensible regulatory structures that protect public health without imposing unnecessary burdens. This includes reasonable testing requirements, clear labeling standards, and age restrictions. However, excessive regulations that serve only to limit market participation or drive up costs without clear public health benefits should be eliminated. The current system in many states has created oligopolistic markets where licenses cost millions, shutting out small businesses and social equity applicants.

Fourth, tax policies need recalibration. Excessive taxation, especially when layered across cultivation, processing, and retail levels, drives up consumer prices and fuels black markets. A simple, moderate tax based on potency or sale price would generate revenue while allowing legal markets to compete with illicit operations.

Finally, we need honest education about both the benefits and risks of cannabis. Fear-mongering and exaggeration undermine credibility, while dismissing legitimate concerns is equally problematic. The vast majority of consumers—likely over 95%—will never experience serious adverse effects. However, those with predispositions to certain mental health conditions, particularly adolescents whose brains are still developing, face higher risks that should be clearly communicated.

When we take a clear-eyed look at cannabis legalization’s mixed results, the solution becomes evident: we don’t need less legalization—we need more complete, thoughtful implementation. The problems cited by critics largely stem not from legalization itself, but from the compromised, piecemeal approaches that have characterized policy reform thus far.

Federal legalization with home cultivation rights would strike a devastating blow to illegal markets by allowing interstate commerce, normalizing banking relationships, and recognizing the fundamental right of adults to grow a plant for personal use. The black market doesn’t thrive because legalization failed; it thrives because our current approach is incomplete and inconsistent.

Overtaxing and overregulating legitimate cannabis businesses while maintaining federal prohibition creates the worst of all worlds—high consumer prices, limited access, and continued incentives for illicit operators. We can’t expect the black market to disappear when we’ve designed systems that actively advantage it.

The National Review article gets one thing right—we should indeed rethink marijuana legalization. But instead of retreat, we need to advance toward more coherent, evidence-based policies that truly put “We the People” at the center. Give Americans the freedom to grow their own cannabis, purchase from a diverse marketplace of businesses both small and large, and make personal health decisions without government interference.

Do that, and watch the promises of legalization—reduced black markets, significant tax revenue, controlled access for adults, and diminished criminal influence—finally come to fruition. It’s time to complete the journey we’ve started, not turn back halfway.

TRUMP 2.0 ON LEGAL WEED? READ ON…

WHAT TRUMP’S CANNABIS POLICIES MEAN FOR AMERICA AND THE WORLD!

We tried Optimal Kleen, the all-natural, fast-acting detox drink

Drug traffickers running routes through war zones, top UN official warns

Cannabis vape companies worry Chinese tariffs will cause safety crisis

Poland And Cannabis – The Fresh Toast

Minnesota: Ishkode cannabis dispensary is now open at Vermilion

Ohio House Republicans’ cannabis measure a ‘slap in face,’ NORML says

Save 30% all month long at The Dispensary Fulton

Ohioans activate to defend weed legalization from lawmakers

It All Turned A Bit Bogan At Aussie Medical Cannabis Symposium

Building cannabis brands that reach across markets

Distressed Cannabis Business Takeaways – Canna Law Blog™

United States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

What you Need to Know

Drug Testing for Marijuana – The Joint Blog

NCIA Write About Their Equity Scholarship Program

It has been a wild news week – here’s how CBD and weed can help you relax

Cannabis, alcohol firm SNDL loses CA$372.4 million in 2022

A new April 20 cannabis contest includes a $40,000 purse

Your Go-To Source for Cannabis Logos and Designs

UArizona launches online cannabis compliance online course

Trending

-

Cannabis News2 years ago

Cannabis News2 years agoDistressed Cannabis Business Takeaways – Canna Law Blog™

-

One-Hit Wonders2 years ago

One-Hit Wonders2 years agoUnited States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

-

Cannabis 1012 years ago

Cannabis 1012 years agoWhat you Need to Know

-

drug testing1 year ago

drug testing1 year agoDrug Testing for Marijuana – The Joint Blog

-

Education2 years ago

Education2 years agoNCIA Write About Their Equity Scholarship Program

-

Cannabis2 years ago

Cannabis2 years agoIt has been a wild news week – here’s how CBD and weed can help you relax

-

Marijuana Business Daily2 years ago

Marijuana Business Daily2 years agoCannabis, alcohol firm SNDL loses CA$372.4 million in 2022

-

California2 years ago

California2 years agoA new April 20 cannabis contest includes a $40,000 purse