Cannabis News

Cannabis Scams 3.0 – Canna Law Blog™

Published

1 year agoon

By

admin

In an era of Theranos, Fyre Fest, FTX and WeWork, cannabis scams, frauds, and scandals probably pale in comparison. However, cannabis scams (and their evolution) are still worth noting, spotting, and avoiding at all costs. I’ve written about cannabis scams in the past (see here), and it’s one of my favorite topics given the still-emerging nature of the industry (plus, federal illegality attracts a lot of personalities and buyers should definitely beware). And since the cannabis economy is getting incredibly lean, scams are back on the rise. Even the Better Business Bureau has an alert out on dispensary scams. So, this is my update on cannabis scams 3.0.

Cannabis pump and dumps remain alive and well

In a pump and dump, fraudsters increase the demand and trading volume in a stock, and the new investors create a sharp rise in its price. Once the stock rises, the scammer group then sells its position at the peak to make a large short-term profit. So we’re talking about publicly traded companies here.

We have more publicly traded cannabis companies than ever thanks to continued state-by-state legalization and the 2018 Farm Bill. Back in 2016, I warned about pump and dumps with OTC-traded cannabis companies. Looks like not much has changed for some of these bad actors. Most recently, in March of this year, American Premium Water Corp. (a cannabis (technically CBD) water company) came under fire with the Department of Justice for allegations of a $10 million classic pump and dump. And don’t forget about Cannabiz Mobile where the company’s former, secret, owner just pled guilty to one count of securities fraud for a cannabis pump and dump and is now facing up to 20 years in prison and a $5 million fine.

Spotting a pump and dump in cannabis means looking for: a) drastic upticks in stock price on the back of b) highly concentrated stock promotion with c) no real commercial reason to justify the rise. This is the “pumping”, and in cannabis elevated social media interactions and unsolicited promotional emails from thinly traded cannabis companies may also be a tell. You may also see unregistered, unlicensed, anonymous “advisors” come out of nowhere to promote the stock.

Burner licenses and illegal operations

I recently wrote about the scourge of burner licenses plaguing California’s cannabis industry. And I have no doubt that California cannabis product is winding up in a multitude of states, not just New York. Burner licenses are symptomatic of another grand cannabis scam: straight up illegal operations. Investors and buyers need to be so, so careful when evaluating state-licensed cannabis companies. Due diligence is specialized and obviously key. And even if you do your homework, you should ensure that you have enough control rights to keep an eye on day-to-day management.

A couple of times now, I’ve had clients come to me saying that revenue doesn’t add up for the amount of product that apparently went out the door. Or track-and-trace records don’t make sense compared to inventory that’s left the building. If you’re seeing these issues in your cannabis business operations, someone may be illegally diverting product out the back door (and likely not paying the corresponding taxes). That’s a huge no no, which can land the entire operation in hot water with the state and Feds.

Cannabis crowdfunding

Some years back, the SEC released new crowdfunding rules designed to let the small fry swim with the sharks. Today, companies can solicit $2,500 from anyone (and more in many cases) in exchange for an equity stake in their business. Companies can raise up to $1,235,000 (adjusted up from $1 million due to inflation) annually through these offerings, which fall under Title III of the 2012 JOBS Act. As we have written before, the SEC does not care whether your business is a cannabis business, so long as you follow its offerings rules.

Though the SEC’s rules for crowdfunding advertising are incredibly strict, be mindful that the emerging nature of cannabis breeds some bad behavior that may fall through the cracks. Take, for recent example, TruCrowd Inc. That crowdfunding platform hosted two crowdsource offerings for cannabis and hemp companies, which sold up to $2 million of unregistered securities. The funds were then diverted for personal use by the scammers.

Cannabis and crypto

For some reason, certain cannabis companies and investors believe that crypto is the way for cannabis companies to solve their inability to access financial institutions (guess they’ve never read the 2014 FinCEN Guidelines?). In any event, no, crypto cannot and will not answer the issue of federal illegality when it comes to banking. In fact, some states have even banned its use altogether when it comes to cannabis commerce because it can defeat the purpose of traceability and uncovering illegal conduct altogether. (See here for a recent account in Washington State regarding illegal sales of cannabis and the use of crypto to assist.)

If you’re seeing investment offers from cannabis companies claiming they can solve their banking woes with crypto, definitely think twice. One of the bigger scandals I’m watching is what’s happening with JuicyFields, which appears to be a ponzi, crypto, and crowdfunding cannabis scheme all wrapped into one. You can’t make this stuff up.

Bank fraud

Somewhere up there with crypto cannabis frauds is bank fraud. Cannabis businesses are so desperate for financial relief and ease of business, that they’ll try their hands at a lot of nonsense, including bank fraud, and including defrauding credit card companies. The credit card-related fraud is nothing new where cannabis companies (and even ancillary cannabis companies) will lie to the credit card companies about their line of business, or they’ll even use third party management or consulting companies to access some credit.

Back in 2021, the former CEO of Eaze pled guilty to “one count of conspiracy to commit bank fraud in connection with an alleged scheme to deceive banks into processing more than $100 million worth of credit and debit payments for marijuana purchases.” And don’t forget your run-of-the-mill bust-out schemes either. The credit card companies always eventually figure out this low level scheming, which is why, one day, you may be able to pay your dispensary with a credit card and the next day it’s back to cash.

The other interesting kind of fraud–at least related to financial institutions–is that, as a cannabis business, you may be solicited for banking-like services in order to make your operational life easier. I wrote about this back in 2018, and not much has changed since then. We have no federal changes around cannabis banking after all. Accordinly, cannabis businesses need to be mindful of these roundabout “banking solutions”, and make sure that they’re not getting the slip on what’s actually a fraudulent enterprise designed to steal their money.

You may like

Cannabis News

BREAKING NEWS: DEA Issues Notice of Proposed Rulemaking to Move Marijuana to Schedule III

Published

9 hours agoon

May 16, 2024By

admin

Today is another historic day in the history of cannabis control and regulation. In a much anticipated announcement, the Drug Enforcement Administration (DEA) issued a notice of proposed rulemaking to reschedule marijuana, from Controlled Substances Act (CSA) schedule I to schedule III (the “Proposed Rule”).

We have covered the implications of a Schedule III placement in various posts on this blog, beginning with the Health and Human Services (HHS) recommendation that DEA undertake this rescheduling last August. See:

For now, here are a couple of high-level observations on today’s Proposed Rule.

First, DEA is not proposing an interim final rule. We expected as much, but it would have been nice! Under an interim final rule, an agency finds that it has good cause to issue a final rule without first publishing a proposed rule (as DEA did here). An interim final rule would have gone effect immediately upon publication, and marijuana would have been moved to schedule III today. Instead we’ll have to wait.

Second, the Proposed Rule gives a standard 60-day comment period, from the date the Proposed Rule is published in the Federal Register. That’s a pretty standard window; although, as I’ve explained before, this can always be extended.

Third, the Proposed Rule is clear that “any drugs containing a substance within the CSA’s definition of ‘marijuana’ would also remain subject to the applicable prohibitions in the Federal Food, Drug, and Cosmetic Act (“FDCA”).” No, this does not mean FDA enforcement is going to begin; and no, this does not mean Big Pharma is coming to squash state licensed operators. Stop saying that.

Fourth, the Proposed Rule gives very specific protocols for submitting electronic and other types of comments. These protocols are not hard to follow! But if you fail to do so, your comment will not make it into the record, and it will not be considered by DEA.

Fifth, I really like this paragraph:

HHS recommended in August 2023 that marijuana be rescheduled to schedule III. See Letter for Anne Milgram, Administrator, DEA, from Rachel L. Levine, M.D., Assistant Secretary for Health, HHS (Aug. 29, 2023) (“August 2023 Letter”). The Attorney General then sought the legal advice of the Office of Legal Counsel (“OLC”) at DOJ on questions relevant to this rulemaking proceeding. Among other conclusions, OLC concluded that “HHS’s scientific and medical determinations must be binding until issuance of a notice of proposed rulemaking [(‘NPRM’)].” Questions Related to the Potential Rescheduling of Marijuana, 45 Op. O.L.C. __, at *25 (Apr. 11, 2024) (“OLC Op.”).1 After the issuance of a notice of rulemaking proceedings, HHS’s scientific and medical determinations are accorded “significant deference” through the rest of the rulemaking process.2 OLC Op. at *26.

I’ve always argued that HHS’s scientific and medical determinations are binding under the plain language of the CSA itself. But it’s awfully nice to hear confirmation that OLC agreed– especially because there was some consternation among the cognoscenti about what OLC was doing here. It seems that OLC has essentially confirmed to DEA: “you are stuck with Schedule III.”

Sixth, it’s interesting to see the Proposed Rule delve into problematic international law constraints. The Proposed Rule gives a rather cursory analysis here, but OLC seems to have justified marijuana’s placement on Schedule III in the context of public international law obligations, including the 1961 U.N. Singled Convention on Narcotic Drugs (to which the United States is a party). DEA states, however, at Proposed Rule page 86 that:

“[c]oncurrent with this rulemaking, DEA will consider the marijuana-specific controls that would be necessary to meet U.S. obligations under the Single Convention and the Convention on Psychotropic Substances in the event that marijuana is rescheduled to schedule III, and, to the extent they are needed if marijuana is rescheduled, will seek to finalize any such regulations as soon as possible.”

This could get pretty interesting! Expect a lot of fretting here by industry and the general public.

Seventh, it was also interesting to see DEA and HHS justify why it arrived at a Schedule III conclusion, after concluding in 2016 that marijuana should stay in schedule I. I have wondered aloud about the intellectual gymnastics that might be required for this. Take a read at the rationale on the Proposed Rule at pages 11 – 13 and see if you’re convinced.

_____

OK, that’s it for now. The Proposed Rule is 92 pages and I had less than 30 minutes to read it and write this today. We will follow up as soon as next week with further thoughts on this very significant development.

Cannabis News

The Illegal Cannabis Market in America is Still 3x Bigger Than the Legal Marijuana Market

Published

15 hours agoon

May 16, 2024By

admin

In 2022, illicit cannabis sales soared to over $74 billion, surpassing the legal market’s $28 billion by a remarkable 164%, according to the latest report from New Frontier Data on American cannabis consumers. This significant disparity highlights potential opportunities for legal businesses to attract frequent users who currently depend on unregulated sources, as well as the millions of adults interested in cannabis but hesitant to try it.

Canada has a similar problem, as only 20% of the legally grown cannabis get sold to customers on the legal market.

To delve into the issues contributing to the industry’s multi-billion-dollar challenge, New Frontier Data surveyed over 5,500 U.S. adults from various market segments. Conducted in the first quarter of 2023, this demographically representative survey includes consumers who obtain cannabis through a wide range of sources.

Snapshot of U.S. Cannabis Consumers

-

42% of U.S. consumers obtain cannabis from state-regulated markets.

-

34% live in adult-use markets.

-

8% are registered patients in medical-only markets.

-

24% have access to state-legal cannabis but do not primarily use licensed retailers.

-

17% live in adult-use markets but obtain cannabis from friends, family, or illicit dealers.

-

7% live in medical-only markets but do not participate in their state’s medical program.

-

34% do not have adequate access to legal cannabis in their state and would require policy reform to use licensed markets.

-

23% live in states where cannabis is illegal.

-

11% are non-medical consumers in medical-only states.

Converting Illicit Consumers to Retail Customers

While most dispensaries compete with each other to serve the same group of committed legal market customers, significant opportunities exist outside this current customer pool. New Frontier Data’s research identifies four key barriers that must be overcome to attract frequent gray-market consumers into licensed dispensary shoppers.

Accessibility

Accessibility is a major barrier for frequent gray-market consumers, who disproportionately live in urban areas and may lack convenient transportation to licensed dispensaries. Similarly, those sourcing from friends and family often do not live near a dispensary. Overcoming this barrier requires businesses to work with local regulators to change zoning ordinances and expand delivery coverage areas. For example, in locations with a high population of senior citizens, like Leisure World in Seal Beach, California, local dispensaries offer shuttle services to bring customers to the store, addressing transportation challenges and fostering loyalty.

By addressing these barriers—price, product variety, product quality, and accessibility—licensed retailers can effectively convert gray-market consumers into loyal customers, expanding their reach beyond the current legal market clientele.

Product Quality

Quality is another crucial factor. Much of the illicit cannabis sold in the U.S. is high-quality flower grown in California. To compete with the gray market, retailers in every legal market must offer in-demand strains with quality that meets or exceeds what is available from California farms. This is especially important for consumers with higher tolerances and experienced palates. Ensuring quality and freshness can help attract frequent users who often source from friends and family.

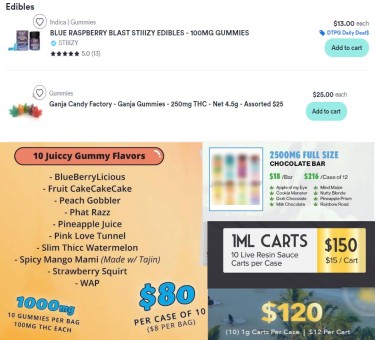

Product Variety

A key differentiator for legal dispensaries is their range of manufactured, non-flower products. Even in adult-use states, fewer than half of surveyed consumers reported access to anything beyond flower, pre-rolls, and edibles. Notably, 25% of frequent consumers in adult-use markets who primarily buy from friends, family, or dealers occasionally visit dispensaries for non-flower products like vape cartridges, concentrates, and topicals. Licensed retailers can better retain these customers by offering promotions that bundle affordable flower with non-flower products.

Price

Price is a significant factor for gray-market consumers, who tend to consume the most cannabis. According to the data, 56% of these consumers use cannabis multiple times per day, with about 32% consuming more than an ounce per month. These frequent consumers often have lower household incomes than those sourcing from friends and family, who in turn have lower incomes than licensed dispensary shoppers. High inflation disproportionately affects low-income households, making affordability crucial. To appeal to this segment in 2024, retailers should offer a variety of products at different price points, with attractive promotions like bulk discounts and one-gram deals. However, heavy taxation in many markets can make price competition challenging.

Capturing the Canna-Curious Market

While current gray-market customers may be entrenched in their habits or face difficult-to-overcome barriers, there are millions of potential new adult customers open to trying cannabis for the first time, or the first time in decades.

According to the report, “Roughly two in five (39 percent) potential consumers in adult-use states described themselves as likely to try cannabis in the next six months. The good news is that for any of these potential consumers who choose to begin consuming cannabis, retail is a likely and attractive source of cannabis relative to the illicit market.”

New Frontier Data’s insights into product preferences are crucial for attracting these new customers. A significant 76% of potential customers expressed interest in edibles, 50% are interested in topicals, 42% in beverages, and 28% in tinctures. Only 18% showed interest in smoking flower. Although flower remains a dominant product in retail sales nationwide, dispensaries that effectively market non-flower products have the best chance of attracting a new wave of older, suburban, canna-curious individuals with disposable income.

By focusing on the preferences and interests of these potential new consumers, dispensaries can expand their customer base and tap into a growing market of curious holdouts eager to explore legal cannabis options.

Bottom Line

The dominance of illicit cannabis sales over the legal market in the U.S. underscores significant challenges for the cannabis industry but also presents opportunities. To convert gray-market consumers to legal dispensary shoppers, businesses must address barriers such as accessibility, product quality, variety, and price. Enhancing transportation options to dispensaries, ensuring high-quality products that rival those from California, expanding non-flower product offerings, and creating competitive pricing strategies are essential. Additionally, there is a substantial untapped market among canna-curious adults who are open to trying cannabis legally. Legal retailers can attract these potential customers by focusing on their preferences for edibles, topicals, and other non-smoking products. By implementing these strategies, the legal cannabis market can expand its customer base, convert illicit users, and strengthen the industry’s overall growth and sustainability.

HOW MUCH CHEAPER IS WEED ON THE ILLICIT MARKET, READ ON…

Cannabis News

Can Taking CBD While Pregnant Cause Glucose Intolerance in Male Offspring But Not Female Children?

Published

16 hours agoon

May 16, 2024By

admin

A recent preclinical investigation reported in the Journal of Endocrinology has unveiled that prenatal exposure to cannabidiol (CBD) induces glucose intolerance in 3-month-old Wistar rats. Additionally, a Canadian research group observed changes in hepatic development and metabolic processes.

The authors stated, “CBD can traverse the placenta and enter fetal circulation, potentially affecting the development of crucial metabolic organs.” They hypothesized that maternal exposure to CBD during rat pregnancy would result in deficiencies in both pancreatic β-cell mass and glucose regulation in the offspring.

The pregnant Wistar rats were given intraperitoneal injections of 3 mg/kg CBD or a vehicle by the research team during the trial, which lasted from gestational day 6 until delivery. Male offspring exposed to CBD showed glucose intolerance but maintained normal pancreatic β/α-cell mass; nevertheless, there were no significant changes in maternal food consumption, weight gain, or neonatal outcomes.

A transcriptomic analysis was conducted on the livers of male rats exposed to CBD, revealing altered gene expression related to circadian clock machinery. Additionally, reductions in the expression of genes involved in hepatic development and metabolic processes were observed.

Remarkably, at three months of age, only male offspring exposed to CBD showed signs of glucose intolerance. The authors speculate that estrogen-mediated mechanisms may have prevented female rats from acquiring glucose intolerance, given estrogen’s established protective effect against metabolic dysfunction. To validate this theory, more research is necessary.

Previous research has linked alterations in the liver’s circadian rhythm to glucose intolerance. As a result, the scientists speculate that exposure to CBD during pregnancy and the resulting alterations in circadian gene expression may be connected to the abnormalities in glucose intolerance seen in male rats.

Although CBD has become more and more popular, especially in the last few years, the authors advise pregnant women to take it with caution since it may have negative consequences on the offspring’s metabolic health.

Gender-Specific Effects of Prenatal CBD Exposure

Intriguingly, the study’s findings underscore a notable discrepancy in the metabolic responses between male and female offspring following prenatal CBD exposure. While male rats exhibited glucose intolerance, their female counterparts appeared unaffected. This gender-specific variation prompts a deeper exploration into the underlying mechanisms driving such disparities.

Recent research suggests that estrogen, a hormone predominant in female physiology, may play a pivotal role in buffering against metabolic dysfunction. The authors speculate that estrogen-mediated processes might confer protection against glucose intolerance in female rats exposed to CBD during gestation. However, elucidating the precise molecular pathways involved warrants further investigation.

Understanding the differential susceptibility to CBD-induced metabolic alterations based on gender holds significant implications for both research and clinical practice. Unraveling the interplay between CBD exposure, hormonal dynamics, and metabolic outcomes could pave the way for tailored therapeutic strategies and inform guidelines regarding cannabinoid use during pregnancy.

Altered Gene Expression and Circadian Rhythm Disruption

The transcriptome investigation of liver tissue from male rats exposed to prenatal CBD reveals fascinating changes in gene expression patterns, notably those related to circadian clock mechanisms and hepatic development. These molecular alterations shed light on the mechanisms behind CBD-induced metabolic abnormalities.

Circadian rhythms serve an important part in the body’s metabolic activities, including glucose homeostasis. The observed disruption in circadian gene expression reveals a possible mechanism connecting prenatal CBD exposure to glucose intolerance. Disruptions in the liver’s circadian rhythm have already been linked to metabolic diseases, emphasizing the importance of these results.

Furthermore, worries regarding the long-term effects of prenatal CBD exposure on liver function and metabolic health are raised by the decreases in gene expression linked to hepatic development. Gaining knowledge of how CBD disrupts the molecular processes that control hepatic growth may help to lessen its negative effects.

This study discovers potential therapeutic targets for intervention in addition to clarifying the intricate molecular processes behind CBD’s impacts on metabolic health. It will be necessary to develop targeted therapeutics in the future that elucidate the causal relationships between altered gene expression, circadian rhythm disruption, and metabolic dysfunction to lessen the adverse effects of prenatal CBD exposure.

Implications for Maternal Health and Public Policy

The increasing evidence of the negative consequences of prenatal CBD exposure on metabolic health in children has important implications for maternal well-being and public policy addressing marijuana usage while pregnant.

Given the growing popularity of CBD products and their perceived advantages, particularly in the treatment of various health concerns such as anxiety and pain, pregnant women may be more likely to use them. However, the outcomes of this study highlight the significance of exercising caution and making educated decisions about CBD usage while pregnant.

In light of the observed gender-specific effects and potential long-term consequences on metabolic health, there is a pressing need for comprehensive public health policies addressing the use of cannabinoids, including CBD, by pregnant individuals. These policies should aim to educate healthcare providers and expectant mothers about the potential risks associated with prenatal CBD exposure and emphasize the importance of seeking professional medical advice before using such products during pregnancy.

This study also emphasizes the necessity for future research to fully evaluate the safety of cannabis usage during pregnancy and to clarify the mechanisms underlying CBD’s impacts on metabolic health. These kinds of research are going to be crucial in helping to shape evidence-based policies and guidelines that protect the health of expectant mothers and fetuses.

Ultimately, we can better protect the health of expectant mothers and their children while ensuring that access to potentially helpful therapies remains balanced with the need to mitigate potential risks by incorporating the results of preclinical research into public health initiatives and policy development.

Bottom Line

The preclinical research highlights the possible negative consequences of cannabidiol (CBD) exposure during pregnancy on the metabolic well-being of male progeny, including glucose intolerance, disturbances in hepatic development, and irregularities in circadian gene expression. The results of the study not only warn against the use of CBD during pregnancy but also emphasize the necessity of comprehensive public health policies that inform medical professionals and pregnant women about the dangers of cannabis exposure. To protect the health of mothers and fetuses, further study is necessary to understand gender-specific reactions, investigate hormonal dynamics, and develop evidence-based recommendations. Incorporating these discoveries into public health campaigns and policy formulation will facilitate well-informed decision-making, minimize possible hazards, and guarantee the availability of advantageous treatments.

CBD AND DIABETES, READ ON…

Cannabis Rescheduling Takes The Next Steps

BREAKING NEWS: DEA Issues Notice of Proposed Rulemaking to Move Marijuana to Schedule III

Slovakia And Cannabis

The Illegal Cannabis Market in America is Still 3x Bigger Than the Legal Marijuana Market

Can Taking CBD While Pregnant Cause Glucose Intolerance in Male Offspring But Not Female Children?

AI is making cannabis cultivation smarter

New York Stooges – New York’s Cannabis Industry is Such a ClusterFudge, Gov. Hochul is Blaming Google and Yelp

Irrational Fear of High THC Cannabis Dispelled by New German Medical Study

Does Francis Ford Coppola Consume Weed

Can lemon-smelling weed cause less anxiety than others?

Distressed Cannabis Business Takeaways – Canna Law Blog™

United States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

Drug Testing for Marijuana – The Joint Blog

What you Need to Know

Cannabis, alcohol firm SNDL loses CA$372.4 million in 2022

NCIA Write About Their Equity Scholarship Program

City Of Oakland Issues RFP For Employee Training Programs

It has been a wild news week – here’s how CBD and weed can help you relax

A new April 20 cannabis contest includes a $40,000 purse

UArizona launches online cannabis compliance online course

Trending

-

Cannabis News1 year ago

Cannabis News1 year agoDistressed Cannabis Business Takeaways – Canna Law Blog™

-

One-Hit Wonders1 year ago

One-Hit Wonders1 year agoUnited States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

-

drug testing5 months ago

drug testing5 months agoDrug Testing for Marijuana – The Joint Blog

-

Cannabis 1011 year ago

Cannabis 1011 year agoWhat you Need to Know

-

Marijuana Business Daily1 year ago

Marijuana Business Daily1 year agoCannabis, alcohol firm SNDL loses CA$372.4 million in 2022

-

Education1 year ago

Education1 year agoNCIA Write About Their Equity Scholarship Program

-

Education1 year ago

Education1 year agoCity Of Oakland Issues RFP For Employee Training Programs

-

Cannabis1 year ago

Cannabis1 year agoIt has been a wild news week – here’s how CBD and weed can help you relax