Cannabis News

How Much More Does It Cost to Grow Weed Indoors Compared to Outdoors?

Published

1 year agoon

By

admin

Growing cannabis offers the benefit of customization to fit your personal preferences and circumstances. If you relish spending time outdoors with the sun’s warmth on your skin and the grass under your feet, you can cultivate weed in your garden. Conversely, if you prefer technological gadgets, control, discretion, and the comfort of an indoor setting, growing cannabis inside may be more appealing to you.

However, your preferred location for growing may not always be a matter of choice. Some cultivators may be obligated to grow indoors due to stringent regulations, while others may have to grow outside due to budget constraints.

If you are a first-time cannabis grower and want to know the financial implication of each type of setting, this guide clues you in. This article gives a rough estimate of the cost and expenses relating to operational size for indoor and outdoor cultivation.

Indoor Cultivation vs. Outdoor Cultivation.

Indoor or outdoor marijuana cultivation costs vary significantly based on a number of factors. Given the need for sophisticated equipment and the more significant energy cost, indoor cultivation typically costs more than outdoor cultivation.

Indoor cultivation necessitates a designated location, such as a grow tent or a spare room, where temperature, light, humidity, and ventilation can be managed. To stimulate the best environment, cannabis farmers must invest in equipment like grow lights, fans, air conditioning units, dehumidifiers, and carbon filters. Depending on the size of the cultivation room and the quality of the equipment, the cost of these products can range from hundred to thousands of dollars.

Indoor cultivation involves an initial equipment investment and recurring expenses for energy and water. High electricity expenses result from the large energy requirements of grow lights and other equipment. To ensure their plants receive clean, nutrient-rich water, growers might also need to invest in a water filtration system.

On the other hand, outdoor cultivation may be less expensive since it depends on natural light and ventilation. Although growers may need to spend money on necessary supplies like soil, fertilizer, and pest control, these expenses are typically less than those related to growing indoors.

Outdoor cultivation, however, also presents a unique set of difficulties. Farmers need to pick a spot that gets enough sunlight and has the right kind of soil. Also, they must safeguard their plants from pests and bad weather, which may necessitate additional fence, netting, or tarps expenses.

In general, indoor marijuana cultivation is more expensive than outdoor cultivation. Indoor cultivation, conversely, can provide more control over the growing environment and produce bigger yields and better-quality buds. Each farmer must consider the advantages and disadvantages to determine the optimal growing technique for their needs and budget.

Financial Implications

Let’s take a look at a few specific instances to compare the financial costs of growing weed indoors and outdoors:

Instance 1: Small indoor grow tent vs. outdoor grow in a sunny location

-

A small indoor grow tent (2’x2’x4′) costs around $150, plus an LED grow light for $100, a ventilation fan for $50, and a carbon filter for $50, totaling $350.

-

The monthly electricity cost for running the grow tent would be around $30.

-

The total cost for a 4-month cultivation cycle would be around $520.

-

For outdoor growing, a small garden plot in a sunny location could be used for free, with just the cost of soil, nutrients, and pest control.

-

Assuming similar yields, the cost for an outdoor grow would be significantly less than the indoor grow, likely under $100.

Instance 2: Medium-sized indoor grow room vs. outdoor grow with additional security measures

-

A medium-sized indoor grow room (8’x8’x8′) requires more equipment, including high-end LED grow lights for $1,500, an air conditioning unit for $500, ventilation fans for $300, and a carbon filter for $200, totaling $2,500.

-

The monthly electricity cost for running the grow room would be around $500.

-

The total cost for a 6-month cultivation cycle would be around $5,000.

-

For outdoor growing, if additional security measures are needed, such as a fence, security cameras, or a greenhouse, costs could range from a few hundred to a few thousand dollars, depending on the level of security required.

-

Assuming similar yields, the cost for an outdoor grow would still be significantly less than the indoor grow, likely under $2,000.

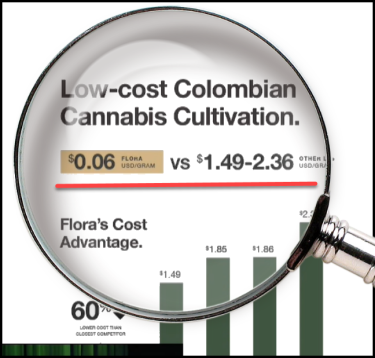

Instance 3: Large-scale commercial indoor operation vs. outdoor cultivation on a large farm

-

A large-scale commercial indoor operation with hundreds or thousands of plants requires even more equipment, including high-end LED grow lights, HVAC systems, dehumidifiers, and sophisticated monitoring systems, costing thousands or even millions of dollars.

-

The monthly electricity cost for a commercial operation could easily exceed $10,000.

-

The total cost for an entire cultivation cycle could easily exceed $1 million.

-

Initial expenditures for the preparation of the land, irrigation infrastructure, and fencing may be expensive for outdoor cultivation on a big farm, but recurring costs would be substantially cheaper. Also, outdoor farms can benefit from rainfall and natural sunlight, which minimizes the need for expensive machinery and energy use.

-

The cost of outdoor cultivation would likely be substantially lower than an indoor operation, with thousands of dollars in operational expenses, assuming equivalent yields. However, outdoor farms may need extra security measures to prevent crop damage or theft, which could raise the overall cost.

Conclusion

The cost of cultivating marijuana, indoors or outdoors, can vary significantly based on several variables, including equipment, power, water, and location. Due to the requirement for specialized equipment and the increased energy cost, indoor cultivation is typically more expensive. In contrast, outdoor gardening uses free sunlight and airflow, which reduces costs.

Indoor cultivation, conversely, can provide more control over the growing environment and produce bigger yields and better-quality buds. The decision to grow marijuana indoors or outdoors ultimately comes down to personal preferences, financial constraints, and production objectives. Whatever the method, it is imperative to cultivate marijuana with care, attention to detail, a dedication to responsible usage, and compliance with regional laws and regulations. By doing so, growers can create a safe and sustainable cultivation environment for themselves and others.

THE COSTS OF GROWING CANNABIS, READ ON…

You may like

-

Arizona Cannabis Sales Go Beyond $1.4 Billion

-

Nicotine Salts Versus Freebase Nicotine: A Comprehensive Comparison

-

German cannabis imports rise to 34.6 tons as cultivators eye end of quota system

-

How To Vape Correctly – The Fresh Toast

-

Will Rescheduling Come In Time To Help The Marijuana Industry

-

Which Cities Consume The Most Marijuana

Cannabis News

Arizona Cannabis Sales Go Beyond $1.4 Billion

Published

2 hours agoon

April 26, 2024By

admin

Arizona’s record-breaking cannabis market

In the landscape of booming and busting cannabis markets, Arizona emerges as a standout success story. A naturally beautiful state that attracts a sizeable group of tourists every year, Arizona skyrocketed past $1 billion in total cannabis sales for 2023. Unlike its northern neighbor of Nevada, Arizona has exceeded $1 billion in sales for three consecutive years, with 4.9% increase from ‘22 to ‘23 to boot. (Nevada, conversely, suffered from a nearly $115 million shortfall from FY 2022 to 2023 despite several millions more tourists than Arizona.)

Cannabis taxation and market comparisons

Compared to other states with recreationally legal cannabis, Arizona packs a considerably lower tax rate, levied as a 16% excise levy. Compare:

- Nevada levies a 25% tax rate, combining both wholesale and retail excise taxes

- Washington has an absurdly high 37% retail excise tax rate

- Montana taxes recreational cannabis sales at 20%

As of FY 2022, the per capita rate for excise taxes is also incredibly lower in Arizona than other recreationally legal states, at only $18. The only two states as of FY 2022 that had a lower per capita rate were both Maine and Michigan. Ironically, the two states with the highest per capita rate are also the first two states to legalize cannabis recreationally, Colorado and Washington, which have rates of $61 and $67 respectively.

Shift towards recreational cannabis sales

Recreational sales have become the life blood of the Arizona cannabis industry. Medical cannabis sales and the number of registered patients in the process are in decline. Whereas recreational sales accounted for only 45% of sales during the first year of retail sales in 2021, adult-use sales then increased to 70% in 2022. In 2023, recreational cannabis sales reached 72%, almost 30% larger than two years prior. Every month since July of 2022, the Arizona cannabis industry has exceeded $80 million in total retail sales.

Impact of regulatory environment on market performance

Like Nevada, Arizona cannabis retail stores benefit from rules that allow cannabis sales after midnight, and allow dispensaries to operate 24/7. Interestingly, unlike e.g. Montana or Minnesota, Arizona doesn’t benefit from any geographic advantage and is mostly surrounded by states with recreationally legal cannabis. This means that out-of-state visitors and business that Arizona receives from Utah certainly wouldn’t be as much as what Nevada draws in its two biggest cities. Yet, the Arizona cannabis industry is outperforming their northern neighbor, despite not possessing all the glitz and glamor of Las Vegas.

While cannabis professionals in the not so prosperous states of California and Oregon are watching some of the biggest juggernauts of business fully exit from their respective states, the billion-dollar Arizona market is seeing no such industry exodus. In particular, Curaleaf has become the best known example of a multi-state operator exiting a state completely, announcing their departure of “the majority of its operations” in California, Oregon and Colorado in 2023 and other East Coast states as well. Yet, that same MSO company has found thriving success in the Arizona market.

“Arizona has been a strong success story for us, and has become one of the top markets in the country for Curaleaf.” explained Curaleaf Vice President of Real Estate Luke Flood. “Uniquely, Arizona offers one of the lowest prices per gram at the retail level in the country.”

Allocation of Arizona cannabis tax revenue

Unlike other states which keep cannabis tax revenue allocations vague, Arizona specifically provides which causes and projects will benefit from the $172.8 million in 2023 excise tax revenue, and at what percentages.

- 33% will be allocated to community college and provisional community college districts.

- 25% will be sent to the Arizona Highway User Revenue Fund.

- 10% will go to the justice reinvestment fund, a program focused on providing health services and other social services, as well as job training for those unfairly impacted by previous cannabis prohibition.

- 10% will go to the justice reinvestment fund, a program which focuses on providing health services and other social services as well as job training for those unfairly impacted by previous cannabis prohibition.

- 10% will go to the justice reinvestment fund, a program which focuses on providing health services and other social services as well as job training for those unfairly impacted by previous cannabis prohibition.

- 3% will go to public safety, which means all branches of first responders.

Arizona’s cannabis industry outlook

Arizona’s cannabis industry stands as a beacon of success, breaking records and showcasing sustainable growth. The politically diverse state’s ability to surpass the $1 billion mark in sales for three consecutive years, despite having less tourists than adjacent Nevada, demonstrates the industry’s robustness. The state’s comparatively lower tax rates have also contributed to its success, making it an attractive market for both consumers and businesses. Finally, Arizona’s strategic location and regulatory environment have allowed it to thrive, even without the glitz and glamor of Las Vegas.

As the Arizona cannabis industry continues to evolve and expand, it will be fascinating to observe its future trajectory and impact on the broader cannabis landscape. Stay tuned.

Cannabis News

Hemp Bioplastics to End Forever Chemicals and PFAS Molecules?

Published

1 day agoon

April 25, 2024By

admin

Ohio Hemp Company, based in Dayton, has signed a substantial deal with Heartland Industries, headquartered in Detroit. According to this new deal, the Ohio Hemp business will supply hemp fibre to aid the development of bioplastic, which will then be used in the fabrication of automobile components by a Belgian business.

Following the federal legalization of hemp under the 2018 Farm Bill, Ohio Republican Governor Mike DeWine supports the state’s legalization of the substance in 2019. TJ Richardson and Justin Helt, proprietors of Ohio Hemp Company, were among the first farmers in Ohio to produce hemp. They began a planting effort in 2020 with 11,000 cannabinoid hemp plants in an attempt to capitalize on the then-growing CBD business.

Through this partnership, Ohio Hemp Company increases its customer base to include a processor in Michigan, marking a significant new milestone. The company’s position in the market is strengthened by this strategic collaboration, which allows it to source raw hemp material to create bioplastics.

Shifting Focus: Transitioning to Hemp for Grain and Fiber Production

Following the downturn in the CBD market, Richardson and Helt shifted their focus to cultivating hemp plants optimized for grain and fibre production rather than CBD and other cannabinoids. Recognizing the versatility of hemp, the company continued to explore various opportunities within the crop.

Helt shared insights with agricultural news outlet Farm and Dairy, citing his grandfather’s belief that hemp represents a significant development in agriculture akin to the emergence of soybeans in the 1950s. This perspective underscores the potential growth trajectory for hemp within the state.

From the inception of their venture, Richardson and Helt understood the manifold applications of hemp. Transitioning away from CBD-centric hemp cultivation, they sought out local businesses in Ohio utilizing hemp in their products. This quest led them to Heartland Industries, a Detroit-based hemp processing facility established in 2020. In 2022, a partnership was forged between Heartland Industries and Ravago, a Belgian bioplastics manufacturer, wherein hemp fibre supplied by the former would be utilized.

Tim Almond, chairman and co-founder of Heartland Industries, acknowledged the challenges faced by his company and collaborating farmers in navigating the cultivation and processing of hemp. With decades of prohibition, much of the knowledge and equipment associated with hemp had either been lost or redirected to other crops like corn, soybeans, and wheat. Consequently, there was a learning curve in reacquainting themselves with hemp cultivation techniques and technology.

Heartland Industries utilizes hemp fibre sourced from Ohio Hemp Company and other Midwest farmers to produce small hemp pellets known as nurdles. Following this initial processing stage, the nurdles are dispatched to Ravago, where they are blended with plastic nurdles to create a bioplastic comprising 70% plastic and 30% hemp fibre. This bioplastic is subsequently employed in the fabrication of automotive parts.

Almond emphasized the importance of environmental considerations in product development, highlighting the challenges of balancing environmental benefits with cost and performance factors. He noted that Heartland Industries has achieved a harmonious equilibrium within the plastic manufacturing realm, incorporating hemp as a 30% ingredient in the recipe. This approach not only yields cost savings and weight reduction but also maintains performance standards while significantly reducing the carbon footprint.

Expansion and Innovation: Ohio Hemp Company’s Growth Strategy

Initially, Heartland Industries established partnerships with farmers in Michigan to streamline its hemp sourcing and enhance operational efficiency. However, as the hemp fiber market expanded, the company extended its collaborations to include growers from neighboring states such as Indiana, Illinois, and Ohio.

In 2022, Ohio Hemp Company embarked on cultivating and researching dual-purpose hemp varieties capable of yielding both fiber and grain. With the successful cultivation of 100 acres of this crop last year, the company is poised to double its efforts, aiming to plant 200 acres of dual-purpose hemp this year, fueled by the recent contract with Heartland Industries.

This new agreement between the hemp grower and Heartland Industries constitutes a purchase contract, operating on a non-binding, year-to-year basis, ensuring a steady supply of hemp fiber. Ohio Hemp Company is actively expanding its infrastructure to accommodate its growing operations, investing in a new processing and storage facility while also researching innovative hemp varieties.

Helt expressed enthusiasm regarding the contract with Heartland Industries and other developments within his company, emphasizing the burgeoning demand for hemp in the region. He remarked on the significance of having a major processor with substantial demand, noting that all the elements necessary for building a comprehensive hemp industry—from cultivation to consumer products—are finally falling into place, heralding a promising future for the sector.

Cultivating Sustainable Solutions: Ohio Hemp Company’s Commitment to Environmental Stewardship

Ohio Hemp Company is still very much devoted to environmental stewardship even as it grows and develops strategic alliances. The organization has adopted a concept of sustainability that goes beyond just profitability, realizing the ecological advantages inherent in hemp growing. Ohio Hemp Company responds to the changing market conditions while staying true to its fundamental principles of supporting sustainable farming methods by giving priority to the growing of hemp optimized for grain and fiber production rather than CBD-centric variants.

Ohio Hemp Company is involved in the development of bioplastics, a viable substitute for traditional plastics with a far lower environmental effect, in partnership with Heartland Industries and other local farmers. This collaboration enables hemp fiber to be used as a vital component in the production of bioplastics, providing the automobile sector with an environmentally responsible and sustainable option. This dedication to using hemp to produce bioplastics is a reflection of Ohio Hemp Company’s proactive approach to tackling environmental issues while promoting regional economic development and innovation.

Ohio Hemp Company is firmly establishing itself as a pioneer in sustainable agriculture as it expands its hemp crop to include dual-purpose varieties capable of producing both fiber and grains. The company positions itself at the forefront of the expanding hemp sector by investing in infrastructure and research, enabling it to meet the growing demand for environmentally friendly alternatives. Ohio Hemp Company is dedicated to innovation and environmental stewardship, and it aims to guide the industry and agricultural sectors towards a more sustainable future.

Bottom Line

Ohio Hemp Company’s partnership with Heartland Industries marks a significant step forward in the development of sustainable solutions within the hemp industry. By prioritizing environmental stewardship and innovation, Ohio Hemp Company not only navigates market shifts but also drives positive change in agriculture and industry. Through strategic alliances, research initiatives, and a commitment to sustainability, Ohio Hemp Company is poised to lead the way towards a more environmentally responsible and economically viable future for the hemp sector and beyond.

HEMP BIOPLASTICS, READ ON…

WAIT, WHY ARE WE NOT USING HEMP PLASTICS YET? READ THIS!

Cannabis News

How Worried Should You Be about Heavy Metals in Your Rolling Papers?

Published

1 day agoon

April 25, 2024By

admin

Inhaling dangerous metals from rolling papers is a possible health risk for cannabis users, according to a recent study published in ACS Omega. These studies had high concentrations of heavy metals such as copper, chromium, and vanadium, which alarmed researchers since they may pose health problems.

The investigation delved into the metal composition of 53 varieties of rolling papers and cones widely used in the cannabis industry. The findings should serve as a warning to both occasional and frequent cannabis consumers alike.

Uncovering Significant Findings and Associated Health Risks

The investigative team at Michigan’s Lake Superior State University embarked on a thorough examination of 53 different types of rolling papers and cones utilized within the cannabis industry. Their findings, published in ACS Omega, revealed a startling discovery: approximately one-quarter of the tested products surpassed established safety thresholds for metal inhalation, with copper levels being particularly noteworthy. These heightened concentrations were notably prevalent in papers featuring colorful designs or metallic embellishments, often favored for their aesthetic appeal by consumers.

Of grave concern to researchers was the potential neurological impact of these metals, especially when present in colored papers. The study underscores the alarming prospect of neurotoxic effects linked to prolonged exposure, potentially implicating a heightened risk of neurodegenerative diseases. Derek Wright, co-author of the study, expressed dismay at the lack of governmental oversight, particularly in states where regulations for cannabis flowers do not extend to rolling papers. This regulatory gap underscores the urgency for comprehensive oversight to safeguard consumers, especially those relying on cannabis for therapeutic purposes.

Wright’s observations illuminate a disconcerting reality: many consumers assume that regulatory bodies oversee the safety of products associated with cannabis consumption. However, the absence of stringent regulations surrounding rolling papers poses a tangible threat to public health, particularly for vulnerable populations. Individuals leveraging cannabis for medicinal purposes, often grappling with pre-existing health conditions, could unknowingly expose themselves to further harm through the inhalation of toxic metals.

In essence, the study’s revelations serve as a clarion call for swift action within the industry and regulatory spheres. Strong supervision procedures must be put in place as soon as possible, and safety regulations must be strictly followed in all areas of cannabis use. In addition to endangering customer safety, delaying the resolution of these issues damages the legitimacy and long-term viability of the emerging cannabis industry.

Advocating for Industry Response and Regulatory Reform

The cannabis business and regulatory agencies have both loudly called for action in response to the release of these data. Concerned about the study’s ramifications, experts stress the urgent need for stricter laws and a radical change to safer production methods. Co-author of the research Derek Wright emphasizes how crucial it is to pinpoint the origins of potentially dangerous compounds in order to facilitate the creation of safer goods.

Daniel Curtis, an analytical and atmospheric chemist consulted on the matter, underscores the importance of future research endeavors. He advocates for a deeper understanding of how metals transfer from rolling papers through the combustion process. Such insights could inform targeted interventions aimed at mitigating exposure risks and enhancing consumer safety. With cannabis consumption on the ascent, the imperative to identify and address sources of toxic chemicals grows ever more urgent.

The study’s consequences go well beyond the confines of scholarly research and have a significant impact on the hallways of industry. In order to put consumer welfare first and enact evidence-based reforms, stakeholders must work together in a coordinated effort. Regulatory agencies may protect the public’s health and promote innovation by establishing a culture of openness and responsibility. In order to overcome these obstacles and reach its full potential as a catalyst for responsible growth, the cannabis sector will need to work together and demonstrate unshakable dedication.

Pioneering Safer Smoking Solutions: Innovations Towards Harm Reduction

As worries about the safety of rolling papers grow, forward-thinking businesses are leading campaigns to reduce dangers and encourage safer smoking environments. Leading the pack of these innovators is RAW, which is well-known for its dedication to transforming the cannabis industry. In their most recent project, RAW presents a novel rolling paper designed to reduce any impurities while highlighting the organic tastes found in cannabis. With a focus on the health and happiness of the customer, this invention signifies a paradigm change in product design.

The foreword to RAW’s groundbreaking study highlights the industry’s increasing realization of how important it is to give damage reduction methods top priority. RAW is working to raise the bar for cannabis accessory safety and purity by using state-of-the-art manufacturing methods and strict quality control procedures. The notably thinner paper not only makes smoking more enjoyable, but also demonstrates RAW’s ongoing commitment to customer welfare.

Beyond product innovation, RAW’s mission represents a larger culture of business responsibility and social concern. By promoting safer smoking options, the firm hopes to provide customers with educated choices and build a harm-reduction culture within the cannabis community. Furthermore, RAW’s proactive strategy establishes a precedent for industry-wide collaboration and responsibility, igniting a collective effort to solve systemic concerns while maintaining the greatest levels of safety and integrity.

Customer safety must continue to be the priority as the cannabis business develops and diversifies. RAW’s creative efforts are a ray of hope, encouraging other industry participants to take the lead in damage reduction. Through leveraging innovation and teamwork, the cannabis sector may steer towards a more secure and sustainable future where the welfare of users is the top priority.

Bottom Line

The study’s findings underscore the urgent need for regulatory reform and industry response to address the presence of toxic metals in commercially available cannabis rolling papers. With significant health risks posed by inhaling heavy metals such as copper, chromium, and vanadium, consumers, especially those using cannabis for therapeutic purposes, are at risk. The absence of stringent regulations governing rolling papers highlights a critical gap in oversight, emphasizing the necessity for comprehensive safety measures to safeguard public health. Advocacy for safer production practices and innovative solutions, exemplified by initiatives like RAW’s pioneering rolling paper, is essential to mitigate risks and promote harm reduction within the cannabis community. Ultimately, prioritizing consumer safety and implementing evidence-based reforms are paramount for the sustainable growth and legitimacy of the emerging cannabis industry.

TOXIC METAL LEVELS IN CANNABIS, READ ON…

WHY ARE HEAVY METALS TESTING OUT SO HIGH IN CANNABIS USERS BLOOD?

Arizona Cannabis Sales Go Beyond $1.4 Billion

Nicotine Salts Versus Freebase Nicotine: A Comprehensive Comparison

German cannabis imports rise to 34.6 tons as cultivators eye end of quota system

How To Vape Correctly – The Fresh Toast

Will Rescheduling Come In Time To Help The Marijuana Industry

Which Cities Consume The Most Marijuana

Marijuana Milk? It’s A Thing And We Have The Recipe

Hemp Bioplastics to End Forever Chemicals and PFAS Molecules?

How Worried Should You Be about Heavy Metals in Your Rolling Papers?

All The Ways To Consume Cannabis

Distressed Cannabis Business Takeaways – Canna Law Blog™

United States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

Drug Testing for Marijuana – The Joint Blog

What you Need to Know

Cannabis, alcohol firm SNDL loses CA$372.4 million in 2022

NCIA Write About Their Equity Scholarship Program

City Of Oakland Issues RFP For Employee Training Programs

It has been a wild news week – here’s how CBD and weed can help you relax

A new April 20 cannabis contest includes a $40,000 purse

UArizona launches online cannabis compliance online course

Trending

-

Cannabis News1 year ago

Cannabis News1 year agoDistressed Cannabis Business Takeaways – Canna Law Blog™

-

One-Hit Wonders1 year ago

One-Hit Wonders1 year agoUnited States: Alex Malyshev And Melinda Fellner Discuss The Intersection Of Tax And Cannabis In New Video Series – Part VI: Licensing (Video)

-

drug testing4 months ago

drug testing4 months agoDrug Testing for Marijuana – The Joint Blog

-

Cannabis 1011 year ago

Cannabis 1011 year agoWhat you Need to Know

-

Marijuana Business Daily1 year ago

Marijuana Business Daily1 year agoCannabis, alcohol firm SNDL loses CA$372.4 million in 2022

-

Education1 year ago

Education1 year agoNCIA Write About Their Equity Scholarship Program

-

Education1 year ago

Education1 year agoCity Of Oakland Issues RFP For Employee Training Programs

-

Cannabis1 year ago

Cannabis1 year agoIt has been a wild news week – here’s how CBD and weed can help you relax